Concept explainers

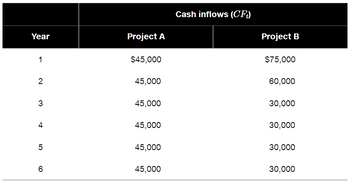

P10–24 ALL TECHNIQUES, CONFLICTING RANKINGS Nicholson Roofing Materials Inc. is considering two mutually exclusive projects that both cost $150,000. The company’s board of directors has set a maximum four-year payback requirement, the cost of capital is 9%. The project cash flows appear below.

a. Calculate the payback period for each project.

b. Calculate the NPV of each project at 0%.

c. Calculate the NPV of each project at 9%.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Can you show how the NPV for project B was calculated. Still need to understand how answer was achieved. Maybe showing formula in excel. Thanks

Can you show how the NPV for project B was calculated. Still need to understand how answer was achieved. Maybe showing formula in excel. Thanks

- hrk.3arrow_forwardNonearrow_forwardExercise 14-7 (Algo) Net Present Value Analysis of Two Alternatives [LO14-2] Perit Industries has $115,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Project A Project B Cost of equipment required $ 115,000 $ 0 Working capital investment required $ 0 $ 115,000 Annual cash inflows $ 21,000 $ 69,000 Salvage value of equipment in six years $ 8,700 $ 0 Life of the project 6 years 6 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries’ discount rate is 15%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. Compute the net present value of Project B. (Enter negative values with a minus sign. Round your…arrow_forward

- Nonearrow_forward7.1 A project will increase revenue from $1.7 million to $2.6 million. Wages are 40% of revenue. Maintenance on the machine will be $31,000 less than it is on the machine that will be replaced. What is the incremental net revenue (i.e. change in revenue minus expenses) that will result from accepting this project? a. $0.540 million b. $0.571 million c. $0.900 million d. $0.509 millionarrow_forward3arrow_forward

- Q3 7a 7. XYZ Co. is evaluating whether to invest in a project with the following information: Project cost = $950,000 Project life = five years Projected number of units sold per year = 10,000 Projected price per unit = $200 Projected variable cost per unit = 150 Fixed costs per year = $150,000 Required rate of return = 15% Marginal tax rate = 35% Assume straight-line depreciation to zero over five years, and ignore the half-year rule for accounting for depreciation. a. Calculate the cash break-even sales quantity for this project.arrow_forwardA1arrow_forwardA8arrow_forward

- 28 cton 1 Lawrence Corporation is considering the purchase of a new piece of equipment. When discounted at the cost of capital of 17%, the project has a net present va $24,670. When discounted at rate of 21%, the project has a net present value of $(29,010). The Internal rate of return of the project is: О zero Multiple Choice between 17% and 21% greater than % between zero and 17%arrow_forward2:38 d ces The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,955,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed. out-of-pocket costs $750,000 591,000 $ 2,865,000 1,015,000 1,850,000 Depreciation Total fixed expenses Net operating income Click here to view Exhibit 128-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Profitability index 1,341,000 $ 509,000 Foundational 12-5 (Algo) 5. What is the profitability index for this project? (Round your answer to 2 decimal places.)arrow_forwardNonearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education