FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

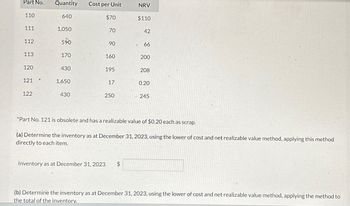

Transcribed Image Text:Part No.

Quantity

Cost per Unit

NRV

110

640

$70

$110

111

1,050

70

42

112

59

90

66

113

170

160

200

120

430

195

208

121

1,650

17

0.20

122

430

250

245

*Part No. 121 is obsolete and has a realizable value of $0.20 each as scrap.

(a) Determine the inventory as at December 31, 2023, using the lower of cost and net realizable value method, applying this method

directly to each item.

Inventory as at December 31, 2023

$

(b) Determine the inventory as at December 31, 2023, using the lower of cost and net realizable value method, applying the method to

the total of the inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- g0.3arrow_forwardPresented below is information related to Rembrandt Inc.’s inventory, assuming Rembrandt uses lower-of-LIFO cost-or-market. 000000(per unit)000000 0 Skis0 0Boots0 Parkas Historical cost $190.00 $106.00 $53.00 Selling price 212.00 145.00 73.75 Cost to distribute 19.00 8.00 2.50 Current replacement cost 203.00 105.00 51.00 Normal profit margin 32.00 29.00 21.25 Determine the following: (a) the two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis, (b) the cost amount that should be used in the lower-of-cost-or-market comparison of boots, and (c) the market amount that should be used to value parkas on the basis of the lower-of-cost-or-market.arrow_forwardwhat journal entry is needed?arrow_forward

- Sheridan Combines, Inc. has $12000 of ending finished goods inventory as of December 31, 2022. If beginning finished goods inventory was $7000 and cost of goods sold was $42000, how much would Sheridan Combines, Inc. report for cost of goods manufactured? O $54000 O $7000 O $47000 O $37000 Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardAs of 12-31-15, Acme Company has three different inventory items on hand. Data on the three items follows: Item Quantity on hand Unit cost (Acme uses LIFO) Replacement cost Normal profit Expected selling price Estimated disposal costs A 75 $405 $625 $750 $1,500 $100 B 24 $310 $300 $230 $400 $25 C 51 $775 $800 $300 $1,000 $250 Using the lower-of-cost-or-market approach applied on an individual-item basis, determine if Acme needs to make an entry to write her inventory down. If so, prepare the entry Acme should makearrow_forwardNm. 152.arrow_forward

- Nonearrow_forwardSunland Corporation had the following items in inventory as at December 31, 2023: Item No. A1 84 C2 D3 (a) Quantity 4 120 110 190 120 Inventory 1 Unit Cost $3.20 Inventory 1.70 8.50 7.50 Your answer is partially correct. Assume that Sunland uses a periodic inventory system, and that none of the inventory items can be grouped together for accounti purposes. The opening inventory on January 1, 2023, was $3,200 in total. Account Titles and Explanation Allowance to Reduce Inventory to NRV NRV $3.80 1.10 Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. List all debit entries before credit entries.) 10.30 7.10 (To transfer out beginning inventory balance) Allowance to Reduce Inventory to NRV (To record ending inventory at…arrow_forwardWhat is the beginning inventory? You left it blank. Direct Materials Conversion costs Beginning Inventory ? ? ? Add: Current costs 3798000 2160000 1638000 ($594000+$1044000) Total costs to account for (A) 3798000 2160000 1638000arrow_forward

- hre.2arrow_forwardDetermine the ending inventory amount by applying the lower of cost or market value to a. Each inventory item of inventoryb. Total inventory The following data refer to Froning Company’s ending inventoryItem Code, Quantity, Unit Cost, Unit MarketLXC 60 $45 $48KMT 210 $38 $34MOR 300 $22 $20NES 100 $27 $32arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education