Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

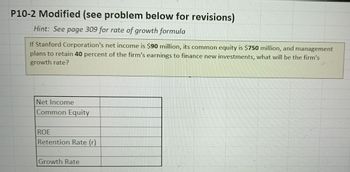

Transcribed Image Text:P10-2 Modified (see problem below for revisions)

Hint: See page 309 for rate of growth formula

If Stanford Corporation's net income is $90 million, its common equity is $750 million, and management

plans to retain 40 percent of the firm's earnings to finance new investments, what will be the firm's

growth rate?

Net Income

Common Equity

ROE

Retention Rate (r)

Growth Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determining PB Ratio for Companies with Different Returns and Growth Assume that the present value of expected ROPI follows a perpetuity with growth g (Value = Amount/ [r - g]). Determine the theoretically correct PB ratio for each of the following companies A and B. Note: NOPAT = NOA » RNOA. Company Net Operating Assets Equity RNOA ROE Weighted Avg. Cost of Capital Growth Rate in ROPI $100 $100 19% 19% 10% 2% $100 $100 12% 12% 10% 4% A B Round answers to two decimal places. PB Ratio Company A Company Barrow_forwardH3. A firm wishes to maintain an sustainable growth rate of 9 percent and a dividend payout ratio of 64 percent. The ratio of total assets to sales is constant at 0.9, and the profit margin is 10.1 percent. If the firm also wishes to maintain a constant debt-equity ratio, what must it be? Please show proper step by step calculationarrow_forwardPlease given answerarrow_forward

- Please give me answer accountingarrow_forwardmange P10-1 (similar to) Question Help ▼ (Measuring growth) If Pepperdine, Inc.'s return on equity is 19 percent and the management plans to retain 55 percent of earnings for investment purposes, what will be the firm's growth rate? The firm's growth rate will be %. (Round to two decimal places.) Worked ent Scor mpts: Question jestion 4 Question jestion 8 Question s course (Busin ms of Use Priv Enter your answer in the answer box and then click Check Answer. Check Answer Clear All All parts showing (8arrow_forwardA firm retains earnings of $40,000. What is the total external financing needed if this company, with $120,00 O in assets, has projected a growth rate of 8 percent? Multiple Choice Zero $3,200 $30,400 $9,600 $100,00 0arrow_forward

- (Measuring growth) If Pepperdine, Inc.'s return on equity is 22 percent and the management plans to retain 63 percent of earnings for investment purposes, what will be the firm's growth rate? Question content area bottom Part 1 The firm's growth rate will be enter your response here%. (Round to two decimal places.)arrow_forwardA firm has decided that its optimal capital structure is 100% equity-financed. It perceives its optimal dividend policy to be a 60% payout ratio. Asset turnover is sales/assets = 0.6, the profit margin is 10%, and the firm has a target growth rate of 3%. a-1. Calculate the sustainable growth rate. (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.) a-2. Is the firm’s target growth rate consistent with its other goals? b. If the firm’s target growth rate is not consistent with its other goals, what would asset turnover need to be to achieve its goals? (Do not round intermediate calculations. Round your answer to 3 decimal places.) c. If the firm’s target growth rate is not consistent with its other goals, how high would the profit margin need to be to achieve its goals? (Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place.)arrow_forwardprovide correct answerarrow_forward

- What is the debt ratio at the optimal capital structure of XYZ Inc.?arrow_forwardA firm's earnings per share (EPS) is $2.50, and equity investors require a return of 12%. The per-share net present value of the firm's growth opportunities is $120. What will be the stock price of the firm after it commits to the new project? Multiple choice question. $140.83 $135.56 $122.50 $142.78arrow_forwardNeed help with this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning