FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

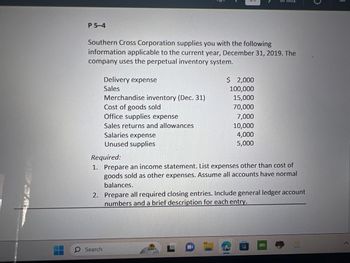

Transcribed Image Text:P 5-4

Southern Cross Corporation supplies you with the following

information applicable to the current year, December 31, 2019. The

company uses the perpetual inventory system.

Delivery expense

Sales

Merchandise inventory (Dec. 31)

Cost of goods sold

Office supplies expense

Sales returns and allowances

O Search

Salaries expense

Unused supplies

3

3

Required:

1. Prepare an income statement. List expenses other than cost of

goods sold as other expenses. Assume all accounts have normal

balances.

ALDU

$ 2,000

100,000

15,000

70,000

7,000

10,000

4,000

5,000

2. Prepare all required closing entries. Include general ledger account

numbers and a brief description for each entry.

1

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the perpetual inventory system is used. Sales $642,363 Merchandise Inventory 582,620 Sales Discounts 58,010 Interest Expense 3,777 Sales Returns and Allowances 90,232 Interest Revenue 10,268 Cost of Goods Sold 225,598 Rent Expense 15,090 Depreciation Expense-Office Equipment 3,400 Insurance Expense 2,450 Advertising Expense 12,870 Accounts Receivable 101,440 Office Supplies Expense 1,600 Rent Revenue 23,680 Sales Salaries Expense 30,410 Accounts Payable 138,404 Common Stock 59,419 Marketing Expense 33,000 A. Use the data provided to compute net sales for 2019.arrow_forwardes N Required information [The following information applies to the questions displayed below.] The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-Store equipment Accounts payable Common stock Retained earnings Dividends NELSON COMPANY Unadjusted Trial Balance January 31 Sales. Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries expense Insurance expense Rent expense-Selling space Rent expense-Office space Store supplies expense Advertising expense…arrow_forward3 different partsarrow_forward

- Sold merchandise inventory to Hayes Company,5500,on account .Term3/15, n/35.Cost of goods ,2,530. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expenses related to the sale. We will do that in the following step.arrow_forwardesc Honest Tea, Inc. is a merchandiser. Use the following information to its Inventory balance on its December 31 year-end balance sheet. Note: All purchases of inventory are on account. Cost of Goods Sold during the year January 1 Inventory Sales during the year December 31 Accounts Receivable Purchases of Inventory on Account during the year December 31 Inventory = $. 1 Q A N Click Save and Submit to save and submit. Click Save All Answers to save all answers. 2 W S Ma # 3 E D x 'I X $34,000 $ 4 10,000 77,000 24,000 35,000 C с R % or op F 5 T MacBook Pro V < 6 G Y & 7 H B * 00 つ 8 J N O Save All Answe O 0 K Marrow_forwardA company that uses a perpetual inventory system purchased inventory on account and later returned goods worth $900.00 to the vendor. Which of the following would be the correct journal entry to record these returns? OA. Accounts Payable 900 Merchandise Inventory 900 OB. Accounts Payable 900 Purchase Returns 900 OC. Merchandise Inventory 900 Accounts Payable 900 OD. Purchase Returns 900 Accounts Payable 900arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education