FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please don't give image format and solve all

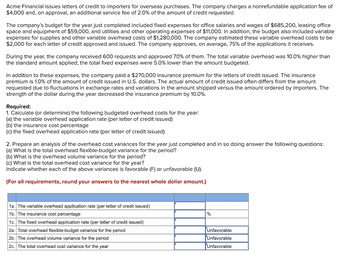

Transcribed Image Text:Acme Financial issues letters of credit to importers for overseas purchases. The company charges a nonrefundable application fee of

$4,000 and, on approval, an additional service fee of 2.0% of the amount of credit requested.

The company's budget for the year just completed included fixed expenses for office salaries and wages of $685,200, leasing office

space and equipment of $59,000, and utilities and other operating expenses of $11,000. In addition, the budget also included variable

expenses for supplies and other variable overhead costs of $1,280,000. The company estimated these variable overhead costs to be

$2,000 for each letter of credit approved and issued. The company approves, on average, 75% of the applications it receives.

During the year, the company received 600 requests and approved 70% of them. The total variable overhead was 10.0% higher than

the standard amount applied; the total fixed expenses were 5.0% lower than the amount budgeted.

In addition to these expenses, the company paid a $270,000 insurance premium for the letters of credit issued. The insurance

premium is 1.0% of the amount of credit issued in U.S. dollars. The actual amount of credit issued often differs from the amount

requested due to fluctuations in exchange rates and variations in the amount shipped versus the amount ordered by importers. The

strength of the dollar during the year decreased the insurance premium by 10.0%.

Required:

1. Calculate (or determine) the following budgeted overhead costs for the year:

(a) the variable overhead application rate (per letter of credit issued)

(b) the insurance cost percentage

(c) the fixed overhead application rate (per letter of credit issued)

2. Prepare an analysis of the overhead cost variances for the year just completed and in so doing answer the following questions:

(a) What is the total overhead flexible-budget variance for the period?

(b) What is the overhead volume variance for the period?

(c) What is the total overhead cost variance for the year?

Indicate whether each of the above variances is favorable (F) or unfavorable (U).

(For all requirements, round your answers to the nearest whole dollar amount.)

1a. The variable overhead application rate (per letter of credit issued)

1b. The insurance cost percentage

1c. The fixed overhead application rate (per letter of credit issued)

2a. Total overhead flexible-budget variance for the period

2b. The overhead volume variance for the period

2c. The total overhead cost variance for the year

%

Unfavorable

Unfavorable

Unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe the steps to be taken to correct an error.arrow_forwardRepost the complete question and add sub-parts to be solarrow_forwardPlease don't use chat gpt and other ai other wise I give multiplie downvote Which of the following is sometimes called a currently attainable standard? O a. par b. normal standard O c. theoretical standard d. ideal standardarrow_forward

- What is lossy compression? a MP3 is compressed music. b Reduce the size of files by taking out less important information. It drops nonessential information to decrease file size. Reduce the size of the file without losing any information and the original file can be reconstructed from a compressed version. d Joint Photographic Experts Group JPEG) is a compressed image. O O O Carrow_forwardhelp please, the answers I put are not correctarrow_forwardWhat is Contiguous data?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education