Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:P24-5A Coolplay Corp. is thinking about opening a soccer camp in southern California.

To start the camp, Coolplay would need to purchase land and build four soccer fields and a

sleeping and dining facility to house 150 soccer players. Each year, the camp would be run

for 8 sessions of 1 week each. The company would hire college soccer players as coaches.

The camp attendees would be male and female soccer players ages 12-18. Property values

in southern California have enjoyed a steady increase in value. It is expected that after

using the facility for 20 years, Coolplay can sell the property for more than it was originally

purchased for. The following amounts have been estimated.

Cost of land

Cost to build soccer fields, dorm and dining facility

Annual cash inflows assuming 150 players and 8 weeks

Annual cash outflows

$300,000

$600,000

$920,000

$840,000

20 years

$1,500,000

8%

Estimated useful life

Salvage value

Discount rate

Transcribed Image Text:ropriate:

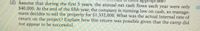

(d) Assume that during the first 5 years, the annual net cash flows each year were only

$40,000. At the end of the fifth year, the company is running low on cash, so manage-

ment decides to sell the property for $1,332,000. What was the actual internal rate of

return on the project? Explain how this return was possible given that the camp did

not appear to be successful.

(d

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kaleo has made up his mind—he wants a pool in the family’s backyard! He figures his kids and spouse will be thrilled. However, to cover the cost of the pool, they’ll have to pack up and live away from home for a few weeks during the summer to rent their home to vacationers. He crunched the numbers based on the following estimates. 1. Cost of pool/installation $50,000 2. Life of the pool (no salvage value) 20 years 3. Annual net cash inflows from renting (net of cash expenses for renting and pool maintenance) $6,500 4. Tax rate 23% 5. Average rate of return 8% Kaleo’s daughter, Sarah, found the above information written on a sheet of paper in his office, along with the following notes. “This is a no-brainer! We’ll recover the cost of this pool in just 7 years, even though we plan to live here until we’re old and gray, or at least as long as the pool hangs on. If we can rent our house out for just 3 weeks each year, it’ll be almost pure profit that we can put toward paying off…arrow_forwardCoronado Skateboards is considering building a new plant. David Al-Saigh, the company's marketing manager, is an enthusiastic supporter of the new plant. Jennifer Miller, the company's chief financial officer, is not so sure that the plant is a good idea. Currently, the company purchases its skateboards from foreign manufacturers. The following figures were estimated for the construction of a new plant: Cost of plant Annual cash inflows Annual cash outflows Estimated useful life Salvage value Discount rate $6,360,000 $6,360,000 $5,883,000 15 years $1,060,000 David believes that these figures understate the true potential value of the plant. He suggests that by manufacturing its own skateboards the company will benefit from a "buy Canadian" patriotism. He also notes that the firm has had numerous quality problems with the skateboards manufactured by its suppliers. He suggests that the inconsistent quality has resulted in lost sales, increased warranty claims, and some costly lawsuits.…arrow_forward3) New Project Investment| Wally loves your analysis. He has now asked you to evaluate potential new project investments. Both projects aim to make widgets. Widgets sell for $10 each. Project A will produce 4,500 units in the first year, 6,500 units in the second and third years and a whopping 44,000 units in the fourth year. Project A requires an investment of 7 machines each costing $50,000. Project B will produce 2,400 units in the first year, 2,200 units in the second year, 1,950 units in the third year and 1,460 units in the fourth year. Project B requires an initial investment of 1 machine worth $50,000. Wally has said that to make the analysis easier - you need not calculate depreciation on the machine, the tax shelter benefit or the residual value of the machine at the end of production. Wally just said I want you understand the cash flows from the information provided above. (a) Calculate the net present value for each of Project A and Project B, assuming a 15% cost of…arrow_forward

