FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:3

pints

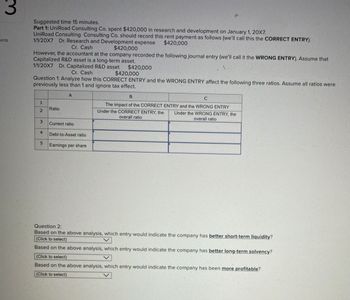

Suggested time 15 minutes.

Part 1: UniRoad Consulting Co. spent $420,000 in research and development on January 1, 20X7.

UniRoad Consulting Consulting Co. should record this rent payment as follows (we'll call this the CORRECT ENTRY).

1/1/20X7 Dr. Research and Development expense

Cr. Cash

$420,000

$420,000

However, the accountant at the company recorded the following journal entry (we'll call it the WRONG ENTRY). Assume that

Capitalized R&D asset is a long-term asset.

1/1/20X7 Dr. Capitalized R&D asset $420,000

Cr. Cash

$420,000

Question 1: Analyze how this CORRECT ENTRY and the WRONG ENTRY affect the following three ratios. Assume all ratios were

previously less than 1 and ignore tax effect.

Ratio

2

A

3 Current ratio

4

5

Debt-to-Asset ratio

Earnings per share

B

C

overall ratio

The impact of the CORRECT ENTRY and the WRONG ENTRY

Under the CORRECT ENTRY, the Under the WRONG ENTRY, the

overall ratio

Question 2:

Based on the above analysis, which entry would indicate the company has better short-term liquidity?

(Click to select)

Based on the above analysis, which entry would indicate the company has better long-term solvency?

(Click to select)

Based on the above analysis, which entry would indicate the company has been more profitable?

(Click to select)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On February 13, Scanlon Co. paid $1,530 to repair the transmission on one of its delivery vans. In addition, Scanlon paid $45 to install a GPS system in its van. Question Content Area Journalize the entries for the transmission. If an amount box does not require an entry, leave it blank. DateAccount Debit Credit February 13 Question Content Area Journalize the entry for GPS system expenditures. If an amount box does not require an entry, leave it blank. DateAccount Debit Credit February 13arrow_forwardN1. Accountarrow_forwardTransaction: Laker Co. pays $3,900 on account for tools bought earlier. Required: For the transaction above, complete the following: (a) Select the accounts that are affected (there will be at least two). (b) Are the selected accounts increased or decreased? (c) What is the dollar amount of change in the accounts? (d) If Retained Earnings is selected, choose the reason that it has changed. Cash Account Accounts Receivable Supplies Tools Accounts Payable Capital Stock Which accounts are affected? Is the account increased or decreased? Increase Decrease OO Increase Decrease Increase Decrease Increase Decrease Increase Decrease Increase Decrease What is the amount of transaction? $0 $0 $0 $ 6A $0 Why has Retained Earnings changed?arrow_forward

- Assume Power LLC sold 500 fans for OMR 40 each. But because of small unidentifiable color damage, the company offered OR 5000 sales allowance to the customer. From the following given options identify the journal entry for recording the allowance expenses in the books of company. a. Dr Accounts receivables OMR 5000 and Cr Cash OMR 5000 b. Dr Accounts receivables OMR 5000 and Cr Sales allowance OMR 5000 c. Dr Sales allowance OMR 5000 and Cr Accounts receivables OMR 5000 d. Dr Cash OMR 5000 and Cr Accounts receivables OMR 5000 Clear my choicearrow_forwardMarigold Co. has equipment that cost $76,500 and that has been depreciated $49,600. Record the disposal under the following assumptions. (a) (b) (c) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) It was discarded with no cash received. It was sold for $22,100. It was sold for $28,200. No. Account Titles and Explanation (a) (b) U Debit Creditarrow_forwarddont provide handwritinh solution ...arrow_forward

- On February 13, GTS Co. paid $2,300 to repair the transmission on one of its delivery vans. In addition, GTS paid $36 to install a GPS system in its van. Question Content Area Journalize the entries for the transmission. If an amount box does not require an entry, leave it blank. Date Account Debit Credit February 13 Feedback Area Feedback Question Content Area Journalize the entry for GPS system expenditures. If an amount box does not require an entry, leave it blank. Date Account Debit Credit February 13arrow_forwardWhy is there no entry in the books of the lessee on Dec. 31, 20x2 given this problem? Please explain.arrow_forwardSarasota Co. has equipment that cost $79,200 and that has been depreciated $50,100. Record the disposal under the following assumptions. (a) (b) (c) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) It was discarded with no cash received. It was sold for $23,200. It was sold for $31,100. No. Account Titles and Explanation (a) (b) Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education