FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

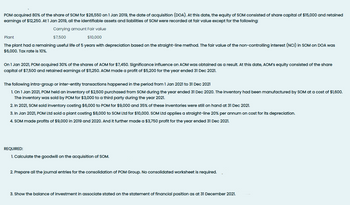

Transcribed Image Text:POM acquired 80% of the share of SOM for $26,550 on 1 Jan 2019, the date of acquisition (DOA). At this date, the equity of SOM consisted of share capital of $15,000 and retained

earnings of $12,250. At 1 Jan 2019, all the identifiable assets and liabilities of SOM were recorded at fair value except for the following:

Carrying amount Fair value

Plant

$7,500

$10,000

The plant had a remaining useful life of 5 years with depreciation based on the straight-line method. The fair value of the non-controlling interest (NCI) in SOM on DOA was

$6,000. Tax rate is 10%.

On 1 Jan 2021, POM acquired 30% of the shares of AOM for $7,450. Significance influence on AOM was obtained as a result. At this date, AOM's equity consisted of the share

capital of $7,500 and retained earnings of $11,250. AOM made a profit of $5,200 for the year ended 31 Dec 2021.

The following intra-group or inter-entity transactions happened in the period from 1 Jan 2021 to 31 Dec 2021

1. On 1 Jan 2021, POM held an inventory of $2,500 purchased from SOM during the year ended 31 Dec 2020. The inventory had been manufactured by SOM at a cost of $1,600.

The inventory was sold by POM for $3,000 to a third party during the year 2021.

2. In 2021, SOM sold inventory costing $6,000 to POM for $9,000 and 35% of these inventories were still on hand at 31 Dec 2021.

3. In Jan 2021, POM Ltd sold a plant costing $8,000 to SOM Ltd for $10,000. SOM Ltd applies a straight-line 20% per annum on cost for its depreciation.

4. SOM made profits of $9,000 in 2019 and 2020. And it further made a $3,750 profit for the year ended 31 Dec 2021.

REQUIRED:

1. Calculate the goodwill on the acquisition of SOM.

2. Prepare all the journal entries for the consolidation of POM Group. No consolidated worksheet is required.

3. Show the balance of investment in associate stated on the statement of financial position as at 31 December 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Munabhaiarrow_forwardOn January 1, 2023, Bertrand Incorporated paid $70,800 for a 40% interest in Chestnut Corporation's common stock. This investee had assets with a book value of $235,000 and liabilities of $95000. A patent held by Chestnut having a book value of $8900 was actually worth $25,400. This patent had a six year remaining life. Any further excess cost associated with this acquisition was attributed to an indefinite-lived asset. During 2023, Chestnut earned income of $45,700 and declared and paid dividends of $20,000. During 2024, the fair value of Bertrand's investment in Chestnut had risen from $84,080 to $88,960. Assuming Bertrand uses the quity method, what balnace should appear in the investment in Chestnut account as of December 31, 2024? Assuming Bertrand uses fair-value accounting, what income from the investment in Chestnut should be reported for 2024?arrow_forwardOn June 30, 2021, Plaster, Inc., paid $988,000 for 80 percent of Stucco Company's outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at $247,000. At acquisition date, Stucco reported the following book values for its assets and liabilities: Cash Accounts receivable Inventory Land Buildings Equipment Accounts payable (Parentheses indicate credit balances.) On June 30, Plaster allocated the excess acquisition-date fair value over book value to Stucco's assets as follows: $ 64,500 136,900 Equipment (3-year remaining life) Database (10-year remaining life) Cash Accounts receivable (net) Inventory Land Buildings (net) Equipment (net) Database 219, 200 70,400 189,400 324,300 (37,700) At the end of 2021, the following comparative (2020 and 2021) balance sheets and consolidated income statement were available: Plaster, Inc. December 31, 2020 Total assets Accounts payable Long-term liabilities Common stock Noncontrolling interest…arrow_forward

- On 1/1/2020, X Company acquired 100% of Y Company's Net assets for $150,000 cash. The Book value of Y's Net assets was equal to the fair value of Y Company's net assets at the date of acquisition except for Land (included in fixed assets) its market value was less than the book value by $1,000, the balance sheet data at 1/1/2020, are as follows: item X co Y co cash 404,000 150,000 Fixed assets 100,000 66,000 Liabilities 144,000 72,000 Common stock 120,000 60,000 Retained earning 240,000 84,000 required: if the acquisition are merger record the journal entries and prepare x balance sheet after the mergerarrow_forwardOn January 1, 2023, French Company acquired 60 percent of K-Tech Company for $306,000 when K-Tech's book value was $406,000. The fair value of the newly comprised 40 percent noncontrolling interest was assessed at $204,000. At the acquisition date, K-Tech's trademark (10-year remaining life) was undervalued in its financial records by $80,000. Also, patented technology (5- year remaining life) was undervalued by $24,000. In 2023, K-Tech reports $28,000 net income and declares no dividends. At the end of 2024, the two companies report the following figures (stockholders' equity accounts have been omitted): Itens Current assets Trademarks Patented technology Liabilities Revenues Expenses Investment income French Company Carrying Amounts $ 624,000 264,000 414,000 (394,000) (904,000) 496,000 Not given K-Tech Company Carrying Amounts $ 304,000 204,000 154,000 (124,000) (404,000) 304,000 K-Tech Company Fair Values $ 324,000 284,000 178,000 (124,000) Note: Parentheses indicate a credit…arrow_forwardOn January 1, 2025, Henderson Company purchased 100% of the common stock of Caramel Company for $590,000 cash. Fair values differed from book values as follows: Fair value Land 100,000 Patent 250,000 Bonds Payable 105,000 The trial balances of the companies at the acquisition date are as follows: Trial Balance Account Titles Henderson Caramel Cash 650,000 65,000 Land 120,000 30,000 Buildings, net 250,000 180,000 Goodwill 400,000 200,000 Current Liabilities 170,000 75,000 Bonds Payable 500,000 100,000 Common Stock 70,000 30,000 APIC 350,000 70,000 Retained Earnings 330,000 200,000 The amount reported for Cash on the consolidated balance sheet at the acquisition date is Question Answer a. $125,000 b. $650,000 c. $65,000 d. $715,000arrow_forward

