SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please help & explain answer

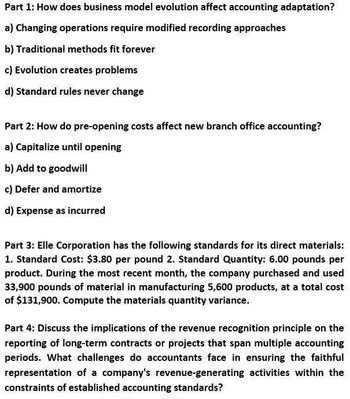

Transcribed Image Text:Part 1: How does business model evolution affect accounting adaptation?

a) Changing operations require modified recording approaches

b) Traditional methods fit forever

c) Evolution creates problems

d) Standard rules never change

Part 2: How do pre-opening costs affect new branch office accounting?

a) Capitalize until opening

b) Add to goodwill

c) Defer and amortize

d) Expense as incurred

Part 3: Elle Corporation has the following standards for its direct materials:

1. Standard Cost: $3.80 per pound 2. Standard Quantity: 6.00 pounds per

product. During the most recent month, the company purchased and used

33,900 pounds of material in manufacturing 5,600 products, at a total cost

of $131,900. Compute the materials quantity variance.

Part 4: Discuss the implications of the revenue recognition principle on the

reporting of long-term contracts or projects that span multiple accounting

periods. What challenges do accountants face in ensuring the faithful

representation of a company's revenue-generating activities within the

constraints of established accounting standards?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Subject: accountingarrow_forwardThis is currently a single-step Income Statement. Add/adjust/remove as needed to convert this to a multi-step Income Statement. 2. The formatting here needs your help! You are presenting this to important external stakeholders. Apply required (andadditional formatting to make it professional in appearance) formatting.arrow_forwardSubject: accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College