FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

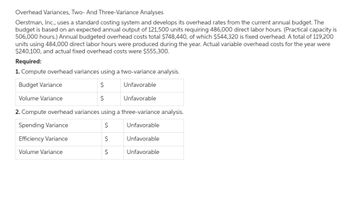

Transcribed Image Text:Overhead Variances, Two- And Three-Variance Analyses

Oerstman, Inc., uses a standard costing system and develops its overhead rates from the current annual budget. The

budget is based on an expected annual output of 121,500 units requiring 486,000 direct labor hours. (Practical capacity is

506,000 hours.) Annual budgeted overhead costs total $748,440, of which $544,320 is fixed overhead. A total of 119,200

units using 484,000 direct labor hours were produced during the year. Actual variable overhead costs for the year were

$240,100, and actual fixed overhead costs were $555,300.

Required:

1. Compute overhead variances using a two-variance analysis.

Budget Variance

$

Unfavorable

Volume Variance

$

Unfavorable

2. Compute overhead variances using a three-variance analysis.

Spending Variance

$

Unfavorable

Efficiency Variance

$

Unfavorable

Volume Variance

$

Unfavorable

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Overhead Variances, Four-Variance Analysis Oerstman, Inc., uses a standard costing system and develops its overhead rates from the current annual budget. The budget is based on an expected annual output of 126,000 units requiring 504,000 direct labor hours. (Practical capacity is 524,000 hours.) Annual budgeted overhead costs total $846,720, of which $599,760 is fixed overhead. A total of 119,400 units using 502,000 direct labor hours were produced during the year. Actual variable overhead costs for the year were $260,500, and actual fixed overhead costs were $556,050. Required: 1. Compute the fixed overhead spending and volume variances. Fixed Overhead Spending Variance Fixed Overhead Volume Variance. 2. Compute the variable overhead spending and efficiency variances. Do not round intermediate calculations Variable Overhead Spending Variance. Variable Overhead Efficiency Variancearrow_forwardSolve this Problemarrow_forwardPlease help me with all answers thankuarrow_forward

- Please help mearrow_forwardYourtube Company uses a standard cost system and prepared the following budget at normal capacity for the month of January. Direct labor hours Variable factory overhead Fixed factory overhead Total factory overhead per DLH 24,000 $48,000 $108,000 $6.50 Actual data for January were as follows: 22,000 Total factory overhead $147,000 Direct labor hours worked Standard DLH allowed for the capacity attained 21,000 Using the two-way analysis of overhead variances, what is the budget (controllable) variance for January? A. $3,000. B. $13,500 unfavorable. C. $9,000 favorable. D. $10,500 unfavorable.arrow_forwardOverhead costs are applied using direct labour hours. The following were budgeted for the year: Planned production (units) 50,000 Direct labour hours 200,000 Variable overhead 1,000,000 Fixed overhead 600,000 The following were the actual results: Actual production (units) 48,000 Direct labour hours 195,000 Variable overhead 950,000 Fixed overhead 610,000 Calculate the variable overhead efficiency variance. Select one: a. $15,000 U b. $25,000 U c. $25,000 F d. $15,000 Farrow_forward

- Robinwood Fixtures manufactures two products, K4 and X7. The company prepares its master budget on the basis of standard costs. The following data are for September: Standards Direct materials Direct labor, Variable overhead (per direct labor-hour) Fixed overhead (per month) Expected activity (direct labor-hours) Actual results Direct material (purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) Direct materials Direct labor Variable overhead Fixed overhead Price Variance F F KA -0.75 pounds at $8.00 per pound 1.25 hours at $26.00 per hour $ 21.20 K4 $ 416,400 17,350 Required: a. Prepare a variance analysis for each variable cost for each product. b. Prepare a fixed overhead variance analysis for each product. Note: For all requirements, Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. 10,300 pounds at $7.40 per…arrow_forwardValaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education