FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

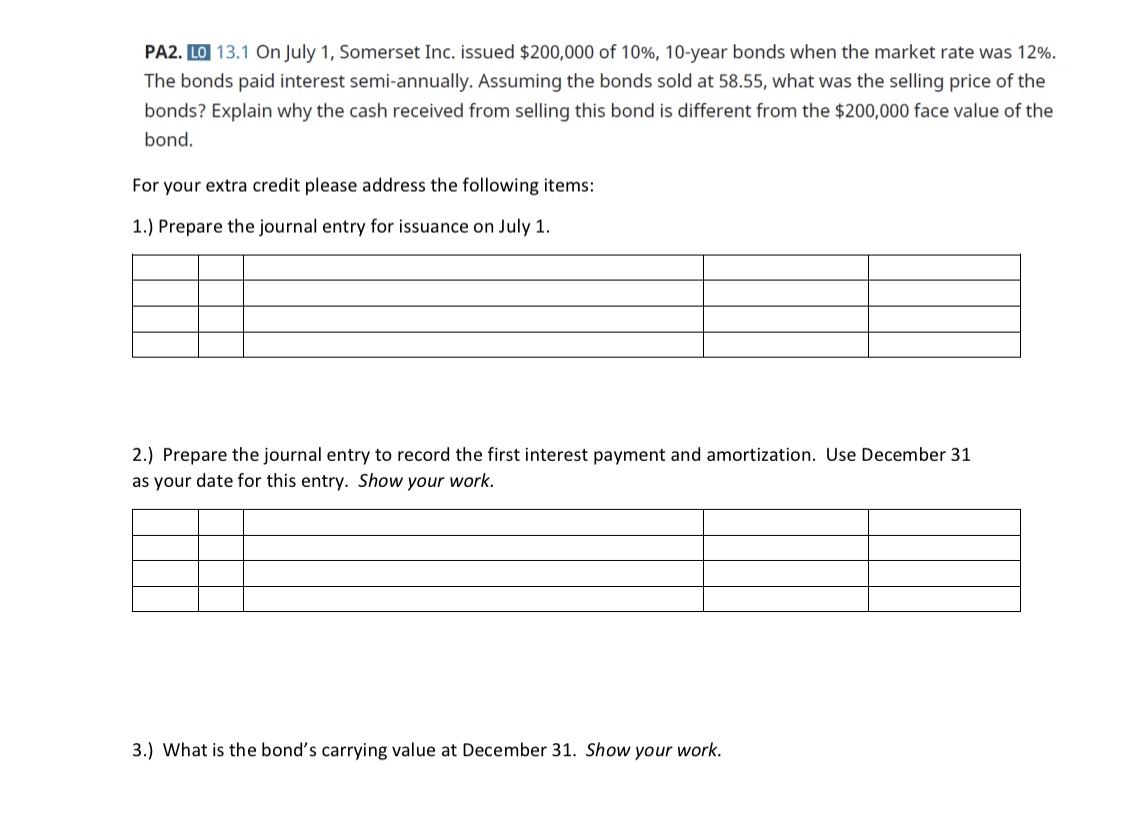

Transcribed Image Text:PA2. LO 13.1 On July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%.

The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of the

bonds? Explain why the cash received from selling this bond is different from the $200,000 face value of the

bond.

For your extra credit please address the following items:

1.) Prepare the journal entry for issuance on July 1.

2.) Prepare the journal entry to record the first interest payment and amortization. Use December 31

as your date for this entry. Show your work.

3.) What is the bond's carrying value at December 31. Show your work.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- PB3. 13.2 Starmount Inc. sold bonds with a $50,000 face value, 12% interest, and 10-year term at $48,000. What is the total amount of interest expense over the life of the bonds?arrow_forward3. Diana Inc. issued $100,000 of its 9%, 5-year bonds for $96,149 when the market rate was 10%. The bonds pay interest semi-annually. Prepare an amortization table for the first three payments. Semiannual Interest Period Semiannual Interest Expense Semiannual Interest Payment Amortization of Discount Ending Carrying Value 1 2 3 PLEASE NOTE: All dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345).arrow_forwardThe following table lists several corporate bonds issued during a particular quarter. Company AT&T Bank ofAmerica GeneralElectric GoldmanSachs Verizon WellsFargo Time to Maturity (years) 10 10 2 3 8 7 Annual Rate (%) 3.40 4.00 4.25 6.15 5.15 4.50 If the General Electric bonds you purchased had paid you a total of $8,680 at maturity, how much did you originally invest? (Round your answer to the nearest dollar.) $arrow_forward

- In January 1 20x1 abc company issued a 1000000 10 year bond with a stated interest rate of 9% payable annually every December 31st the market interest rate is 7% the bonds price is 1140160.arrow_forwardThe following table lists several corporate bonds issued during a particular quarter. Company AT&T Bank ofAmerica GeneralElectric GoldmanSachs Verizon WellsFargo Time toMaturity(years) 10 10 2 3 8 7 AnnualRate (%) 2.40 5.00 5.25 7.15 4.15 3.50 If the General Electric bonds you purchased had paid you a total of $6,630 at maturity, how much did you originally invest? (Round your answer to the nearest dollar.)arrow_forward.14.. Fly Adventures issues bonds due in 10 years with a stated interest rate of 6% and a face value of $500,000. Interest payments are made semi-annually. The market rate for this type of bond is 5%. What is the issue price of the bonds? A. $537,194. B. $464,469. C. $538,973. D. $500,000. PV 1 2.5% 20pds .61027 PV 13% 10pds .74409 PVA 2.5% 20pds 15.56816 PVA 3% 20pds 14.87747arrow_forward

- Need help with 19 and 20 pleasearrow_forward31. Help me selecting the right answer. Thank youarrow_forward2. Deccan Corporation issued 10% 1,000,000 bond on January 1.2011 The market rate of interest is 12% Interest is paid semi annual The term of the bond is 5 years. V. How much would an investor pay for this bond? VI. Make Journal entries to record the receipt of cash from the sale of the bond in Deccan Corporations books VII. Amortize the bond discount over the term of bond using a. Straight line Method b. interest rate method VIII. Make Journal entries to record the payment of interest on 31 December 2011.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education