FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

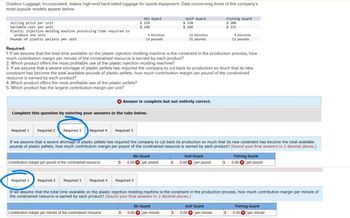

Transcribed Image Text:Outdoor Luggage, Incorporated, makes high-end hard-sided luggage for sports equipment. Data concerning three of the company's

most popular models appear below.

Selling price per unit.

Variable cost per unit

Plastic injection molding machine processing time required to

produce one unit

Pounds of plastic pellets per unit

Required 1

Complete this question by entering your answers in the tabs below.

Required 2

Required:

1. If we assume that the total time available on the plastic injection molding machine is the constraint in the production process, how

much contribution margin per minute of the constrained resource is earned by each product?

2. Which product offers the most profitable use of the plastic injection molding machine?

Required 1

3. If we assume that a severe shortage of plastic pellets has required the company to cut back its production so much that its new

constraint has become the total available pounds of plastic pellets, how much contribution margin per pound of the constrained

resource is earned by each product?

4. Which product offers the most profitable use of the plastic pellets?

5. Which product has the largest contribution margin per unit?

Required 3 Required 4

Contribution margin per pound of the constrained resource

Required 2

Required 3

Required 4

Ski Guard

$ 220

$ 140

4 minutes

12 pounds

Required 5

Contribution margin per minute of the constrained resource

If we assume that a severe shortage of plastic pellets has required the company to cut back its production so much that its new constraint has become the total available

pounds of plastic pellets, how much contribution margin per pound of the constrained resource is earned by each product? (Round your final answers to 2 decimal places.)

Answer is complete but not entirely correct.

Required 5

Golf Guard

$ 330

$ 260

Ski Guard

$ 0.00 per pound

$

12 minutes

15 pounds

Ski Guard

0.00 per minute

Fishing Guard

$ 200

$ 115

Golf Guard

$ 0.00 per pound

9 minutes

13 pounds

If we assume that the total time available on the plastic injection molding machine is the constraint in the production process, how much contribution margin per minute of

the constrained resource is earned by each product? (Round your final answers to 2 decimal places.)

Golf Guard

$ 0.00 per minute

Fishing Guard

$ 0.00 per pound

$

Fishing Guard

0.00 per minute

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with all answers thankuarrow_forwardNumber 4 for this is all I need please: Contribution Margin, Break-Even Units, Contribution Margin Income Statement, Margin of Safety Zebra Company manufactures custom-designed skins (covers) for iPods® and other portable MP3 devices. Variable costs are $5.50 per custom skin, the price is $10, and fixed costs are $114,300. Required: 1. What is the contribution margin for one custom skin? Round your answer to the nearest cent.$fill in the blank 1 per custom skin 2. How many custom skins must Zebra Company sell to break even? fill in the blank 2 custom skins 3. If Zebra Company sells 26,000 custom skins, what is the operating income?$fill in the blank 3 4. Calculate the margin of safety in units and in sales revenue if 26,000 custom skins are sold. Margin of safety in units fill in the blank 4 units Margin of safety in sales revenuearrow_forwardNonearrow_forward

- Outdoor Luggage, Incorporated, makes high-end hard-sided luggage for sports equipment. Data concerning three of the company's most popular models appear below: Ski Guard Golf Guard Selling price per unit $ 310 Variable cost per unit $ 150 $ 330 $ 130 Fishing Gi $ 275 $ 85 Plastic injection molding machine processing time required to produce one unit Pounds of plastic pellets per unit 8 minutes 7 pounds 15 minutes 9 pounds 5 minu 10 poun Required: 1. If the total time available on the plastic injection molding machine is the constraint, how much contribution margin per minute of the constrained resource is earned by each product? 2. Which product offers the most profitable use of the plastic injection molding machine? 3. If a severe shortage of plastic pellets required the company to cut back production so much that its new constraint has become the total available pounds of plastic pellets, how much contribution margin per pound of the constrained resource is earned by each product? 4.…arrow_forwardOutdoor Luggage, Incorporated, makes high-end hard-sided luggage for sports equipment. Data concerning three of the company's most popular models appear below. Selling price per unit Variable cost per unit Plastic injection molding machine processing time required to produce one unit Pounds of plastic pellets per unit Ski Guard $ 260 $ 100 Required 1 Required 2 6 minutes 15 pounds Required 3 Required 4 Required 5 Complete this question by entering your answers in the tabs below. Required: 1. If we assume that the total time available on the plastic injection molding machine is the constraint in the production process, how much contribution margin per minute of the constrained resource is earned by each product? Contribution margin per minute of the constrained resource 2. Which product offers the most profitable use of the plastic injection molding machine? 3. If we assume that a severe shortage of plastic pellets has required the company to cut back its production so much that its new…arrow_forward3. JJ Manufacturing builds and sells switch harnesses for glove boxes. The sales price and variable cost for each follows: Product Selling price per unit Variable cost per unit Trunk switch $60.00 $28.00 Gas door switch $75.00 $33.00 Glove box light $40.00 $22.00 Their sales mix is reflected in the ratio 4:4:1. What is the overall Composite Unit Contribution Margin for JJ Manufacturing with their current product mix? If annual fixed costs shared by the three products are $18,840, how many units of each product are to be sold in order for JJ Manufacturing to break even? Trunk Switch? Gas Door Switch? Glove Box Light? Determine their break-even point in sales dollars. Trunk Switch? Gas Door Switch? Glove Box Light?arrow_forward

- Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or constraint) in the production process is upholstery labor-hours. Information concerning three of Portsmouth's products appears below: Selling price per unit Variable cost per unit Upholstery labor-hours per unit Required 1 Required 2 Required 3 Recliner $ 1,184 $ 800 Complete this question by entering your answers in the tabs below. Additional contribution margin per hour Required: 1. Portsmouth is considering paying its upholstery laborers hourly compensation, in addition to their usual salaries, to work overtime. Assuming that this extra time would be used to produce sofas, up to how much of an overtime rate per hour should the company be willing to pay to keep the upholstery shop open after normal working hours? 2. A small nearby upholstering company has offered to upholster furniture for…arrow_forwardSuppose the figure to the right represents the market for a particular brand of soap such as Zest, Dove, or Ivory. Suppose also that the market is monopolistically competitive and the firm behaves optimally to maximize profit. Use the rectangle drawing tool to shade in the firm's economic profit or loss. Properly label the object. Carefully follow the instructions above, and only draw the required objects. Price and cost (per pack) 4.00- 3.80 3.60 3.40 MC 3.20 ATC 3.00 2.80 2.60 2.40 2.20 2.00- 1.80- 1.60- 1.40- 1.20- 1.00- 0.80- 0.60- 0.40 0.20 0.00+ MR 0 6 8 10 12 14 16 18 Quantity (packs of soap in thousands) 20arrow_forwardSagararrow_forward

- Please answer complete question with working,,,,,answer in text form please (without image)arrow_forwardBonita Industries has gathered the following information for one model of its hiking boots: Variable manufacturing costs Variable selling and administrative costs Fixed manufacturing costs Fixed selling and administrative costs Investment ROI Planned production and sales What is the total cost per pair of boots? O $118 O $54 O $166 $86 $80000 $40000 $190000 $120000 $1700000 30 % 5000 pairsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education