Computer Networking: A Top-Down Approach (7th Edition)

7th Edition

ISBN: 9780133594140

Author: James Kurose, Keith Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

Please help me with this program using java. ( there are two parts)

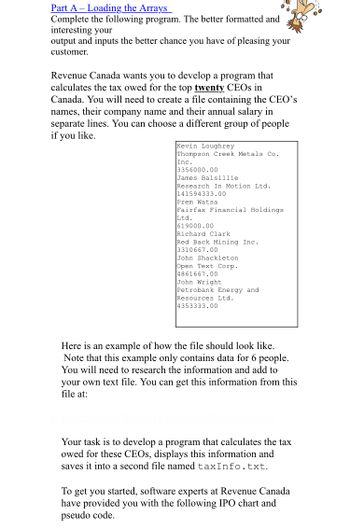

Transcribed Image Text:Part A - Loading the Arrays

Complete the following program. The better formatted and

interesting your

output and inputs the better chance you have of pleasing your

customer.

Revenue Canada wants you to develop a program that

calculates the tax owed for the top twenty CEOs in

Canada. You will need to create a file containing the CEO's

names, their company name and their annual salary in

separate lines. You can choose a different group of people

if you like.

Kevin Loughrey

Thompson Creek Metals Co.

Inc.

3356000.00

James Balsillie

Research In Motion Ltd.

141594333.00

Prem Watsa

Fairfax Financial Holdings

Ltd.

619000.00

Richard Clark

Red Back Mining Inc.

3310667.00

John Shackleton

Open Text Corp.

4861667.00

John Wright

Petrobank Energy and

Resources Ltd.

4353333.00

Here is an example of how the file should look like.

Note that this example only contains data for 6 people.

You will need to research the information and add to

your own text file. You can get this information from this

file at:

Your task is to develop a program that calculates the tax

owed for these CEOs, displays this information and

saves it into a second file named taxInfo.txt.

To get you started, software experts at Revenue Canada

have provided you with the following IPO chart and

pseudo code.

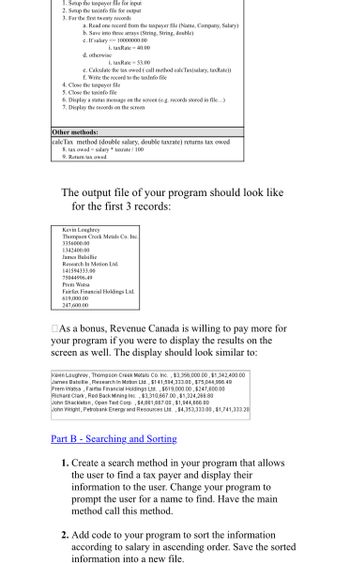

Transcribed Image Text:1. Setup the taxpayer file for input

2. Setup the taxinfo file for output

3. For the first twenty records

a. Read one record from the taxpayer file (Name, Company, Salary)

b. Save into three arrays (String, String, double)

c. If salary < 10000000.00

i, taxRate 40,00

d. otherwise

i. taxRate = 53.00

e. Calculate the tax owed ( call method calcTax(salary, taxRate))

f. Write the record to the taxInfo file

4. Close the taxpayer file

5. Close the taxinfo file

6. Display a status message on the screen (e.g. records stored in file...)

7. Display the records on the screen

Other methods:

caleTax method (double salary, double taxrate) returns tax owed

8. tax owed salary taxrate / 100

9. Return tax owed

The output file of your program should look like

for the first 3 records:

Kevin Loughrey

Thompson Creek Metals Co. Inc.

3356000.00

1342400.00

James Balsillie

Research In Motion Ltd.

141594333.00

75044996.49

Prem Watsa

Fairfax Financial Holdings Ltd.

619,000.00

247,600.00

As a bonus, Revenue Canada is willing to pay more for

your program if you were to display the results on the

screen as well. The display should look similar to:

Kevin Loughrey, Thompson Creek Metals Co. Inc., $3,356,000.00, $1,342,400.00

James Balsillie, Research In Motion Ltd., $141,594,333.00, $75,044,996.49

Prem Watsa, Fairfax Financial Holdings Ltd., $619,000.00, $247,600.00

Richard Clark, Red Back Mining Inc., $3,310,667.00, $1,324,266.80

John Shackleton, Open Text Corp., $4,861,667.00, $1,944,666.80

John Wright, Petrobank Energy and Resources Ltd., $4,353,333.00, $1,741,333.20

Part B - Searching and Sorting

1. Create a search method in your program that allows

the user to find a tax payer and display their

information to the user. Change your program to

prompt the user for a name to find. Have the main

method call this method.

