Concept explainers

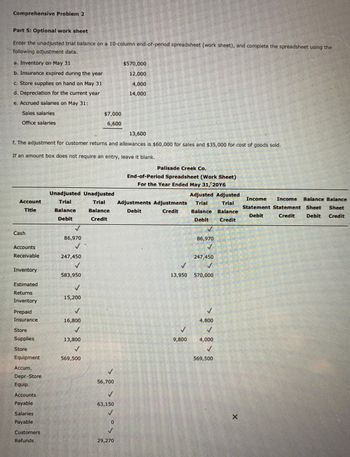

I'm not sure what goes on the adjustments debit and credit column. Need help filling out the spreadsheet.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Journalize the closing entries. Indicate closed accounts by inserting a line in both the balance columns opposite the closing entry. Insert the new balance in the

I added all the items and got an incorrect for the totals on the spreadsheet and partical complete. I'm not sure what else I'm missing. Please help

Journalize the closing entries. Indicate closed accounts by inserting a line in both the balance columns opposite the closing entry. Insert the new balance in the

I added all the items and got an incorrect for the totals on the spreadsheet and partical complete. I'm not sure what else I'm missing. Please help

- T-Accounts (All Formulas/Equations) Would you please provide me with the formula/equation used to find the missing amount in a T-Account. Please look at the example below and provide me the answers in that same type of format so that it is easy to understand. Beginning Balance is missing Transaction on debit side is missing Transaction on credit side is missing FINDING BEGINNING BALANCE EXAMPLEBeginning balance = Ending balance + right side of T-Account - Left side of T-AccountBeginning balance = $9,800 + ($4,500 +$2,200 +$3,500) - ($2,500 +$4,000 +$3,400)Beginning balance = $9,800 + $10,200 - $9,900Begining balance = $10,100arrow_forwardWildhorse Corporation sells rock-climbing products and also operates an indoor climbing facility for climbing enthusiasts. During the last part of 2025. Wildhorse had the following transactions related to notes payable Sept. 1 Sept. 30 Oct. 1 Oct. 31 Nov. 1 Nov. 30 Dec. 1 Dec. 31 Issued a $13,200 note to Pippen to purchase inventory. The 3-month note payable bears interest of 9% and is due December 1. (Wildhorse uses a perpetual inventory system) Recorded accrued interest for the Pippen note. Issued a $22,800, 9%, 4-month note to Prime Bank to finance the purchase of a new climbing wall for advanced climbers. The note is due February 1. Recorded accrued interest for the Pippen note and the Prime Bank note. Issued a $24,000 note and paid $7,600 cash to purchase a vehicle to transport clients to nearby climbing sites as part of a new series of climbing classes. This note bears interest of 6% and matures in 12 months. Recorded accrued interest for the Pippen note, the Prime Bank note, and…arrow_forwardPlease help with the following question COMPLETION STATEMENTS 1.Notes and accounts receivable that result from sales transactions are often called______________ receivables. 2.Two accounting problems associated with accounts receivable are (1) ______________ and (2) ______________ accounts receivable. 3.The net amount expected to be collected in cash from receivables is the _____________. 4.When credit sales are made, _________________ Expense is considered a normal and necessary risk of doing business on a credit basis. 5.The two methods used in accounting for uncollectible accounts are the ____________ method and the ______________ method. 6.Allowance for Doubtful Accounts is a_____________ account which is ______________ from Accounts Receivable on the balance sheet. 7.When the allowance method is used to account for uncollectible accounts, ____________ is debited when an account is determined to be uncollectible. 8.The _________________ basis of…arrow_forward

- Would you please remind me how the debits and credits system works? Why do the assets get debit increased and the liabilities and owner’s equity get debit decreased? I know the parts must balance and clear each other out, but reviewing my notes from a previous class, I’m having a hard time getting a perspective on the principle of the T-balance.arrow_forwardshow calculations where neededarrow_forwardHi, Can you please help me with problem 5.6? Thank you.arrow_forward

- How can you check for unbilled charges or time in QuickBooks Online? Select all that apply. Via the money bar in the Vendor center Via the Reports center Via the Unbilled Charges card in the Dashboard Via the money bar in the Sales center Via the money bar in the Time tab in the left-hand navigationarrow_forwardHi I asked this question previously and the individual did not explain things clearly. For instance he provided the I'm guessing standard method of finding a missing amount on a certain type of T-Account but then would turn around and solve it using a different method. I am posting the response that were not clear below. If you could tell me what the actual method is and if there exceptions and if so what those are.Answer #1 I needed the BEGINNING balance of a debit account. As you can see the response below the individual provided a formula that included the BB which is UNKOWN because that is WHAT I NEED. At the bottom they change around the equation to come to the answer. So what is the proper way???Part-1. Begining balance of cash account is missing. The cash account is having a debit balance always. The formula for Cash account is as under:Ending balance of Cash Account = Begining Balance of cash account + All debits - All creditsHere,Ending Balance of cash = 9800All debits…arrow_forwardIn maintaining the accounts receivable, the method that applies a customer’s payment to the account balance without consideration of which unpaid invoices the customer is paying is: TurnaroundOpen-invoice Balance-forwardCycle billingMatchingarrow_forward

- If a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forwardSuppose a co-worker has recorded a cash disbursement twice (Supplies Expense was debited twice for $100 and Cash was credited twice for $100) and wants you to record a correcting entry that will reverse the mistake. The correcting entry will record a debit to the Cash account and a credit to the Supplies account. Would you make this correcting entry? What should you investigate before making a decision about the correcting entry? Are there any other steps you would take to address this issue?arrow_forwardPrepare separate adjusting entries for any checks that require adjustment. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation (To record adjusting entry for due to Metro Bank-Special Account.) (To record adjusting entry for due to Metro Bank_special Account.) (To record adjusting entry for due from Metro Bank-Special Account.) Debit Creditarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education