FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:PA5. 7.4 Brown Inc. records purchases in a purchases journal and purchase returns in the general

journal. Record the following transactions using a purchases journal, a general journal, and an

accounts payable subsidiary ledger. The company uses the periodic method of accounting for

inventory.

Oct.1 Purchased inventory on account from Price Inc. for $2,000

Oct.1 Purchased inventory on account from Cabrera Inc. for $3,000

Oct.8 Returned half of the inventory to Price Inc.

Oct.9 Purchased inventory on account from Price Inc. for $4,200

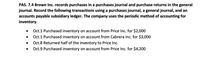

Transcribed Image Text:Gen.

POST.

Pg. 121

Journal

DATE

DESCRIPTION

REF.

DEBIT

CREDIT

1| 20--

2 Oct

1

8

3

3

4

4

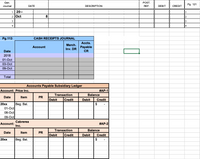

Pg.113

CASH RECEIPTS JOURNAL

Accts.

Merch.

Account

Payable

Inv. DR

Date

CR

2018

01-Oct

03-Oct

09-Oct

Total

Accounts Payable Subsidiary Ledger

Account: Price Inc.

#АP-1

Transaction

Balance

Date

Item

PR

Debit

Credit

Debit

Credit

20хx

Beg. Bal.

$

01-Oct

08-Oct

09-Oct

Cabrerea

Account:

Inc.

#AP-2

Transaction

Balance

Date

Item

PR

Debit

Credit

Debit

Credit

20xx

Beg. Bal.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brown Inc. records purchases in a purchases journal and purchase returns in the general journal. Oct. 1 Purchased inventory on account from Price Inc. for $2,000. Oct. 3 Purchased inventory on account from Cabrera Inc. for $3,000. Oct. 8 Returned half of the inventory to Price Inc. Oct. 9 Purchased inventory on account from Price Inc. for $4,200. Record the above transactions using a purchases journal, a general journal, and an accounts payable subsidiary ledger. The company uses the periodic method of accounting for inventory. If an amount box does not require an entry, leave it blank. Page: 121 DATE ACCOUNT TITLE DOC.NO. POST.REF. DEBIT CREDIT 1 Oct. 8 Accounts Receivable-Cabrera Inc. Accounts Receivable-Cabrera Inc. 1 2 Accounts Payable-Price Inc. Accounts Payable-Price Inc. 2 PURCHASES JOURNAL Page: 113 Date Account PurchaseOrder No. Ref. MerchandiseInventory DR AccountsPayable CR 2019 Oct. 1 fill…arrow_forwardThe following are the transactions of CARI, INC during 2022: The company follows a periodic inventory system 04.01.2022 Purchases merchandise, in cash SR 100,000.00 01.03.2022 Sales merchandise, on credit SR 180,000.00 06.03.2022 Customer takes discount and pays SR 162,000.00 15.10.2022 Pays downtow's shop rent SR 4,000.00 30.12.2022 Purchases a machinery, in cash SR 35,000.00 31.12.2022 Closes beginning inventory SR 30,000.00 31.12.2022 Records the ending inventory SR 12,000.00 31.12.2022 Revenues & expenses balanced off TBD Record the transactions, prepare the trial balance and show the following financial statements: → Balance sheet (Statement of Financial Position) as of 31.12.2022 → Profit & Loss account (Income Statement) for 2022arrow_forwardA company that uses a perpetual inventory system purchased inventory on account and later returned goods worth $900.00 to the vendor. Which of the following would be the correct journal entry to record these returns? OA. Accounts Payable 900 Merchandise Inventory 900 OB. Accounts Payable 900 Purchase Returns 900 OC. Merchandise Inventory 900 Accounts Payable 900 OD. Purchase Returns 900 Accounts Payable 900arrow_forward

- Record the following transactions related to purchases for Horston's Art Supplies using the general journal foem provided below. Assume Horston's uses a periodic inventory system. Omit transaction descriptions from entries. Date Transaction Sept. 1 Purchased $8,000 of merchandise on account, FOB destination, n/30. 3 Returned $1,000 of merchandise purchased on September 1 due to defects. 7 Purchased $1,500 of merchandise on account, terms FOB shipping point, 2/10, n/30. Prepaid fresght of $75 was added to the invoice. 14 Paid for the merchandise purchased on September 7, less discoutnt. 20 Paid for merchandise purchased on September 1, less retarn. Sept. 1 Purchased $8,000 of merchandise on account, FOB destination, n/30. 3 Returned $1,000 of merchandise purchased on September 1 due to defects. 7 Purchased $1,500 of merchandise on account, terms FOB shipping point, 2/10, n/30. P 14 Paid for the merchandise purchased on September 7, less discount. 20 Paid for merchandise purchased on…arrow_forwardPrepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system and the gross method. August 1 Purchased merchandise from Aron Company for $7,000 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. August 5 Sold merchandise to Baird Corporation for $4,900 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost $3,000. August 8 Purchased merchandise from Waters Corporation for $6,000 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. August 9 Paid $150 cash for shipping charges related to the August 5 sale to Baird Corporation. August 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $500 and was sold for $1,000. The merchandise was restored to inventory. August 12 After negotiations with Waters Corporation concerning problems with the purchases on August 8, Lowe's received a price reduction from Waters of…arrow_forwardBremmer uses a periodic inventory system and the following information is available: Sales Beginning Inventory Ending Inventory Purchases What is the cost of goods sold? Select one: Oa. $230,400 Ob. $96,800 Oc. $133,600 Od. $132,200 $ 230,400 21,200 19,800 132,200arrow_forward

- Journalize the following transactions for Armour Inc. Oct. 7 Sold merchandise on credit to Rondo Distributors, for $1,200, terms n/30. The cost of the merchandise was $720. Purchased merchandise, $10,000, terms FOB shipping point, 2/15, n/30, with prepaid freight charges of $525 added to the invoice. Journalize the transactions above using the periodic inventory system. If an amount box does not require an entry, leave it blank. Oct. 7 Oct. 8 Journalize the transactions above using the perpetual inventory system. Oct. 7- Sale Cost Oct. 8arrow_forwardWilliam & Company uses a perpetual inventory system. The following information is available for November: Nov. 1 4 7 10 (a) 12 Balance Purchase Purchase Sale Sale Nov. 12 Units Date Account Titles Nov. 4 20 40 40 (20) (50) Assume all sales and purchases are on credit. Purchase Sales Price Price Prepare journal entries to record the November 4 purchase and the November 12 sale using FIFO. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) $5.00 $5.50 $9.00 (To record sales on account) (To record cost of goods sold) $8.00 $8.00 Debit Creditarrow_forward7 Morgan, Incorporated uses a perpetual inventory system and the net method of recording purchases. On May 12, a merchandise purchase of $19,600 was made on credit, 3/10, n/30. The journal entry to record this purchase is: Multiple Choice Account Title Debit Credit Merchandise Inventory 19,600 Accounts Payable 19,600 Account Title Debit Credit Purchases 19,600arrow_forward

- Heer Don't upload any image pleasearrow_forwardTravis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardCurrent Attempt in Progress Prepare the necessary journal entries to record the following transactions, assuming Cullumber Company uses a perpetual inventory system. (a) Cullumber sells $57,500 of merchandise, terms 1/10, n/30. The merchandise cost $39,220. (b) The customer in (a) returned $5,300 of merchandise to Cullumber. The merchandise returned cost $3,710. (c) Cullumber received the balance due within the discount period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Transactions Account Titles and Explanation (a) (To record credit sale.) (To record cost of goods sold.) Debit Credit SUarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education