ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

I just need an answer for part d) and part e).

Answer I got for b) was Q=12, P=36, Profit=120, and CS=144.

Answer I got for c) was minimum

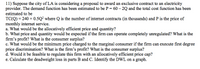

Transcribed Image Text:11) Suppose the city of LA is considering a proposal to award an exclusive contract to an electricity

provider. The demand function has been estimated to be P = 60 – 2Q and the total cost function has been

estimated to be

TC(Q) = 240 + 0.5Q? where Q is the number of internet contracts (in thousands) and P is the price of

monthly internet service.

a. What would be the allocatively efficient price and quantity?

b. What price and quantity would be expected if the firm can operate completely unregulated? What is the

firm's profit? What is the consumer surplus?

c. What would be the minimum price charged to the marginal consumer if the firm can execute first degree

price discrimination? What is the firm's profit? What is the consumer surplus?

d. Would it be feasible to regulate this firm with an allocatively efficient price cap?

e. Calculate the deadweight loss in parts B and C. Identify the DWL on a graph.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Practice Sheet: Market Structure The objective of this sheet is to show you how prices and quantities are determined for each market structure and competition styles. It will also allow you to compare different market outcomes The demand for cookies is given by Q=120-P, where Q is the number of boxes of cookies. Assume a constant unit cost of $10, i.e. ATC=MC-$10. You may use the table below to help you understand the steps, but you don't have to. Price 0 10 20 30 40 50 60 70 80 90 100 110 120 Quantity Profit Perfect Competitive market: Assume the market was perfectly competitive. a. The long run equilibrium P=....... and Q=.. b. Industry profit=...arrow_forwardThe answer displated chopped and cut, but i think i gathered it. Follow up questions Determine the revenue at a price of $25 Which price will yield a higher revenue? $28 or $40?arrow_forwardWhat is the total revenue in a market with the following demand and supply curves? QD=478-6P and QS=128+8Parrow_forward

- Assume your theater will not sell a ticket for less than 80% of regular price $$$ (my assigned price is 145), but will sell one ticket for one performance at 80% of regular price plus $5 and two performances for 80% of regular price plus $10 for each ticket, for small numbers of movies, x, the theater’s supply curve is modeled by p=S(x). Write down your supply function. Find the equilibrium point. (make sure to provide both x and y coordinates and label it on the graph)arrow_forwardQuestion 6 options: The price of a product in a competitive market is $100. The cost per unit of producing the product is c=50+.1x, where x is the number of units produced each month. Find a) The monthly revenue R(x) b) The monthly cost function C(x) c) The monthly profit function P(x) d) Find x such that profit is maximized, and find the maximum profitarrow_forwardplease explain why the answer is Carrow_forward

- Which of the following statements about the precept of costs, value and price is CORRECT? Cost is equal to value and value is not equal to price (cost = value ≠ price) Cost is not equal to value and value is not equal price (cost ≠ value ≠ price) Cost is equal to value and value is equal price (Cost = value = price) Cost is not equal to value and value is equal to price (cost ≠ value = price)arrow_forward(i) If the demand curve for a particular commodity is p = −0.09x + 51 and the total cost function C(x) = 1.32x2 + 11.7x + 101.4,where x is the level of production. Find: 1. All values of x for which production of the commodity is profitable.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education