FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

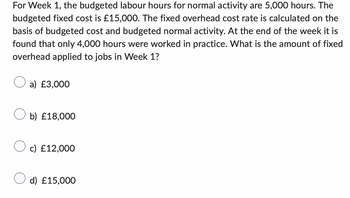

Transcribed Image Text:For Week 1, the budgeted labour hours for normal activity are 5,000 hours. The

budgeted fixed cost is £15,000. The fixed overhead cost rate is calculated on the

basis of budgeted cost and budgeted normal activity. At the end of the week it is

found that only 4,000 hours were worked in practice. What is the amount of fixed

overhead applied to jobs in Week 1?

a) £3,000

b) £18,000

c) £12,000

d) £15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Factory Overhead Rates, Entries, and Account Balance Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning August 1 $717,960 $1,050,800 Estimated direct labor hours for year 14,200 Estimated machine hours for year 23,160 Actual factory overhead costs for August $57,510 $90,930 Actual direct labor hours for August 1,280 Actual machine hours for August 1,810 a. Determine the factory overhead rate for Factory 1. per machine hour b. Determine the factory overhead rate for Factory 2. per direct labor hour c. Journalize the entries to apply factory overhead to production in each factory for August. If an amount box does not require an entry, leave it blank. Factory 1 Factory 2arrow_forwardEntry for Jobs Completed; Cost of Unfinished Jobs The following account appears in the ledger prior to recognizing the jobs completed in January: Work in Process Balance, January 1 $17,970 Direct materials 146,100 Direct labor 157,600 Factory overhead 82,840 Jobs finished during January are summarized as follows: Job 210 $72,810 Job 224 $84,950 Job 216 44,500 Job 230 149,670 a. Journalize the entry to record the jobs completed. If an amount box does not require an entry, leave it blank.arrow_forwardEntry for Jobs Completed; Cost of Unfinished Jobs The following account appears in the ledger prior to recognizing the jobs completed in January: Work in Process Balance, January 1 $11,420 Direct materials 92,840 Direct labor 100,150 Factory overhead 52,650 Jobs finished during January are summarized as follows: Job 210 $46,270 Job 224 $53,980 Job 216 28,280 Job 230 97,680 a. Journalize the entry to record the jobs completed. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - b. Determine the cost of the unfinished jobs at January 31.$fill in the blank 14d786ff9fe8ffc_1arrow_forward

- Entry for Jobs Completed; Cost of Unfinished Jobs The following account appears in the ledger prior to recognizing the jobs completed in January: Work in Process Balance, January 1 Direct materials Direct labor Factory overhead Jobs finished during January are summarized as follows: Job 210 $69,290 Job 224 $80,830 42,340 Job 230 142,420 Job 216 a. Journalize the entry to record the jobs completed. If an amount box does not require an entry, leave it blank. Finished Goods Work in Process $17,100 139,020 149,970 78,830 Feedback LA Check My Work a. Move the cost of completed jobs out of work in process and into finished goods. b. Determine the cost of the unfinished jobs at January 31.arrow_forwardJob-Order Costing Variables On July 1, Job 46 had a beginning balance of $690. During July, prime costs added to the job totaled $670. Of that amount, direct materials were three times as much as direct labor. The ending balance of the job was $1,500. Required: 1. What was overhead applied to the job during July? 2. What was direct materials for Job 46 for July? Direct labor? If rounding is required, round your answers to the nearest cent. Direct labor Direct materials $ 3. Assuming that overhead is applied on the basis of direct labor cost, what is the overhead rate for the company? Round your answer to the nearest whole percent. %arrow_forwardVaughn Church Furniture manufactures custom pews, altars, and pulpits for churches across the southern United States. Since each order is unique, Vaughn uses a job order costing system. During the month of June, Vaughn worked on orders for three churches: Faith Church, Grace Church, and Hope Church. Production on the Faith and Grace orders began in May, and the Faith job was completed in June. Production on the Hope order began in June and was incomplete at the end of the month. Vaughn applies overhead to each job based on machine hours. Prior to the year, managers had estimated manufacturing overhead at $ 693,000, along with 21,000 machine hours. Additional cost information related to the three orders is as follows: Faith Grace Hope Beginning balance, June 1 $ 4,000 $ 2,800 Direct materials, June $ 8,300 $ 6,500 $ 4,000 Direct labor, June $ 13,000 $7,000 $ 5,500 Manufacturing OH, June ? ? Machine hours, June 2,200 1,300 1,400arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education