2. Add code to your program to sort the information

according to salary in ascending order. Save the sorted

information into a new file.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Can you explain what it means to "debug" a computer program in technical terms?arrow_forwardPlease correct it In javaarrow_forwardComplete the following program to implement the user interface of the preceding exercise. For simplicity, only the units cm, m, and in are supported. Hint: The value of factor1 or factor2 should be the conversion factor from the selected unit to cm. Ex: If the selected unit is in, factor1 is 2.54 because 1 in = 2.54 cm."in java"arrow_forward

- (With java please)arrow_forwardWrite one line of code ONLY. Print the value of language and its data type in two separate lines, using the variable given below: language = "python" Example Output pythonarrow_forwardChoose the right answer from among the following statements. The term "utilities" refers to applications such as word processors, spreadsheets, e-mail clients, web browsers, and games.arrow_forward

- What do you mean by looping statements? Why looping statements are required? Explain with the help of example.arrow_forwardName:- Mit (Question-1) Note:- Please type this java code and also need an output for this given Java program.arrow_forwardHi, can someone explain to me the diff between type errors and run-time errors in java, please use simplest detail.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Computer Networking: A Top-Down Approach (7th Edi...Computer EngineeringISBN:9780133594140Author:James Kurose, Keith RossPublisher:PEARSON

Computer Networking: A Top-Down Approach (7th Edi...Computer EngineeringISBN:9780133594140Author:James Kurose, Keith RossPublisher:PEARSON Computer Organization and Design MIPS Edition, Fi...Computer EngineeringISBN:9780124077263Author:David A. Patterson, John L. HennessyPublisher:Elsevier Science

Computer Organization and Design MIPS Edition, Fi...Computer EngineeringISBN:9780124077263Author:David A. Patterson, John L. HennessyPublisher:Elsevier Science Network+ Guide to Networks (MindTap Course List)Computer EngineeringISBN:9781337569330Author:Jill West, Tamara Dean, Jean AndrewsPublisher:Cengage Learning

Network+ Guide to Networks (MindTap Course List)Computer EngineeringISBN:9781337569330Author:Jill West, Tamara Dean, Jean AndrewsPublisher:Cengage Learning Concepts of Database ManagementComputer EngineeringISBN:9781337093422Author:Joy L. Starks, Philip J. Pratt, Mary Z. LastPublisher:Cengage Learning

Concepts of Database ManagementComputer EngineeringISBN:9781337093422Author:Joy L. Starks, Philip J. Pratt, Mary Z. LastPublisher:Cengage Learning Prelude to ProgrammingComputer EngineeringISBN:9780133750423Author:VENIT, StewartPublisher:Pearson Education

Prelude to ProgrammingComputer EngineeringISBN:9780133750423Author:VENIT, StewartPublisher:Pearson Education Sc Business Data Communications and Networking, T...Computer EngineeringISBN:9781119368830Author:FITZGERALDPublisher:WILEY

Sc Business Data Communications and Networking, T...Computer EngineeringISBN:9781119368830Author:FITZGERALDPublisher:WILEY

Computer Networking: A Top-Down Approach (7th Edi...

Computer Engineering

ISBN:9780133594140

Author:James Kurose, Keith Ross

Publisher:PEARSON

Computer Organization and Design MIPS Edition, Fi...

Computer Engineering

ISBN:9780124077263

Author:David A. Patterson, John L. Hennessy

Publisher:Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:9781337569330

Author:Jill West, Tamara Dean, Jean Andrews

Publisher:Cengage Learning

Concepts of Database Management

Computer Engineering

ISBN:9781337093422

Author:Joy L. Starks, Philip J. Pratt, Mary Z. Last

Publisher:Cengage Learning

Prelude to Programming

Computer Engineering

ISBN:9780133750423

Author:VENIT, Stewart

Publisher:Pearson Education

Sc Business Data Communications and Networking, T...

Computer Engineering

ISBN:9781119368830

Author:FITZGERALD

Publisher:WILEY