FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

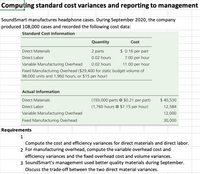

Transcribed Image Text:Compuțing standard cost variances and reporting to management

SoundSmart manufactures headphone cases. During September 2020, the company

produced 108,000 cases and recorded the following cost data:

Standard Cost Information

Quantity

Cost

Direct Materials

2 parts

$ 0.16 per part

Direct Labor

0.02 hours

7.00 per hour

Variable Manufacturing Overhead

0.02 hours

11.00 per hour

Fixed Manufacturing Overhead ($29,400 for static budget volume of

98,000 units and 1,960 hours, or $15 per hour)

Actual Information

Direct Materials

(193,000 parts @ $0.21 per part)

$ 40,530

Direct Labor

(1,760 hours @ $7.15 per hour)

12,584

Variable Manufacturing Overhead

12,000

Fixed Manufacturing Overhead

30,000

Requirements

1

Compute the cost and efficiency variances for direct materials and direct labor.

2 For manufacturing overhead, compute the variable overhead cost and

efficiency variances and the fixed overhead cost and volume variances.

3 SoundSmart's management used better quality materials during September.

Discuss the trade-off between the two direct material variances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need answer of the questionarrow_forwardplease help mearrow_forwardLily Company uses a standard cost accounting system. In 2025, the company produced 28,300 units. Each unit took several pounds of direct materials and 1.6 standard hours of direct labor at a standard hourly rate of $13.00. Normal capacity was 49,900 direct labor hours. During the year, 131,200 pounds of raw materials were purchased at $0.94 per pound. All materials purchased were used during the year. (a) If the materials price variance was $1,312 favorable, what was the standard materials price per pound? (Round answer to 2 decimal places, e.g. 2.75.) Your answer is correct. Standard materials price per pound $ (b) eTextbook and Media (c) Your answer is correct. Standard materials quantity per unit If the materials quantity variance was $17,100 unfavorable, what was the standard materials quantity per unit? eTextbook and Media Your answer is correct. What were the standard hours allowed for the units produced? Standard hours allowed 0.95 45,280 hours Attempts: 1 of 5 used 4 pounds…arrow_forward

- .arrow_forwardPittman Framing's cost formula for its supplies cost is $1,040 per month plus $14 per frame. For the month of November, the company planned for activity of 614 frames, but the actual level of activity was 604 frames. The actual supplies cost for the month was $9,200. The spending variance for supplies cost in November would be closest to: Multiple Choice О $296 F о О $296 U $436 F $436 Uarrow_forwardZizi plc uses a standard absorption costing system and produces and sells product 8W. The standard cost card is below: Product 8W (€ per unit) Direct material (5 per kg) 15 Direct labour (6 per hour) 12 Fixed manufacturing overhead 10 Total production cost 37 Standard profit 13 Standard selling price 50 * Absorption rate based on standard labour hours Budgeted and actual production and sales units for december 2020 were as follows: Budget Actual Production 1,100 900 Sales 1,000 800 Actual data for December 2020 were as follows € Direct material purchases 1,200 kgs costing 12,000 Direct materials used 1,100 kgs Direct labour hours 500 hours costing 6,000 Fixed manufacturing overhead 5,000 Sales revenue 30,000 An analysis of the Direct labour hours shows that the 500 hours that were paid for 50 were idle time due to a machinery breakdown. There were no inventories of Direct materials or finished products (planned or actual) at the…arrow_forward

- The following data get out from Samsung industrial company: Direct materials costs JD 75 Direct manufacturing labor costs 20 Variable manufacturing overhead costs 15 Fixed overhead costs 28 Each TV need to 0.75 hour, and each hour by JD 31.5. The number of units manufactured is the cost driver for direct materials, direct manufacturing labor, and variable manufacturing overhead. The relevant range for the cost driver is from 0 to 6,000 TV. Budgeted and actual data for November 2019 are: Budgeted fixed costs for production JD 141, 750 Budgeted selling price JD 138 per unit Actual selling price 152.75 per unit Revenue at budgeted…arrow_forwardOpal Manufacturing Company established the following standard price and cost information: Sales price $70 per unit 52 per unit Variable manufacturing cost Fixed manufacturing cost $ 120,000 total $50,000 total Fixed selling and administrative cost Opal expected to produce and sell 29,000 units. Actual production and sales amounted to 32,500 units. Required: a. and b. Determine the sales volume variances, including variances for number of units, sales revenue, variable manufacturing cost, fixed manufacturing cost, and fixed selling and administrative cost. Classify the variances as favorable (F) or unfavorable (U). Note: Indicate the effect of each variance by selecting "Favorable", "Unfavorable", and "None" for no effect (i.e., zero variance). Units Static Budget Flexible Budget Volume Variance Favorable or Unfavorablearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education