FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

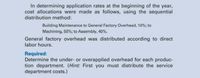

Transcribed Image Text:In determining application rates at the beginning of the year,

cost allocations were made as follows, using the sequential

distribution method:

Building Maintenance to General Factory Overhead, 10%; to

Machining, 50%; to Assembly, 40%.

General factory overhead was distributed according to direct

labor hours.

Required:

Determine the under- or overapplied overhead for each produc-

tion department. (Hint: First you must distribute the service

department costs.)

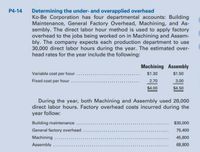

Transcribed Image Text:P4-14

Determining the under- and overapplied overhead

Ko-Be Corporation has four departmental accounts: Building

Maintenance, General Factory Overhead, Machining, and As-

sembly. The direct labor hour method is used to apply factory

overhead to the jobs being worked on in Machining and Assem-

bly. The company expects each production department to use

30,000 direct labor hours during the year. The estimated over-

head rates for the year include the following:

Machining Assembly

Variable cost per hour

$1.30

$1.50

Fixed cost per hour

2.70

3.00

$4.00

$4.50

During the year, both Machining and Assembly used 28,000

direct labor hours. Factory overhead costs incurred during the

year follow:

Building maintenance

$30,000

.....

General factory overhead

75,400

Machining

45,800

... ...

Assembly

68,800

.... ..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A-5arrow_forwardMason Company has two manufacturing departments-Machining and Assembly. All of the company's manufacturing overhead costs are fixed costs. It provided the following estimates at the beginning of the year as well as the following information for Jobs A and B: Estimated Data Manufacturing overhead Direct labor-hours Machine-hours Job A Direct labor-hours Machine-hours Job B Direct labor-hours Machine-hours Machining $5,054,000 19,000 266,000 Machining Assembly 5 10 11 2 Machining 4 12 Assembly 5 3 Assembly $361,000 266,000 14,000 Total 15 13 Total 9 15 Total $5,415,000 285,000 280,000 Required: 1. If Mason Company uses a plantwide predetermined overhead rate with direct labor-hours as the allocation base, how much manufacturing overhead cost would be applied to Job A? Job B? 2. Assume Mason Company uses departmental predetermined overhead rates. The Machining Department is allocated based on machine-hours and the Assembly Department is allocated based on direct labor-hours. How much…arrow_forwardMontanaTechnology, Inc. has a job-order costing system. The company uses pre- determined overhead rates in applying manufacturing overhead cost to individual jobs. The pre-determined overhead rate in Department A is based on machine hours, and the rate in Department B is based on direct materials cost. At the beginning of the most recent year, the company's management made the following estimates for the year: Department B 19,000 60,000 $282,000 $520,000 $705,000 Machine-hours 70,000 30,000 $195,000 $260,000 $420,000 Direct labour-hours Direct materials cost Direct labour cost Manufacturing overhead cost Job 243 entered into production on April 1 and was completed on May 12. The company's cost records show the following information about the job: Department A 250 B 60 Machine-hours Direct labour-hours 70 120 $840 $610 $1,100 $880 Direct materials cost Direct labour cost At the end of the year, the records of Montana showed the following actual cost and operating data for all jobs…arrow_forward

- At the beginning of the year, a company estimated a predetermined plantwide overhead rate of $8.50 per machine - hour. Job X used 16 machine-hours and it was charged $200 and $288 for direct materials and direct labor, respectively. What is the total job cost for Job X? A. $446 B. $136 C. $624 D. $488arrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $980,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Molding $ 370,000 $ 200,000 15,000 Job C-200 Direct…arrow_forwardCrosshill Company's total overhead costs at various levels of activity are presented below: Month April May June July Machine-Hours 70,000 60,000 80,000 90,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost Total Overhead Cost $200,200 $177,300 $223,100 $246,000 $ 48,000 21,000 108,300 $177,300 The company wants to break down the maintenance cost into its variable and fixed cost elements. Maintenance cost in July Required: 1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first betermine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the "Variable cost per unit" to 2 decimal places.)arrow_forward

- d. Assume that the actual level of activity next year was 36,000 direct labor hours and that manufactur- ing overhead was $341,550. Determine the underapplied or overapplied manufacturing overhead at the end of the year. e. Describe two ways of handling any underapplied or overapplied manufacturing overhead at the end of the year. e. Describe two ways of handling any underapplied or overapplied manufacturing overhead at the end of the year.arrow_forwardCrosshill Company's total overhead costs at various levels of activity are presented below: Month Machine- Hours Total Overhead Cost April 70,000 $ 202,200 May 60,000 $ 180,300 June 80,000 $ 224,100 July 90,000 $ 246,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows: Utilities (variable) $ 52,200 Supervisory salaries (fixed) 21,000 Maintenance (mixed) 107,100 Total overhead cost $ 180,300 The company wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first determine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the "Variable cost per unit" to 2 decimal places.) 2. Using the high-low…arrow_forwardManjiarrow_forward

- Your Company uses a predetermined overhead rate in applying overhead to production orders on a labor cost basis in Department A and on a machine-hours basis in Department B. At the beginning of the most recently completed year, the company made the following estimates: Dept. A Dept. B Direct labor cost $56,000 $33,000 Manufacturing overhead $67,200 $45,000 Direct labor hours 8,000 9,000 Machine hours 4,000 15,000 The Johnson job used 300 machine hours and incurred $5,000 of labor costs. What was the total overhead applied to this job?arrow_forwardFranklin, Inc. estimates manufacturing overhead costs for the Year 3 accounting period as follows. Equipment depreciation. Supplies Materials handling Property taxes Production setup Rent Maintenance Supervisory salaries $190,100. 20,000 33,200 a. Predetermined overhead rate b. Applied manufacturing overhead 13,300 20,100 43,000 39,000 281,300 The company uses a predetermined overhead rate based on machine hours. Estimated hours for labor in Year 3 were 201,000 and for machines were 128,000. Required a. Calculate the predetermined overhead rate. (Round your answer to 2 decimal places.) b. Determine the amount of manufacturing overhead applied to Work in Process Inventory during the Year 3 period if actual machine hours were 143,000. (Do not round intermediate calculations.) per machine hourarrow_forwardAuduon, Incorporated uses a predetermined factory overhead rate based on machine-hours. For October, Audubon recorded $5,500 in overapplied overhead, based on 35,100 actual machine-hours worked and actual manufacturing overhead incurred of $603,485. Audubon estimated manufacturing overhead for October to be $572,550. Required: What was the estimated number of machine-hours Audubon expected in October? Note: Do not round intermediate calculations. Expected machine-hours machine-hoursarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education