- On January 2, 2019, Peace Co. acquired 80% of the outstanding common stock of Shade Co. for ₱1,344,000 with no goodwill resulting from the acquisition. The following selected account balances were taken from the accounting records of Shade Co. BV FV Building 12,000,000 12,400,000 Machinery 620,000 500,000 The building has an estimated useful life of 10 years and the equipment is expected to last for 5 years. For the year 2019, Peace Co. reported net income from own operations of ₱2,240,000 and Shade Co. reported ₱600,000 net income from own operations. Peace Co. accounts its investment in Shade Co. using the cost method. What is the consolidated income statement for the year 2019.arrow_forwardGrand Champion Inc. purchased America’s Sweethearts Corporation on January 1, 2019. At the time, America’s Sweethearts had the following assets and liabilities (stated at fair value): Cash $62,000 Accounts receivable 138,000 Inventory 185,000 Property, plant, and equipment 300,000 Patent 65,000 Accounts payable 200,000 Notes payable 325,000 Grand Champion paid $900,000 for America’s Sweethearts. Assume that America’s Sweethearts is a reporting unit of Grand Champion. At the end of 2020, America’s Sweethearts has a fair value of $720,000 and a book value of $850,000, which includes any goodwill recorded. Of this fair value, $350,000 is attributable to identifiable assets net of (or identifiable net assets) liabilities. Required: Calculate the impairment loss of goodwill (if any) and record the appropriate journal entry.arrow_forwardPritano Company acquired all the net assets of Succo Company on December 31, 2013, for $2,185,400 cash. The balance sheet of Succo Company immediately prior to the acquisition showed: Book value Fair value Current assets $ 871,440 $871,440 Plant and equipment 1,025,090 1,437,590 Total $1,896,530 $2,309,030 Liabilities $194,060 $207,670 Common stock 484,800 Other contributed capital 632,900 Retained earnings 584,770 Total $1,896,530 As part of the negotiations, Pritano agreed to pay the stockholders of Succo $356,690 cash if the post-combination earnings of Pritano averaged $2,185,400 or more per year over the next two years. The estimated fair value of the contingent consideration was $143,480 on the date of the acquisition. (a) Prepare the journal entry on the books of Pritano to record the acquisition on December 31, 2013. (If no entry is required, select…arrow_forward

- On January 2, 2019, ABC Co. acquired 80% of the outstanding common stock of Shade Co. for ₱1,344,000 with no goodwill resulting from the acquisition. The following selected account balances were taken from the accounting records of XYZ Co. Details shown doe XYZ Co. in the image. The building has an estimated useful life of 10 years and the equipment is expected to last for 5 years. For the year 2019, ABC Co. reported net income from own operations of ₱2,240,000 and XYZ Co. reported ₱600,000 net income from own operations. ABC Co. accounts its investment in XYZ Co. using the cost method. What is the consolidated income statement for the year 2019. NCI in the consolidated FS for the year 2019.arrow_forwardOn January 1, 2015, Pomegranate Company acquired 80% of the voting stock of Starfruit Company for $47,100,000 in cash. The fair value of the noncontrolling interest in Starfruit at the date of acquisition was $6,900,000. Starfruit's book value was $12,000,000 at the date of acquisition. Starfruit's assets and liabilities were reported on its books at values approximating fair value, except its plant and equipment (10-year life, straight-line) was overvalued by $13,000,000. Starfruit Company had previously unreported intangible assets, with a market value of $16,000,000 and 5-year life, straight- line, which were capitalized following GAAP. Additional information: Pomegranate uses the complete equity method to account for its investment in Starfruit on its own books. Goodwill recognized in this acquisition was impaired by a total of $1,000,000 in 2015 and 2016, and by $250,000 in 2017. It is now December 31, 2017, the accounting year-end.Here is Starfruit Company's trial balance at…arrow_forwardRequired: On January 3, 2024, Matteson Corporation acquired 40 percent of the outstanding common stock of O'Toole Company for $1,379,000. This acquisition gave Matteson the ability to exercise significant influence over the investee. The book value of the acquired shares was $863,000. Any excess cost over the underlying book value was assigned to a copyright that was undervalued on its balance sheet. This copyright has a remaining useful life of 10 years. For the year ended December 31, 2024, O'Toole reported net income of $353,000 and declared cash dividends of $35,000. On December 31, 2024, what should Matteson report as its investment in O'Toole under the equity method? Investmentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education