FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

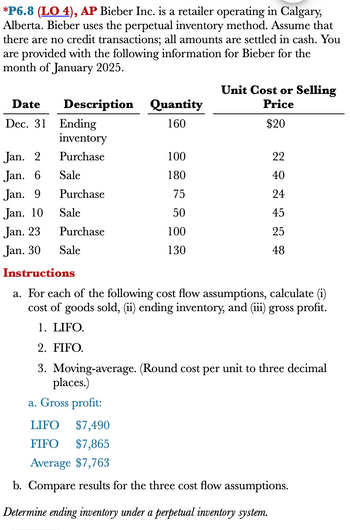

Transcribed Image Text:*P6.8 (LO 4), AP Bieber Inc. is a retailer operating in Calgary,

Alberta. Bieber uses the perpetual inventory method. Assume that

there are no credit transactions; all amounts are settled in cash. You

are provided with the following information for Bieber for the

month of January 2025.

Date

Dec. 31

Jan. 2

Jan. 6

Jan. 9

Jan. 10

Jan. 23

Jan. 30

Description

Ending

inventory

Purchase

Sale

Purchase

Sale

Purchase

Sale

Quantity

160

100

180

75

50

100

130

Unit Cost or Selling

Price

$20

22

40

24

45

25

48

Instructions

a. For each of the following cost flow assumptions, calculate (i)

cost of goods sold, (ii) ending inventory, and (iii) gross profit.

1. LIFO.

2. FIFO.

3. Moving-average. (Round cost per unit to three decimal

places.)

a. Gross profit:

LIFO $7,490

FIFO $7,865

Average $7,763

b. Compare results for the three cost flow assumptions.

Determine ending inventory under a perpetual inventory system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- M IN V F. R | B. H. G. 9- 4. 8. 2$ ) MacBook Pro b. a. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. Travis Company purchased merchandise on account from a supplier for $5,400, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period.arrow_forwardDon't give answer in image formatarrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forward

- Am. 104.arrow_forwardkau.3arrow_forwardJournalize the following transactions for Armour Inc. Oct. 7 Sold merchandise on credit to Rondo Distributors, for $1,200, terms n/30. The cost of the merchandise was $720. Purchased merchandise, $10,000, terms FOB shipping point, 2/15, n/30, with prepaid freight charges of $525 added to the invoice. Journalize the transactions above using the periodic inventory system. If an amount box does not require an entry, leave it blank. Oct. 7 Oct. 8 Journalize the transactions above using the perpetual inventory system. Oct. 7- Sale Cost Oct. 8arrow_forward

- 7 Morgan, Incorporated uses a perpetual inventory system and the net method of recording purchases. On May 12, a merchandise purchase of $19,600 was made on credit, 3/10, n/30. The journal entry to record this purchase is: Multiple Choice Account Title Debit Credit Merchandise Inventory 19,600 Accounts Payable 19,600 Account Title Debit Credit Purchases 19,600arrow_forward. EX.06.204.ALGO Sampson Co. sold merchandise to Batson Co. on account, $28,500, terms 2/15, net 45. The cost of the merchandise sold is $21,375. Batson Co. paid the invoice within the discount period. Assume both Sampson and Batson use a perpetual inventory system. Journalize these transactions for Sampson Co. If an amount box does not require an entry, leave it blank. a. fill in the blank 9d2beefcd029043_2 fill in the blank 9d2beefcd029043_3 fill in the blank 9d2beefcd029043_5 fill in the blank 9d2beefcd029043_6 b. fill in the blank 9d2beefcd029043_8 fill in the blank 9d2beefcd029043_9 fill in the blank 9d2beefcd029043_11 fill in the blank 9d2beefcd029043_12 c. fill in the blank 9d2beefcd029043_14 fill in the blank 9d2beefcd029043_15 fill in the blank 9d2beefcd029043_17 fill in the blank 9d2beefcd029043_18 Journalize these transactions for Batson Co. If an amount box does not require an entry, leave it blank. a. and b.…arrow_forwardHeer Don't upload any image pleasearrow_forward

- T Select all that apply X-Mart uses the perpetual inventory system to account for its merchandise. On June 1, it sold $7,000 of merchandise for cash. The original cost of the merchandise to X-Mart was $500. Demonstrate the required journal entry to record the sale and the cost of the sale by selecting all of the correct actions below. (Check all that apply.) Debit Sales $7,000. Debit Cash $7,000. Credit Sales $7,000. Credit Cost of Goods Sold $500. Debit Cost of Goods Sold $500. Debit Merchandise Inventory $500. Credit Cash $7,000. Credit Merchandise Inventory $500.arrow_forwardTravis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education