FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

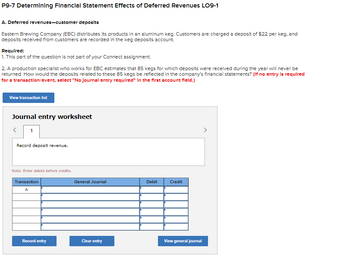

Transcribed Image Text:P9-7 Determining Financial Statement Effects of Deferred Revenues LO9-1

A. Deferred revenues-customer deposits

Eastern Brewing Company (EBC) distributes its products in an aluminum keg. Customers are charged a deposit of $22 per keg, and

deposits received from customers are recorded in the keg deposits account.

Required:

1. This part of the question is not part of your Connect assignment.

2. A production specialist who works for EBC estimates that 85 kegs for which deposits were received during the year will never be

returned. How would the deposits related to these 85 kegs be reflected in the company's financial statements? (If no entry is required

for a transaction/event, select "No journal entry required" In the first account fleld.)

View transaction list

Journal entry worksheet

<

1

Record deposit revenue.

Note: Enter debits before credits.

Transaction

A

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

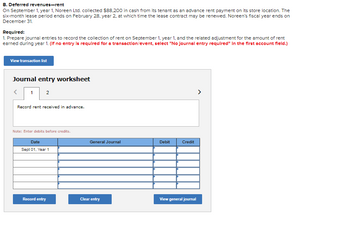

Transcribed Image Text:B. Deferred revenues-rent

On September 1, year 1, Noreen Ltd. collected $88,200 in cash from its tenant as an advance rent payment on its store location. The

six-month lease period ends on February 28, year 2, at which time the lease contract may be renewed. Noreen's fiscal year ends on

December 31.

Required:

1. Prepare journal entries to record the collection of rent on September 1, year 1, and the related adjustment for the amount of rent

earned during year 1. (If no entry is required for a transaction/event, select "No journal entry required" In the first account fleld.)

View transaction list

Journal entry worksheet

1 2

Record rent received in advance.

Note: Enter debits before credits.

Date

Sept 01, Year 1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardExercise 9-15 During its first year of operations, Mack’s Plumbing Supply Co. had sales of $3,250,000, wrote off $27,800 of accounts as uncollectible using the direct write-off method, and reported net income of $487,500. Determine what the net income would have been if the allowance method had been used and the company estimated that 1% of sales would be uncollectible. --------------------------------------------------------------------- Using the data in Exercise 9-15, assume that during the second year of operations, Mack’s Plumbing Supply Co. had sales of $4,100,000, wrote off $34,000 of accounts as uncollectible using the direct write-off method, and reported net income of $600,000.a. Determine what net income would have been in the second year if the allowance method (using 1% of sales) had been used in both the first and second years.b. Determine what the balance of the allowance for doubtful accounts would have been at the end of the second year if the allowance method had been…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Morrison Company Balance Sheet January 1 Assets Cash $ 40,950 Raw materials Work in process Finished goods Prepaid expenses Property, plant, and equipment (net) $ 17,800 6,600 31,800 56, 200 3,350 124,000 $ 224,500 Total assets Liabilities and Stockholders' Equity Accounts payable Retained earnings $ 7,100 217,400 Total liabilities and stockholders' equity $ 224,500 During January the company completed the following transactions: a. Purchased raw materials on account, $75,200. b. Raw materials used in production, $91,500 ($80,200 was direct materials and $11,300 was indirect materials). c. Paid $202.100 of salaries and wages in cash ($108,800 was direct labor, $41,700 was indirect labor, and $51,600 was related to employees responsible for selling and administration). d. Various manufacturing overhead costs incurred (on account) to support production, $43,350. e. Depreciation recorded on property, plant, and equipment, $63,600 (70% related to manufacturing equipment and 30% related to…arrow_forwardDo not provide answer in image formatarrow_forwardSales by Knight Inc. to major customers are as follows: Sales $2,850,000 3,570,000 3,920,000 Reporting Segment Computer hardware Computer software Service contract 2,260,000 Service contract 4,670,000 Computer software 2,920,000 Computer hardware 5,430,000 Computer hardware Customer State of Illinois Cook County, Illinois U.S. Treasury Department U.S. Department of Defense Bank of England Philips NV Honda Required: Assume if worldwide sales total $44,200,000 for the year, what amount of Knight's sales from major customer should be disclosed under the following reporting segments? s Service contracts Computer software Computer hardwarearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education