Our closed economy has a production function Y = A•F(K,LxE), where Y, K, L, E & A all have their usual meanings as per our lectures & course textbook. Also, this production function exhibits all the usual mathematical/economic properties we usually assume: positive marginal

products, diminishing marginal products, complementarity between K & (LxE), and constant returns to scale. The aggregate consumption function depends negatively on the real interest rate,

the government budget is balanced initially & the economy is in both a long-run equilibrium and steady state initially. The population growth rate is 2% per year, capital

3% per year, the saving rate is 25% and technology is constant.

Suppose the level of labour effectiveness (E) suddenly permanently rises by 10%.

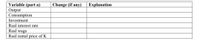

a) Use the long-run classical model to determine the qualitative impact of this shock on the long-run equilibrium levels of real output, consumption, investment, real interest rate, real wage & real rental

NOTE: Fill in the following table to submit along with your answer to this part. Do not

forget to provide an economic explanation as to why this change did or did not occur.

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

- In the above, Yt stands for output in period t, Kt stock of capital, It investment, St savings, and Ct consumption. (a) Derive the equilibrium capital accumulation equation and for an initial value of the capital stock K0 = 1 in period 0, derive the values of Y0, S0, and C0 in period 0 and K1, I1, Y1, S1, and C1 in period 1. (b) Consider the economy at steady state and derive the equilibrium steady state values of KE, YE, IE and CE.arrow_forwardSuppose that the production function for an economy is given by Y = K1/4L3/4. The depreciation rate is 4%, the saving rate is 12%, Explain how the economy goes from one steady state to another.arrow_forwardAssume that the production function for a country is given by Y=√K and annual investment is given by the function I=γ×YI where γ=0.280, and that the yearly depreciation rate is 4.67%. Suppose that this year, the output in the country is 1, and a neighbor country's output is 50% higher. Calculate the time it would take for the country's output to catch up with its neighbor's output. Assume the neighbor country's economy is neither growing nor shrinking.arrow_forward

- Consider the production function modelled by the following equation: Y₁ = AK₁-α(BH₂)ªL₹ where Kt is capital, Ht is human capital, Lt is the number of workers, B is a scalar larger than 0, A is the (constant) level of technology, 0 < a <1 and 0 <ɛ<1. a) Does this production function satisfy all the neoclassical properties? Discuss the meaning of each property intuitively and mathematically. t Imagine that parents invest in the human capital of their children up to the point where the marginal product of physical capital, Kt, is equal to the marginal product of human capital, Ht. b) What is the relation between Kt and Ht? Use this relation to write down total output as a function of Kt only. Q3(b) in order to make output a function of K alone, after establishing that H and K are proportional, should we also establish H=h*L to remove L from the equation? Or are we treating L and H as independent variables like we did for the previous PSET and question 3(a) above.arrow_forwardConsider an economy with the following aggregate production function: Y = 3K1/3(AL)2/3 Capital grows through investment but also decays due to wear and tear at a constant rate δ per period. Assume that A is growing at the exogenous rate g, that L is growing at the exogenous rate n, and that households save a constant proportion s of their income. (a ) Find the steady state level of the capital per effective worker (k*), output per effective worker (y*) and consumption per effective worker (c*) - in terms of the parameters of the model. (B) What is the level of k (k**) that maximizes consumption? (C) Given a depreciation rate of 7%, population growth rate of 2%, technological progress of 1% and a saving rate of 30%, calculate the steady state levels of k, y and c. (D) To move to the level of capital that maximizes consumption, how should the saving rate be changed? Explain. (E) Calculate the saving rate needed to reach the golden rule level of capital per effective worker.arrow_forwardConsider the following one-period model. Assume that the consumption good is produced by a linear technology: Y = zND where Y is the output of the con- sumption good, z is the exogenous total factor productivity, ND is the labour hours. Government has to finance its expenditures, G, using a lump-sum tax, T, on the rep- resentative consumer. There is no other tax in the economy. The firm is owned by the representative consumer who is endowed with h hours of time she can allocate between work, NS and leisure, l. Preferences of the representative consumer are: U (c, l) = α ln c + (1 − α) ln l (1) where 0 < α < 1 is a parameter. (a) Write down the definition of a competitive equilibrium for the above economy 1 (b) Solve for the leisure, l, the consumption, c, employment, N, wage rate, w, lump-sum tax, T , and output, Y in equilibrium. (c) Solve for the optimal allocation of leisure, l, the consumption, c, employment, N, output, Y . Contrast these quantities with those…arrow_forward

