FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

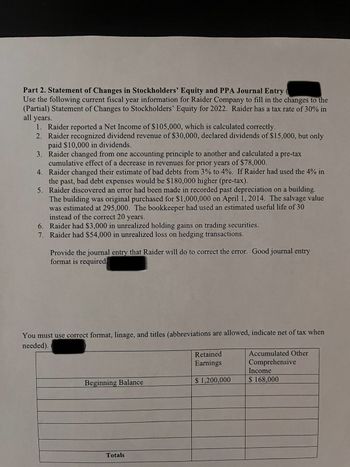

Transcribed Image Text:Part 2. Statement of Changes in Stockholders' Equity and PPA Journal Entry(

Use the following current fiscal year information for Raider Company to fill in the changes to the

(Partial) Statement of Changes to Stockholders' Equity for 2022. Raider has a tax rate of 30% in

all years.

1. Raider reported a Net Income of $105,000, which is calculated correctly.

2. Raider recognized dividend revenue of $30,000, declared dividends of $15,000, but only

paid $10,000 in dividends.

3.

Raider changed from one accounting principle to another and calculated a pre-tax

cumulative effect of a decrease in revenues for prior years of $78,000.

4. Raider changed their estimate of bad debts from 3% to 4%. If Raider had used the 4% in

the past, bad debt expenses would be $180,000 higher (pre-tax).

5. Raider discovered an error had been made in recorded past depreciation on a building.

The building was original purchased for $1,000,000 on April 1, 2014. The salvage value

was estimated at 295,000. The bookkeeper had used an estimated useful life of 30

instead of the correct 20 years.

6. Raider had $3,000 in unrealized holding gains on trading securities.

7.

Raider had $54,000 in unrealized loss on hedging transactions.

Provide the journal entry that Raider will do to correct the error. Good journal entry

format is required

You must use correct format, linage, and titles (abbreviations are allowed, indicate net of tax when

needed).

Beginning Balance

Totals

Retained

Earnings

$ 1,200,000

Accumulated Other

Comprehensive

Income

$ 168,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Calculation of EPS and retained earnings Everdeen Mining, Inc., ended 2019 with net profits before taxes of $447,000. The company is subject to a 21% tax rate and must pay $64,100 in preferred stock dividends before distributing any earnings on the 168,000 shares of common stock currently outstanding. a. Calculate Everdeen's 2019 earnings per share (EPS). b. If the firm paid common stock dividends of $0.76 per share, how many dollars would go to retained earnings? a. The firm's EPS is $ (Round to the nearest cent.) Carrow_forwardPlease do not give image formatarrow_forwardDo not give image formatarrow_forward

- answer must be in table format or i will give down votearrow_forwardBalance Sheet Nicole Corporation's year-end 2019 balance sheet lists current assets of $753,000, fixed assets of $603,000, current liabilities of $542,000, and long-term debt of $697,000. What is Nicole's total stockholders' equity? Multiple Choice О о $117,000 $1,356,000 There is not enough information to calculate total stockholder's equity. $1,239,000arrow_forwardanswer quicklyarrow_forward

- what is the the quick ratio for both yearsarrow_forwardSpicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023. Assume that the preferred shares are non-cumulative. Accounts Payable Accounts Receivable Accumulated depreciation, Equipment Accumulated depreciation, Warehouse Cash Cash Dividends Common Shares Equipment Income Tax Expense Land Notes Payable, due in 2026 Operating Expenses Preferred Shares Retained Earnings Revenue Warehouse Current assets $ 26,760 40,200 11,140 22,280 9,400 20,600 Required: Prepare a classified balance sheet at December 31, 2023. (Enter all amounts as positive values.) Assets 122,000 79,400 41,600 127,600 34,600 110,200 40,200 28,720 282,100 138,800 SPICER INC. Balance Sheet December 31, 2023 Karrow_forwardThese financial statement items are for Sunland Corporation at year end, July 31, 2021: Operating expenses Salaries expense Deferred revenue Utilities expense Equipment Accounts payable Service revenue Rent revenue Common shares Cash Accounts receivable D Accumulated depreciation-equipment $32,500 46,700 12,000 2,600 70,200 5,020 116,100 19,000 27,500 5,560 16,100 5,800 Interest payable Supplies expense Dividends declared Depreciation expense Retained earnings, August 1, 2020 Rent expense Income tax expense Supplies Trading investments Bank loan payable (due December 31, 2021) Interest expense O $900 777891 700 14,500 3,500 22,940 11,500 5,700 2,100 20,500 24,800 Additional information: Sunland started the year with $14,000 of common shares and issued additional shares for $13,500 during the year. 1,900 O Warrow_forward

- Manarrow_forwardView Policies Current Attempt in Progress The shareholders' equity accounts of Sandhill Inc. at December 31, 2023, are as follows: Preferred shares, $3 noncumulative, unlimited number authorized, 5,000 issued Common shares, unlimited number authorized, 140,000 issued Retained earnings Accumulated other comprehensive loss Sandhill has a 35% income tax rate. During the following fiscal year ended December 31, 2024, the company had the following transactions and events: Feb. July Dec. 1 Repurchased 10,000 common shares for $40,000. Announced a 2-for-1 preferred stock split. The market price of the preferred shares at the date of announcement was $150. 12 1 $500,000 700,000 550,000 (48,000) Dec. 18 Dec. 31 Declared the annual cash dividend ($1.50 post-split) to the preferred shareholders of record on January 10, 2025, payable on January 31, 2025, Declared a 10% stock dividend to common shareholders of record at December 20, distributable on January 12. 2025. The fair value of the common…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education