FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

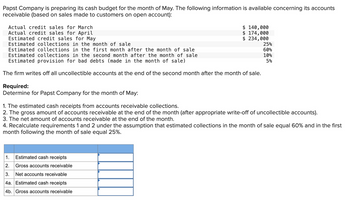

Transcribed Image Text:Papst Company is preparing its cash budget for the month of May. The following information is available concerning its accounts

receivable (based on sales made to customers on open account):

Actual credit sales for March

Actual credit sales for April

Estimated credit sales for May

Estimated collections in the month of sale

Estimated collections in the first month after the month of sale

Estimated collections in the second month after the month of sale

Estimated provision for bad debts (made in the month of sale)

The firm writes off all uncollectible accounts at the end of the second month after the month of sale.

Required:

Determine for Papst Company for the month of May:

$ 140,000

$ 174,000

$ 234,000

1. The estimated cash receipts from accounts receivable collections.

2. The gross amount of accounts receivable at the end of the month (after appropriate write-off of uncollectible accounts).

3. The net amount of accounts receivable at the end of the month.

Estimated cash receipts

Gross accounts receivable

25%

60%

10%

5%

4. Recalculate requirements 1 and 2 under the assumption that estimated collections in the month of sale equal 60% and in the first

month following the month of sale equal 25%.

1.

2.

3. Net accounts receivable

4a. Estimated cash receipts

4b. Gross accounts receivable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps with 2 images

Knowledge Booster

Similar questions

- Santos Company is preparing a cash budget for February. The company has $16,000 cash at the beginning of February and budgets $65,000 in cash receipts from sales and $114,000 in cash payments during February. Prepare the cash budget for February assuming the company maintains a $5,000 minimum cash balance and will take a loan if necessary to maintain this balance. The company has no loans outstanding on February 1. (Negative cash balances, if any, should be indicated with minus sign.) SANTOS COMPANY Cash Budget February Beginning cash balance Total cash available Preliminary cash balance Loan activity Ending cash balance Loan balance, end of montharrow_forwardDon't give answer in image formatarrow_forwardJasper Company has sales on account and for cash. Specifically, 61% of its sales are on account and 39% are for cash. Credit sales are collected in full in the month following the sale. The company forecasts sales of $526,000 for April, $536,000 for May, and $561,000 for June. The beginning balance of Accounts Receivable is $299,400 on April 1. Prepare a schedule of budgeted cash receipts for April, May, and June. April May June Cash sales 39% Sales on account 61% Total sales $ O $ JASPER COMPANY Schedule of Cash Receipts For April, May, and June April May June Cash receipts from: Cash sales Collection of accounts receivable Total budgeted cash receiptsarrow_forward

- Jasper Company has 62% of its sales on credit and 38% for cash. All credit sales are collected in full in the first month following the sale. The company budgets sales of $522,000 for April, $532,000 for May, and $557,000 for June. Total sales for March are $304,900. Prepare a schedule of cash receipts from sales for April, May, and June. Sales Cash receipts from: Accounts receivable Total cash receipts JASPER COMPANY Schedule of Cash Receipts from Sales April 522,000 May 532,000 June 557,000arrow_forwardPapst Company is preparing its cash budget for the month of May. The following information is available concerning its accounts receivable (based on sales made to customers on open account): Actual credit sales for March Actual credit sales for April Estimated credit sales for May Estimated collections in the month of sale Estimated collections in the first month after the month of sale Estimated collections in the second month after the month of sale Estimated provision for bad debts (made in the month of sale) $225,000 $ 293,000 $ 438,000 25% 60% 10% 5% The firm writes off all uncollectible accounts at the end of the second month after the month of sale. Required: Determine for Papst Company for the month of May: 1. The estimated cash receipts from accounts receivable collections. 2. The gross amount of accounts receivable at the end of the month (after appropriate write-off of uncollectible accounts). 3. The net amount of accounts receivable at the end of the month. 4. Recalculate…arrow_forwardThe president of the retailer Prime Products has just approached the company's bank with a request for a $57,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $30,800. Accounts receivable on April 1 will total $159,600, of which $136,800 will be collected during April and $18,240 will be collected during May. The remainder will be uncollectible. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the…arrow_forward

- Hernandez Company expects credit sales for January to be $58,000. Cash sales are expected to be $38,000. The company expects credit and cash sales to increase 10% for the month of February. Credit sales are collected in the month following the month in which sales are made. Based on this information, the amount of cash collections in February would be:arrow_forwardCloudy Company had the following historical collection pattern for its credit sales: 70% collected in the month of sale 12% collected in the first month after month of sale 10% collected in the second month after month of sale 5% collected in the third month after month of sale 3% uncollectible The sales on open account (credit sales) have been budgeted for the last six months of the year as shown below: July August September October November December The estimated cash collection by Cloudy Company during September from credit sales in July, August, and September is: Multiple Choice $83,840. $100,160. $90,880. $ 92,000 $ 104,000 $ 116,000 $ 128,000 $ 140,000 $ 122,000 $64,400.arrow_forwardThe Overland Company is preparing its cash budget for the month of June. The following information is available concerning its accounts receivable: $304,000 229,000 Estimated credit sales for June Actual credit sales for May Estimated collections in June for credit sales in June Estimated collections in June for credit sales in May Estimated collections in June for credit sales prior to May 25% 65% $ 22,000 16,000 14,000 Estimated write-offs in June for uncollectible credit sales Estimated provision for bad debts in June for credit sales in June What are the estimated cash receipts from accounts receivable collections in June?arrow_forward

- Minden Company is a wholesale distributor of premium European chocolates. The company's balance sheet as of April 30 is given below: Assets Cash Accounts receivable Inventory Buildings and equipment, net of depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Minden Company Balance Sheet April 30 Note payable Common stock Retained earnings Total liabilities and stockholders' equity Required: For May: The company is in the process of preparing a budget for May and assembled the following data: a. Sales are budgeted at $247,000 for May. Of these sales, $74,100 will be for cash; the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder are collected in the following month. All of the April 30 accounts receivable will be collected in May. b. Purchases of inventory are expected to total $172,000 during May. These purchases will all be on account. Forty percent of all purchases are paid…arrow_forwardThe following data are from the budget of Ritewell Publishers. Half the company's sales are transacted on a cash basis. The other half are paid for with a 1-month delay. The company pays all of its credit purchases with a 1-month delay. Credit purchases in January were $140, and total sales in January were $290. TT February March $ 420 April Total sales $ 440 $ 400 125 135 115 Cash purchases Credit purchases Labor and administrative purchases Taxes, interest, and dividends Capital expenditures 95 85 95 85 85 85 65 65 65 210 Complete the following cash budget. (Leave no cells blank. Enter '0' when necessary. Negative amounts should be indicated by a minus sign.) February March Aprit Sources of cash Collections on current sales Collections on amounts receivable Total sources of cash 0 $ Uses of cash Payments of accounts payable Cash purchases o searcharrow_forwardWestern Company is preparing a cash budget for June. The company has $10,400 in cash at the beginning of June and anticipates $31,600 in cash receipts and $37,700 in cash payments during June. Western Company has an agreement with its bank to maintain a minimum cash balance of $10,000. As of May 31, the company has no loans outstanding. To maintain the $10,000 required balance, during June the company must:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education