ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:P (S),

MC

125

99

79

75

D.

139

99

MR

45

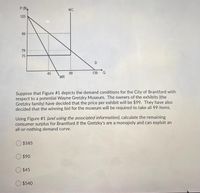

Suppose that Figure #1 depicts the demand conditions for the City of Brantford with

respect to a potential Wayne Gretzky Museum. The owners of the exhibits (the

Gretzky family) have decided that the price per exhibit will be $99. They have also

decided that the winning bid for the museum will be required to take all 99 items.

Using Figure #1 (and using the associated information), calculate the remaining

consumer surplus for Brantford if the Gretzky's are a monopoly and can exploit an

all-or-nothing demand curve.

O $585

$90

$45

$540

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Pre-mixed concrete is an important input for the construction industry. Concrete cannot be stored or transported over long distances as it begins to set after only a few hours. For this reason, only the three local firms—Aggregate Inc., Big Industries and ConCorp—are in a position to compete in the market. Moreover, the capital and regulatory requirements for constructing a new concrete plant are substantial, creating an effective barrier to entry. Pre-mixed concrete is regarded as a homogeneous good by the construction industry. Inverse demand in the market has been estimated to be,P = 670 − Q/40,where P represents the price of a cubic metre of concrete in dollars, and Q is the total number of cubic metres of concrete supplied into the market on a given day. At present the three firms appear have identical production costs, with each firm facing fixed costs of $400,000 per day and a marginal cost of $190 per cubic metre. Big Industries and ConCorp estimate that the proposed merger…arrow_forwardNeed answers to all questionsarrow_forwardGiven that MR = P"(1 + 1/Ep) = p*((Ep+1)/Ep) where Ep is the price elasticity of demand, if marginal cost is constant at $20 over the range of current potential production and the price elasticity of demand = -2.0, then the profit maximizing price to charge is: $35 $45 $30 $40arrow_forward

- Pre-mixed concrete is an important input for the construction industry. Concrete cannot be stored or transported over long distances as it begins to set after only a few hours. For this reason, only the three local firms—Aggregate Inc., Big Industries and ConCorp—are in a position to compete in the market. Moreover, the capital and regulatory requirements for constructing a new concrete plant are substantial, creating an effective barrier to entry. Pre-mixed concrete is regarded as a homogeneous good by the construction industry. Inverse demand in the market has been estimated to be,P = 670 − Q/40,where P represents the price of a cubic metre of concrete in dollars, and Q is the total number of cubic metres of concrete supplied into the market on a given day. At present the three firms appear have identical production costs, with each firm facing fixed costs of $400,000 per day and a marginal cost of $190 per cubic metre. Big Industries and ConCorp estimate that the proposed merger…arrow_forward******ONLY ANSWER PART 3 IN PICTURE PLEASE**** Demand for Thunder games in Oklahoma City is given by: P(0)=430-20 Seattle does not currently have an NBA team, but they would like to attract the the Thunder. ok ok ok Demand for Thunder games in Seattle is given by: P (Q) = 490 -20 The marginal cost of production in both cities is constant at MC = 70. Suppose that the Thunder faces an extra fixed cost of 10000 in Seattle because they need to build a new stadium if they move. If the Thunder decides to stay in Oklahoma City, they don't need to pay the fixed cost. Cities can still offer bids to attract the team. a) Will the Thunder move to Seattle? b) How much is the winning bid? c) What is the profit plus bid for the Thunder? d) What is the value minus bid for the winning city?arrow_forwardPre-mixed concrete is an important input for the construction industry. Concrete cannot be stored or transported over long distances as it begins to set after only a few hours. For this reason, only the three local firms—Aggregate Inc., Big Industries and ConCorp—are in a position to compete in the market. Moreover, the capital and regulatory requirements for constructing a new concrete plant are substantial, creating an effective barrier to entry. Pre-mixed concrete is regarded as a homogeneous good by the construction industry. Inverse demand in the market has been estimated to be,P = 670 − Q/40,where P represents the price of a cubic metre of concrete in dollars, and Q is the total number of cubic metres of concrete supplied into the market on a given day. At present the three firms appear have identical production costs, with each firm facing fixed costs of $400,000 per day and a marginal cost of $190 per cubic metre. Big Industries and ConCorp estimate that the proposed merger…arrow_forward

- Pre-mixed concrete is an important input for the construction industry. Concrete cannot be stored or transported over long distances as it begins to set after only a few hours. For this reason, only the three local firms—Aggregate Inc., Big Industries and ConCorp—are in a position to compete in the market. Moreover, the capital and regulatory requirements for constructing a new concrete plant are substantial, creating an effective barrier to entry. Pre-mixed concrete is regarded as a homogeneous good by the construction industry. Inverse demand in the market has been estimated to be,P = 670 − Q/40,where P represents the price of a cubic metre of concrete in dollars, and Q is the total number of cubic metres of concrete supplied into the market on a given day. At present the three firms appear have identical production costs, with each firm facing fixed costs of $400,000 per day and a marginal cost of $190 per cubic metre. Big Industries and ConCorp estimate that the proposed merger…arrow_forwardM7arrow_forwardSuppose that a factory that enjoys a monopoly in their market has one of their senior engineers retire. Losing this engineer caused the marginal and average total costs to increase by $20. As a result of this rise in costs, the factory changes its price to continue to maximize profit. We should expect production to: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a increase. b decrease. not change.arrow_forward

- I need help with #111 pleasearrow_forwardProblem 2: Presently, APlus Transport and Big Movers are the only suppliers of services that haul heavy construction equipment between jobs within the Midwest. No other suppliers have the equipment necessary to perform the service. The market inverse demand for these hauling services is given below. P = 4,030-4Q where P is price per trip and Q is total number of trips per year. For simplicity, also assume that neither firm has fixed costs. From company records, you are given the following variable cost function for each firm: a. C. TVC = 300 TVCB = 80QB b. Calculate the Cournot market equilibrium price-output solutions for each firm including their respective profits. d. Assume these two competitors operate as a two-firm Cournot duopoly. Find the reaction functions for each firm. Suppose Big Movers shuts down operations so that APlus now has a monopoly in this market. What is the price, quantity, and profits for APlus after this change? Summarize the results of your findings over the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education