FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

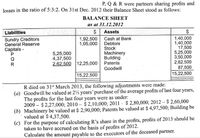

Transcribed Image Text:P, Q & R were partners sharing profits and

losses in the ratio of 5:3:2. On 31st Dec. 2012 their Balance Sheet stood as follows:

BALANCE SHEET

as at 31.12.2012

Liabilities

$| Assets

$

1,40,000

1,40,000

17,500

5,25,000

3,50,000

2,62,500

87,500

15,22,500

Sundry Creditors

General Reserve

Capitals -

1,92,500

1,05,000

Cash at Bank

Debtors

Stock

5,25,000

4,37,500

2.62,500 12,25,000

Machinery

Building

Q

Patents

Goodwill

15,22,500

R died on 31s' March 2013, the following adjustments were made:

(a) Goodwill be valued at 2½ years' purchase of the average profits of last four years,

The profits for the last four years were as under:

2009 – $ 2,27,000; 2010 – $ 2,10,000; 2011 - $ 2,80,000; 2012 – $ 2,60,000

(b) Machinery be valued at $ 2,90,000; Patents be valued at $ 4,97,500; Building be

valued at $ 4,37,500.

(c) For the purpose of calculating R's share in the profits, profits of 2013 should be

taken to have accrued on the basis of profits of 2012.

Calculate the amount payable to the executors of the deceased partner.

POR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Saxe Banners reported the following figures in its financial statements: Cash $ 25,000 Cash Equivalents Total Current Liabilities 33,000 40.000 Compute the cash ratio for Saxe Banners. Determine the formula, then calculate the cash ratio. (Enter the cash ratio to two decimal places, X.XX.) + )÷ Question Viewer = = Cash ratioarrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $340,000 of bonds, on which there was $3,400 of unamortized discount, for $354,000. b. Sold 7,000 shares of $25 par common stock for $56 per share. c. Sold equipment with a book value of $65,500 for $94,300. d. Purchased land for $326,000 cash. e. Purchased a building by paying $81,000 cash and issuing a $90,000 mortgage note payable. f. Sold a new issue of $280,000 of bonds at 97. g. Purchased 2,800 shares of $20 par common stock as treasury stock at $39 per share. h. Paid dividends of $2.50 per share. There were 21,000 shares issued and 3,000 shares of treasury stock. Effect Amount Cash payment а. b. Cash receipt Cash receipt C. d. Cash payment $1 Cash payment е. f. Cash receipt Cash payment g. h. Cash paymentarrow_forwardActivity From the following balances, prepare a balance sheet for Nikea Corp. as of December 31, 2014. Cash in bank: $12,000 Bonds payable: $32,000 Accounts receivable: $17,000 Inventories: $ 40,000 Supplies: Common stock: $15,200 $52,000 Buildings: Accounts payable: Additional paid-in capital: $25,000 Retained earnings: $75,000 $15,000 $ 25,200 Loans Payable: $10,000 Font Sizes = E EE三三 A 4.arrow_forward

- The following is the Comparative Balance Sheet of M/s Manish Ltd. Prepare a Funds Flow Statement and verify your answer. Liabilities Assets 31st Dec., 31st Dec., 31st Dec., 31st Dec., 2013 2014 2013 2014 Creditors 40,000 344,000 Cash 10,000 37,000 Loan 25,000 Debtor's 330,000 350,000 Loan from S.B.I 40,000 50,000 Stock 335,000 25,000 Capital 31,25,000 31,53,000 Machinery 380,000 355,000 2,30,000 32,47,000 Land 40,000 350,000 Building 35.000 360.000 2,30,000 32,47,000 During the year machine costing 10,000 (accumulated depreciation 3,000) was sold for 35,000. The provision for depreciation against machinery as on 31.12.13 was 25,000 and on 31.12.14 was 40,000. Net profit for the year amounted to 345,000. you are required to prepare Funds Flow statement.arrow_forward(30) Bonds with a face value of $270,000 are issued at 103. The statement of cash flows would report a cash inflow of: A. $278,100 in the financing activities section B. $270,000 in the investing activities section C. $270,000 in the financing activities section D. $8,100 in the financing activities sectionarrow_forwarda corporation reported cash of 15,200 and total assets of 179,500 on its balance sheet its common size percent for cash equals 8.47% 20.44% 13.97% 11.81% 6.47%arrow_forward

- Effect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $300,000 of bonds, on which there was $3,000 of unamortized discount, for $312,000. b. Sold 12,000 shares of $10 par common stock for $25 per share. c. Sold equipment with a book value of $61,500 for $88,600. d. Purchased land for $462,000 cash. e. Purchased a building by paying $45,000 cash and issuing a $100,000 mortgage note payable. f. Sold a new issue of $170,000 of bonds at 98. g. Purchased 3,600 shares of $35 par common stock as treasury stock at $68 per share. h. Paid dividends of $1.80 per share. There were 27,000 shares issued and 4,000 shares of treasury stock. a. b. C. d. e. f. g. h. Effect ▼ $ $ $ $ $ $ Amountarrow_forwardHh1. Accountarrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $210,000 of bonds, on which there was $2,100 of unamortized discount, for $218,000. b. Sold 7,000 shares of $20 par common stock for $43 per share. c. Sold equipment with a book value of $56,600 for $81,500. d. Purchased land for $391,000 cash. e. Purchased a building by paying $80,000 cash and issuing a $110,000 mortgage note payable. f. Sold a new issue of $180,000 of bonds at 97. g. Purchased 2,400 shares of $20 par common stock as treasury stock at $37 per share. h. Paid dividends of $1.70 per share. There were 20,000 shares issued and 3,000 shares of treasury stock. Effect Amount а. $ b. c. d. $ е. f. $ g. $ h.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education