Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Part A: Find the total federal income tax for a person earning $196,520 per year. Enter an exact answer only, no approximations.

Part B: Find the total federal income tax for a person earning $337,405 per year. Enter an exact answer only, no approximations.

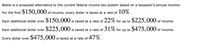

Transcribed Image Text:Below is a proposed alternative to the current federal income tax system based on a taxpayer's annual income:

For the first $150,000 of income, every dollar is taxed at a rate of 10% .

Each additional dollar over

$150,000 is taxed at a rate of 22% for up to $225,000 of income.

Each additional dollar over $225,000 is taxed at a rate of 31% for up to $475,000 of income.

Every dollar over $475,000 is taxed at a rate of 47% .

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Similar questions

- Jill Janzen's gross weekly pay is $298. Her earnings to date for the year total $14,900. What amount is deducted from her pay each week for Social Security, which is taxed at 6.2%? Select one: O a. $30.88 ОБ. $18.48 O c. $14.52 O d. $21.33arrow_forward3. Jenfay bought a car for $28 000. Her car depreciates by 38% every year. How much will her car be worth in 5 years?arrow_forwardSuppose that the luxury sales tax rate in a foreign country is 19%. A very wealthy socialite bought a diamond tiara for $244,000. How much tax does she pay?arrow_forward

- What are the total expenses after a year (52 weeks) for the groomers?arrow_forward2. Carl Morris. Clerk typist. Earns $3.90 per hour. Worked 17 hours last week. What is his straight-time pay?arrow_forwardIf you earn $9.10 per hour and you work a 37-hour week, what are your gross (before tax) earnings?arrow_forward

- A store had receipts of $6045.50. If the sales tax rate is 7%, how much merchandise did the store sell? The value of the merchandise sold (not including sales tax) is ___$5,000 ___$5,500 ___$5,650 ___$5,725arrow_forwardIf Rita receives $39.24 interest for a deposit earning 6% simple interest for 110 days, what is the amount of her deposit? (Round your answer to the nearest cent.) Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,