FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

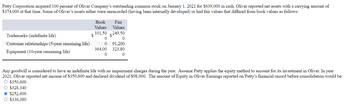

Transcribed Image Text:Patty Corporation acquired 100 percent of Oliver Company's outstanding common stock on January 1, 2021 for $639,000 in cash. Oliver reported net assets with a carrying amount of

$374,000 at that time. Some of Oliver's assets either were unrecorded (having been internally developed) or had fair values that differed from book values as follows:

Trademarks (indefinite life)

Customer relationships (5-year remaining life)

Equipment (10-year remaining life)

$

Book

Values

101,50

0

0

364,00

0

Fair

Values

249,50

0

91,200

323,80

0

Any goodwill is considered to have an indefinite life with no impairment charges during the year. Assume Patty applies the equity method to account for its investment in Oliver. In year

2021, Oliver reported net income of $350,600 and declared dividend of $98,000. The amount of Equity in Oliver Earnings reported on Patty's financial record before consolidation would be:

O $350.600

O $328,340

Ⓒ$252,600

O $336.380

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pitino acquired 90 percent of Brey's outstanding shares on January 1, 2019, in exchange for $342,000 in cash. The subsidiary's stockholders' equity accounts totaled $326,000, and the noncontrolling interest had a fair value of $38,000 on that day. However, a building (with a nine-year remaining life) in Brey's accounting records was undervalued by $18,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (six-year remaining life). Brey reported net income from its own operations of $64,000 in 2019 and $80,000 in 2020. Brey declared dividends of $19,000 in 2019 and $23,000 in 2020. Brey sells inventory to Pitino as follows: Year Cost to Brey Transfer Price to Pitino Inventory Remaining at Year-End (at transfer price) 2019 $ 69,000 $ 115,000 $ 25,000 2020 81,000 135,000 37,500 2021 92,800 160,000 50,000 At December 31, 2021, Pitino owes Brey $16,000 for inventory acquired during the…arrow_forwardOn January 1, 2019, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $50,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $242,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows: NI Div Paid 2019 $150,000 $33,600 2020 $166,400 $55,600 2021 $184,000 $75,000 On December 31, 2021, Vacker owed $20,800 to Carper. There have been no changes in Carper's common stock account since the acquisition. 2. Calculate the following amounts for individual accounts: the balance of investment in Carper on Vacker’s book on Dec 31st 2020; noncontrolling interest on consolidated financial statement on Dec 31st, 2020); and the balance of noncontrolling interest on Dec 31st 2021. 3. List all…arrow_forwardPitino acquired 90 percent of Brey's outstanding shares on January 1, 2019, in exchange for $351,000 in cash. The subsidiary's stockholders' equity accounts totaled $335,000, and the noncontrolling interest had a fair value of $39,000 on that day. However, a building (with a ten-year remaining life) in Brey's accounting records was undervalued by $15,000. Pitino assigned the rest of the excess fair value over book value to Brey's patented technology (four-year remaining life). Brey reported net income from its own operations of $65,000 in 2019 and $81,000 in 2020. Brey declared dividends of $19,500 in 2019 and $23,500 in 2020. Brey sells inventory to Pitino as follows: Year Cost to Brey Transfer Price to Pitino Inventory Remaining at Year-End (at transfer price) 2019 $ 70,000 $ 120,000 $ 26,000 2020 77,000 140,000 38,000 2021 99,000 165,000 40,000 At December 31, 2021, Pitino owes Brey $17,000 for inventory acquired during the…arrow_forward

- On March 31, 2020, United Corporation acquired for $750,000 cash all the outstanding common stock of National Company when National's balance sheet showed net assets of $500,000. Out-of-pocket costs of the business combination may be disregarded. The current fair values of assets and liabilities of National were equal to their carrying amounts except for machine which was less than carrying amount by $ 20,000.The amount :of goodwill is .a .230,000 $ .b .200,000 $ .C .250,000 $ .d .270,000 $arrow_forwardOn January 1, 2020, Pail Corporation acquired 75 percent of Sand Company's common stock for $525,000 cash. The fair value of the noncontrolling interest at that date was determined to be $175,000. At the date of the business combination, the book values of Sand's net assets and liabilities approximated fair value except for depreciable plant assets, which were OVERvalued by $4000 and Inventory, which was UNDERvalued by $9000 The remaining useful life of the plant assets was set at 10 years. For the year ended December 31, 2020, Pail reported Cost of Goods Sold of $14000 on its general ledger. Sand reported Cost of Goods Sold of $16000 on its general ledger. What amount of COST OF GOODS SOLD should be reported on the 12/31/20 consolidated Income Statement?arrow_forwardWebHelper Incorporated acquired 100% of the outstanding stock of Silicon Chips Corporation (SCC) for $46.4 million, of which $17.8 million was allocated to goodwill. At the end of the current fiscal year, an impairment test revealed the following: fair value of SCC, $48.2 million; book value of SCC’s net assets (including goodwill), $46.2 million. What amount of impairment loss should WebHelper report in its income statement? Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education