- The city of Oak Ridge is evaluating three mutually exclusive landscaping plans for refurbishing a public greenway. Benefits to the community have been estimated by a landscaping committee, and the costs of planting trees and shrubbery, as well as maintaining the greenway, are summarized below. The city’s cost of capital is 8% per year, and the planning horizon is 10 years. Which landscaping plan will you recommend based on B/C ratio analysis? Landscaping plan A B C Initial planning cost $75,000 $50,000 $65,000 Annual maintenance expense 4,000 5,000 4,700 Annual community benefits 20,000 18,000 20,000arrow_forwardRussell Trent was recently tasked with evaluating projects for Stan's No Touch Car Wash. The company recently decided to use NPV as its primary criterion for approving projects. To be selected, a project must have a positive NPV. Russell is currently evaluating a project with the following estimated investment requirements ($ millions) by year (starting in year 0): \ Investment Year Investment 0 16 1 10.1 2 12.5 The estimated revenues ($ millions) from the project, expected to begin at time 2, are given in the table below: Investment Year Investment 0 11.1 1 11.3 2 8.2 3 14.3 4 11.9 To account for the different risk characteristics throughout the project's life, Russell has determined that a hurdle rate of 23% should be used beginning at time 0, while 37% should be used beginning in period 4. Determine the NPV for the project. NPV=arrow_forwardThe city is installing a new swimming pool in the east end recreation centre. One design being considered is a reinforced concrete pool that will cost $5000000 to install. Thereafter, the inner surface of the pool will need to be refinished and painted every 10 years at a cost of $450000 per refinishing. Assuming that the pool will have essentially an infinite life, what is the present worth of the costs associated with the pool design? The city uses a MARR of 6%. Review the following table and calculate the present worth of the project for a +5% change in refinishing costs. Round your answer to the nearest dollar. Parameter Construction Costs Refinishing Costs MARR [%] -10% -5% Base Case +5% +10% $5000000 $450000 6 Present Worth of -10% -5% 0% +5% Costs +10% Changes to Construction Costs Changes to refinishing Costs Changes to MARR ????? ?arrow_forward

- i need the answer quicklyarrow_forwardNeed help with this questionarrow_forwardXYZ Inc., the Calapan-based computer manufacturer, has developed a new all-in-one device: phone, music-player, camera, GPS, and computer. The device is called the iPip. The following data have been collected regarding the iPip project. The company has identified a prime piece of real estate and must purchase it immediately for $100,000. In addition, R&D expenditures of $175,000 must be made immediately. During the first year the manufacturing plant will be constructed. The plant will be ready for operation at the end of Year 1. The construction costs are $500,000 and will be paid upon completion. At the end of the Year 1, an inventory of raw materials will be purchased costing $50,000. Production and sales will occur during years 2 and 3. (Assume that all revenues and operating expenses are received (paid) at the end of each year.) Annual revenues are expected to be $850,000. Fixed operating expenses are $100,000 per year and variable operating expenses are 25% of sales. The…arrow_forward

- Larry’s Lawn Service (LLS) currently offers a single lawn maintenance service that includes cutting grass, trimming shrubs, and removing leafs. LLS is considering offering an additional lawn care service which will include fertilizing and pest control. LLS hired you to perform a study to determine whether or not LLS should in fact go ahead with the new service. Your fee to LLS is $10,000 which is due whether LLS makes the investment in the new project or not. Additionally, if this new lawn care service is implemented, LLS believes that it will actually increase business for its original lawn maintenance service. You have estimated the dollar value of this benefit to the existing lawn maintenance service to be $20,000/year 33.) For LLS, the $10,000 fee is a: Question 33 options: Incremental cash flow Externality Sunk cost Opportunity costarrow_forwardPharoah Corp. is thinking about opening a soccer camp in southern California. To start the camp, Pharoah would need to purchase land and build four soccer fields and a sleeping and dining facility to house 150 soccer players. Each year, the camp would be run for 8 sessions of 1 week each. The company would hire college soccer players as coaches. The camp attendees would be male and female soccer players ages 12-18. Property values in southern California have enjoyed a steady increase in value. It is expected that after using the facility for 20 years, Pharoah can sell the property for more than it was originally purchased for. The following amounts have been estimated. Cost of land Cost to build soccer fields, dorm, and dining facility Annual cash inflows assuming 150 players and 8 weeks Annual cash outflows Estimated useful life Salvage value Discount rate Click here to view the factor table. (a) Net present value $ $318,000 $636,000 $975,200 $890,400 Should the project be accepted?…arrow_forwardBaghibenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education