Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please give me answer very fast in 5 min saur

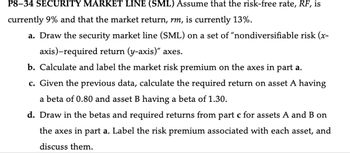

Transcribed Image Text:P8-34 SECURITY MARKET LINE (SML) Assume that the risk-free rate, RF, is

currently 9% and that the market return, rm, is currently 13%.

a. Draw the security market line (SML) on a set of "nondiversifiable risk (x-

axis)-required return (y-axis)" axes.

b. Calculate and label the market risk premium on the axes in part a.

c. Given the previous data, calculate the required return on asset A having

a beta of 0.80 and asset B having a beta of 1.30.

d. Draw in the betas and required returns from part c for assets A and B on

the axes in part a. Label the risk premium associated with each asset, and

discuss them.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The balance (debt) on your credit card is $2500. Your credit card APR is 6%. You are spending $100 each month. You are paying $300 to your credit card each month. How many months it takes to pay all your debt (balance)? NOTE: you need to use Excel to find the answer to this problem (Similar to the exercise we did in the class).arrow_forwardFinance class You borrow $10 from your brother 2 days ago and you are paying him back $11 today. What is the APR? What is the EAR?arrow_forwardPlease see below. Need this asap please and thank you.arrow_forward

- Excel Skills 7. Solve the follow sections: a. Complete the following spreadsheet, showing how much will be in your bank account if you deposit an initial deposit (cell B2) today and it draws annual interest given in cell B1. Interest 2 Initial deposit 3 4 5 6 7 A 8 9 10 Year " 0 1 23 4 5 B b. Graph the results of the bank account. 8% $155 In bank account.arrow_forwardI need 1,2,3,4, and 6 answered without using excel please.arrow_forwardMarcos purchases a top-up card for his pre-paid cell phone. His remaining balance, B, can be modeled by the equation B = 45 – 0.35n, where n is the number of minutes he's talked since purchasing the card. a) How much money was on the card when he purchased it? $ Which intercept is this? Select an answer v b) How many minutes will he have talked when he runs out of money? minutes. Which intercept is this? Select an answer v c) What is the slope of this equation? What are the units on the slope? Select an answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education