Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

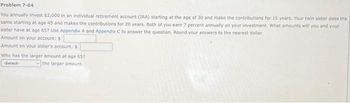

Transcribed Image Text:Problem 7-04

You annually invest $2,000 in an individual retirement account (IRA) starting at the age of 30 and make the contributions for 15 years. Your twin sister does the

same starting at age 45 and makes the contributions for 20 years. Both of you earn 7 percent annually on your investment. What amounts will you and your

sister have at age 657 Use Appendix A and Appendix C to answer the question. Round your answers to the nearest dollar.

Amount on your account: $

Amount on your sister's account: $

Who has the larger amount at age 657

-Select-

the larger amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Gilberto opened a savings account for his daughter and deposited $1000 on the day she was born. Each year on her birthday, he deposited another $1000. If the account pays 11% interest, compounded annually, how much is in the account at the end of the day on her 12th birthday? At the end of the day on her 12th birthday, the amount in the account is $ (Simplify your answer. Type an integer or a decimal. Round to the nearest cent if needed.)arrow_forward(b) Chris Hitchcock is 43 years old today and he wishes to accumulate $512.000 by his 65 th birthday so he can retire to his summer place on Lake Hopatcong. He wishes to accumulate this amount by making equal deposits on his 43 th through his 64 th birthdays. What annual deposit must Chris make if the fund will earn 8% interest compounded annually? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Annual deposit eTextbook and Media Save for Later Attempts: unlimited Submit Answer %24arrow_forwardA grandfather agrees to start contributing $2,500.00 to an educational savings account starting with the 8th birthday of his granddaughter. His last payment is on her 18th birthday at which point she starts a 4 year college program. How much can she afford drawing from this account at the end of each study year until she graduates? The account makes 5.5% per year.arrow_forward

- Logan starts an IRA (Individual Retirement Account) at the age of 30 to save for retirement. He deposits $400 each month. Upon retirement at the age of 65, his retirement savings is $943,445.01. Determine the amount of money Logan deposited over the length of the investment. Round to the nearest thousand dollars.arrow_forward20.arrow_forwardA couple plans to save for their child's college education. What principle must be deposited by the parents when their child is born in order to have? $39000 when the child. Reaches? The age of eighteen assume the money earns seven percent interest compounded quarterly.arrow_forward

- Grandma Patt has decided to open a savings account for her newborn granddaughter. The savings account pays 3% interest. If Grandma Patt wants there to be $10,000 in the account in 18 years, how much should she deposit today? Assume no other deposits or withdrawals. a) $5,873.95 b) $17,024.33 c) $8,362.17 d) $10,609.23arrow_forwardMonique contributed $500.00 every month into an RRSP for 15 years. What nominal annual rate of interest will the RRSP earn if the balance in Monique's account just after she made her last contribution was $200,000.00arrow_forwardYou MUST use the TI BA II calculator features (N, I/Y, PV, PMT, FV, AMORT) to solve questions whenever possible. 1. Seanna O'Brien receives pension payments of $3,200 at the end of every six months from a retirement fund of $50,000. The fund earns 7% compounded semi-annually. What is the size of the final pension payment? 2. For how many years will Prasad make payments on the $28,000 he borrowed to start his machine shop if he makes payments of $3,400 at the end of every three months and interest is 8.08% compounded semi-annually?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education