FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

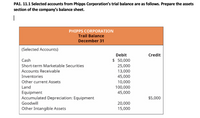

Transcribed Image Text:PA1. 11.1 Selected accounts from Phipps Corporation's trial balance are as follows. Prepare the assets

section of the company's balance sheet.

PHIPPS CORPORATION

Trail Balance

December 31

(Selected Accounts)

Debit

Credit

Cash

$ 50,000

Short-term Marketable Securities

25,000

Accounts Receivable

13,000

Inventories

45,000

Other current Assets

10,000

100,000

45,000

Land

Equipment

Accumulated Depreciation: Equipment

$5,000

Goodwill

20,000

Other Intangible Assets

15,000

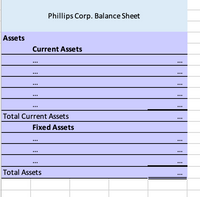

Transcribed Image Text:Phillips Corp. Balance Sheet

Assets

Current Assets

...

...

...

...

...

Total Current Assets

Fixed Assets

...

...

...

Total Assets

...

: : : : :

: :

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected accounts from Han Corporation’s trial balance are as follows. Han Corporation Trial Balance December 31 (Selected Accounts) Debit Credit Cash $160,000 Short-Term Marketable Securities 145,000 Accounts Receivable 25,000 Inventories 90,000 Other Current Assets 20,000 Land 330,000 Buildings 300,000 Accumulated Depreciation-Buildings $40,000 Equipment 144,000 Accumulated Depreciation-Equipment 15,000 Goodwill 40,000 Other Intangible Assets 20,000 Prepare the detailed schedule showing the Property, Plant, and Equipment. Property, Plant, and Equipment, Net $fill in the blank 2 fill in the blank 4 fill in the blank 6 Gross Property, Plant, and Equipment $fill in the blank 7 fill in the blank 9 Total Property, Plant, and Equipment, Net $fill in the blank 10arrow_forwardThe following information was extracted from the records of Lodh Ltd for the year ended 30 June 2021. Lodh LTD Statement of financial position (extract) As at 30 June 2021 Relevant Assets Accounts Receivable $50,000 Allowance for doubtful debts (4,000) $46,000 Prepaid rent 42,000 Plant 200,000 Accumulated depreciation – Plant (25% on cost) (50,000) 150,000 DTA beginning balance 1,000 … Relevant Liabilities Interest Payable 2,000 Provision for long service leave 10,000 Unearned revenue 20,000 DTL beginning balance 5,000 … Additional information · The tax depreciation for plant is considered at 30% of $200,000 (original cost) at 30 June 2021. · Long service leave has not been taken by any employee during the year. · There…arrow_forwardSelected accounts from Han Corporation's trial balance are as follows. Han Corporation Trial Balance December 31 (Selected Accounts) Debit Credit Cash $180,000 Short-Term Marketable Securities 140,000 Accounts Receivable 27,000 Inventories 90,000 Other Current Assets 20,000 Land 320,000 Buildings 300,000 Accumulated Depreciation-Buildings $40,000 Equipment 143,000 Accumulated Depreciation-Equipment 10,000 Goodwill 40,000 Other Intangible Assets 20,000 Prepare the detailed schedule showing the Property, Plant, and Equipment. Property, Plant, and Equipment, Net Gross Property, Plant, and Equipment Total Property, Plant, and Equipment, Netarrow_forward

- X Company reports these account balances on December 31, 2021 Accounts Payable Accounts Receivable Accumulated depreciation $450,000 150.000 180,000 600,000 80.000 300,000 Cash Drawings Operating Expenses Goodwill 90,000 000 080 Service Revenne Owner's capital Unearmed Service Reventie S00,000 720.000 50,000arrow_forwardSelected accounts from Han Corporation’s trial balance are as follows. Prepare a partial balance sheet listing only the Fixed Assets section. Han Corporation Abbreviated Trial Balance December 31, 2020 Account Name (Acct. #) Debit Balances Credit Balances Cash 150,000 Short-term Marketable Securities 145,000 Accounts Receivable 26,000 Inventories 90,000 Other Current Assets 10,000 Land 350,000 Buildings 300,000 Accumulated Depreciation: Buildings 40,000 Equipment 145,000 Accumulated Depreciation: Equipment 150,000 Goodwill 40,000 Other Intangible Assets 20,000arrow_forwardharrow_forward

- Classified Balance Sheet The Werthman Company collected the following information for the preparation of its December 31 classified balance sheet: Accounts receivable $15,000 Property, plant, and equipment $200,000 Cash 17,000 Inventory 65,000 Other current assets 25,000 Other long-term assets 40,000 Accounts payable 21,000 Common stock 95,000 Long-term liabilities 55,000 Retained earnings Other current liabilities 18,000 Prepare a classified balance sheet for Werthman Company. Werthman Company Balance Sheet December 31 Assets Liabilities & Stockholders' Equity Current Assets: Current Liabilities: Other current liabilities Total Current Liabilities Other current assetS Noncurrent Liabilities: Total Current Assets Total Liabilities Noncurrent Assets: Stockholders' Equity Common stock Other long-term assets Total Noncurrent Assets Total Stockholders' Equity Total Assets Total Liabilities & Stockholders' Equity $arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education