FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

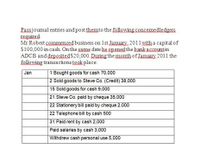

Transcribed Image Text:Passjoumal entries andpost themto the following concemedledgers

required.

Mr Robert commenced business on 1st January, 2011 with a capital of

$100,000 in cash. On the same date he opened the bank accountin

ADCB and deposited$20,000. During the month of January 2011 the

following transactionstook place:

1 Bought goods for cash 70,000

2 Sold goods to Steve Co. (Credit) 38,000

15 Sold goods for cash 9,000

Jan

21 Steve Co. paid by cheque 35.000

22 Stationery bill paid by cheque 2,000

22 Telephone bill by cash 500

31 Paid rent by cash 2,000

Paid salaries by cash 3,000

Withdrew cash personal use 5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello I want the Correct answer about the Questionarrow_forwardb) Sofea Enterprise runs a retail business. All cash and cheque receipt and payment are recorded in the Cash Book. The following transactions occurred during the month of September 2021 and are yet to be recorded in the Cash Book: The debit balance in the Cash and Bank accounts are $2,000 and $17,000 respectively. 3/9 Transfer cash $1,000 into the bank account. 4/9 Purchased goods worth $3,600 by cheque. 5/9 Paid Jamilah & Co. $5,000 by cheque for purchase of goods. 6/9 The owner took $500 cash for his own use. 8/9 Paid the shop rental $3,000 by cheque. 10/9 Received a cheque from Ms. Angie amounting to $3,600 after deducting cash discount $400. 15/9 Cash sales of $3,200. 18/9 Issued $2,850 cheque to Seri Enterprise after deducting cash discount of 5%. 20/9 Received $5,000 cheque from Faiz Enterprise. 23/9 Cash sales banked the same day, $2,600. 28/9 Paid wages to shop assistant by cheque, $1,200. REQUIRED: Prepare a Three-column Cash Book, balancing it at 30 September 2021. Bring down…arrow_forwardPlease provide answer in text (Without image)arrow_forward

- R. Ivanhoe Co. uses special journals and a general journal. The following transactions occurred during May 2020. May 1 R. Ivanhoe invested $53,600 cash in the business. 2 Sold merchandise to Lawrie Co. for $6,290 cash. The cost of the merchandise sold was $4,130. 3 Purchased merchandise for $7,600 from J. Moskos using check no. 101. 14 Paid salary to H. Rivera $775 by issuing check no. 102. 16 Sold merchandise on account to K. Stanton for $950, terms n/30. The cost of the merchandise sold was $600. 22 A check of $8,840 is received from M. Mangini in full for invoice 101; no discount given. (a) Prepare a multiple-column cash receipts journal and record the transactions for May that should be journalized. (Record entries in the order presented in the problem statement.)arrow_forwardFrederick Clinic deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on June 30, 2015, its Cash account shows a $15,645 debit balance. Frederick Clinic's June 30 bank statement shows $14,627 on deposit in the bank. a. Outstanding checks as at June 30 total $1,620. b. The June 30 bank statement included a $75 debit memorandum for bank services. c. Check No. 919, listed with the canceled checks, was correctly drawn for $480 in payment of a utility bill on June 15. Frederick Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $513. d. The June 30 cash receipts of $2,596 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Prepare the adjusting journal entries that Frederick Clinic must record as a result of preparing the bank reconciliation. (Omit the "$" sign in your…arrow_forwardEnter the following transaction in the records and extract a trial balance for the month ended 31 January 2013. January 1: Started business with Kshs.6,000in the bank and 5,000 in cash January 2 Bought goods on credit from Ndung'u Kshs.2,700 January 3: Bought goods on credit form S. Muigai Kshs.750 January 5: Bought goods for cash Kshs.540 January 6: We returned goods to Ndung'u Kshs.120 January 8: Bought goods on credit from S. Muigai Kshs.570 January 10: Sold goods on credit to K. Mwaniki Kshs.1,170 January 12: Sold goods for cash Kshs.630 January 18: Took Kshs.900 of the cash and paid it to the bank January 21: Bought machinery by cheque Kshs.1,650 January 22: Sold goods on credit to M. Otieno Kshs.660 January 23: K. Mwaniki returned goods to us Kshs.420 January 25:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education