- According to the neoclassical growth model, the production function of an economy can be represented as Y=f(L,K, A). Which of the following is considered as a decline in technology under this framework? A fall in the capital to labour ratio Depreciation of capital stock A fall in labour to capital ratio. An increase in the number of steps a business must take to obtain government approval to sell a new product Reduction in immigrationarrow_forward1. Consider an economy that operates under competitive markets and meets the assumptions of the Solow model. The production function is given as follows: Y(t) = K (t) 0.3 (A(t)L(t)) ⁰.7 Assume a saving rate of 15%, labor force growth rate of 2% and depreciation rate of 5% and effectiveness of labor growth rate of 8%. a. Show that the production function exhibit constant return to scale? b. Derive the production function for output per capita. c. Derive the production function for output per effective unit of labor. d. Find equilibrium real wage as a function of capital per unit of effective labor and effectiveness of labor. e. Find equilibrium real rental price of capital as a function of capital per unit of effective labor and effectiveness of labor. f. Solve for steady state level of capital per unit of effective labor. g. Find steady state level of output per unit of effective labor. h. Find growth rate of output and output per worker on the balanced growth path. i. Which one would…arrow_forwardLineararrow_forward

- Our closed economy has a production function Y = A•F(K,LxE), where Y, K, L, E & A all have their usual meanings as per our lectures & course textbook. Also, this production function exhibits all the usual mathematical/economic properties we usually assume: positive marginal products, diminishing marginal products, complementarity between K & (LxE), and constant returns to scale. The aggregate consumption function depends negatively on the real interest rate, the government budget is balanced initially & the economy is in both a long-run equilibrium and steady state initially. The population growth rate is 2% per year, capital depreciates at a rate of 3% per year, the saving rate is 25% and technology is constant. Suppose the level of labour effectiveness (E) suddenly permanently rises by 10%. a) Use the long-run classical model to determine the qualitative impact of this shock on the long-run equilibrium levels of real output, consumption, investment, real interest…arrow_forwardGiven a closed economy where there is no public sector. Production in the economy can be described with the following production function: Y = F (K, AL) = Kα(AL)1−α where Y is the productive capacity of the economy, K is the capital stock, L is the labor force, and A is knowledge. Think of AL as a single factor of production where knowledge and the amount of labor are multiplied together. Let's call the multiplier (ie AL) the efficiency of labor. Given that A = 1.5 and saving is a fixed rate of the production, or s = 33%. The capital stock shrinks by 3% per year, while the population grows is nobody Finally, α = 0.4. Answer the following questions based on the above criteria. (a) Show mathematically that the marginal productivity of labor and capital is positive but diminishing. Explain in words and with a picture what the term positive but diminishing marginal productivity means. (b) Show mathematically that saving and investment are equivalent in a closed economy (c) Show…arrow_forwardThis question requires that you use the law of motion of capital, the production function, and the national income accounts identity. Suppose that a nation's production function is Y= F(Kt,Lt)=K%L}-a You have the following information: The share of income paid to owners of capital The rate of depreciation, 8 =1 The savings rate s=15 The initial capital stock Ko=1 The labor supply, for all t>0 is L=1 What is the long run level of consumption? Please give an exact answer. This question will accept any answer within 0.1 of the correct answer 1/3arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education