Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Tyler Winkle's employer in Pittsburgh makes a matching contribution of $2,000 a year to his 401(k) retirement account at work. If the dollar amount of the employer's contribution increases 6 percent annually, how much will the employer contribute to the plan in the twentieth year from now? Round

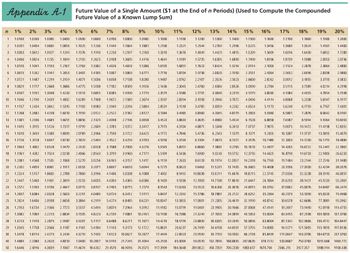

Transcribed Image Text:Appendix A-1

1% 2% 3%

1.0100 1.0200 1.0300

2 1.0201 1.0404 1.0609

1

1.1700

1.1800

1.1100

1.2321

1.3689

1.4161 1.4400

1.3924

1.6430

3

1.0303 1.0612 1.0927

1.3676

1.6016

1.7280

1.6852

2.0053

4

11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1.1300 1.1400 1.1500 1.1600

1.1900 1.2000

1.2769 1.2996 1.3225 1.3456

1.4429 1.4815 1.5209 1.5609

1.8106

2.1003

2.4364

2.8262

3.2784

1.0406 1.0824 1.1255

1.9388

2.0736

1.8739

2.1924

2.5652

2.2878

2.4883

2.3864

2.8398

6 1.0615 1.1262

2.6996

3.0012

3.3793

3.1855

3.7589

2.9860

3.5832

4.2998

2.1436

3.5115

4.0214

4.7854

3.8030

4.1084

4.4355

5.1598

5.2338

5.6947

6.1917

4.8068

5.6240

6.1759

6.7767

7.4301

6.5801

8.0642

8.9161

7.6987

4% 5% 6% 7% 8% 9% 10%

1.0400 1.0500 1.0600 1.0700 1.0800 1.0900

1.1200

1.0816 1.1025 1.1236 1.1449 1.1664 1.1881

1.2544

1.1249 1.1576 1.1910 1.2250 1.2597 1.2950

1.4049

1.1699 1.2155 1.2625 1.3108 1.3605 1.4116

1.5735 1.6305 1.6890 1.7490

5 1.0510 1.1041 1.1593 1.2167 1.2763 1.3382 1.4026 1.4693 1.5386

1.7623 1.8424 1.9254 2.0114

1.1941 1.2653 1.3401 1.4185 1.5007 1.5869 1.6771

1.9738 2.0820 2.1950 2.3131

7 1.0721 1.1487 1.2299 1.3159 1.4071 1.5036 1.6058 1.7138 1.8280

2.2107 2.3526 2.50 23 2.6600

8 1.0829 1.1717 1.2668 1.3686 1.4775 1.5938 1.7182 1.8509 1.9926

2.4760 2.6584 2.8526 3.0590

9 1.0937 1.1951 1.3048 1.4233 1.5513 1.6895 1.8385 1.9990 2.1719 2.3579

2.7731 3.0040 3.2519 3.5179

10 1.1046 1.2190 1.3439 1.4802 1.6289 1.7908 1.9672

2.1589 2.3674 2.5937

3.1058 3.3946 3.7072 4.0456 4.4114

11 1.1157 1.2434 1.3842 1.5395 1.7103 1.8983 2.1049 2.3316 2.5804 2.8531

3.4785 3.8359 4.2262 4.6524 5.1173

12 1.1268 1.2682 1.4258 1.6010 1.7959 2.0122 2.2522 2.5182 2.8127 3.1384

3.8960 4.3345 4.8179 5.3503 5.9360

7.2876

13 1.1381 1.2936 1.4685 1.6651 1.8856 2.1329 2.4098 2.7196 3.0658 3.4523

4.3635 4.8980 5.4924 6.1528 6.8858

8.5994 9.5964 10.6993

14 1.1495 1.3195 1.5126 1.7317 1.9799

2.2609 2.5785 2.9372 3.3417 3.7975

4.8871 5.5348 6.2613 7.0757 7.9875 9.0075 10.1472 11.4198 12.8392

15 1.1610 1.3459 1.5580 1.8009 2.0789

2.3966 2.7590 3.1722 3.6425 4.1772

5.4736 6.2543 7.1379 8.1371 9.2655 10.5387 11.9737 13.5895 15.4070

1.1726 1.3728 1.6047 1.8730 2.1829 2.5404 2.9522 3.4259 3.9703 4.5950

6.1304 7.0673 8.1372 9.3576 10.7480 12.3303 14.1290 16.1715 18.4884

1.1843 1.4002 1.6528 1.9479 2.29 20 2.6928 3.1588 3.7000 4.3276 5.0545

6.8660 7.9861 9.2765 10.7613 12.4677 14.4265 16.6722 19.2441

22.1861

1.1961 1.4282 1.7024 2.0258 2.4066 2.8543 3.3799 3.9960 4.7171

7.6900 9.0243 10.5752 12.3755 14.4625 16.8790 19.6733 22.9005 26.6233

1.2081 1.4568 1.7535 2.1068 2.5270 3.0256 3.6165 4.3157 5.1417

8.6128 10.1974 12.0557 14.2318 16.7765 19.7484 23.2144 27.2516

1.2202 1.4859 1.8061 2.1911 2.6533 3.2071 3.8697 4.6610 5.6044

9.6463 11.5231 13.7435 16.3665 19.4608 23.1056 27.3930 32.4294

1.2324 1.5157 1.8603 2.2788 2.7860 3.3996

4.1406 5.0338 6.1088

10.8038 13.0211 15.6676 18.8215 22.5745 27.0336 32.3238 38.5910

22 1.2447 1.5460 1.9161 2.3699 2.9253 3.6035 4.4304 5.4365 6.6586

12.1003 14.7138 17.8610 21.6447 26.1864 31.6293 38.1421 45.9233

23 1.2572 1.5769 1.9736 2.4647 3.0715 3.8197 4.7405 5.8715 7.2579 8.9543 11.0263 13.5523 16.6266 20.3616 24.8915 30.3762 37.0062 45.0076 54.6487

24 1.2697 1.6084 2.0328 2.5633 3.2251 4.0489 5.0724 6.3412 7.9111 9.8497 12.2392 15.1786 18.7881 23.2122 28.6252 35.2364 43.2973 53.1090 65.03 20 79.4968

25 1.2824 1.6406 2.0938 2.6658 3.3864 4.2919 5.4274 6.8485 8.6231 10.8347 13.5855 17.0001 21.2305 26.4619 32.9190 40.8742 50.6578 62.6686 77.3881 95.3962

1.2953 1.6734 2.1566 2.7725 3.5557 4.5494 5.8074 7.3964 9.3992 11.9182 15.0799 19.0401 23.9905 30.1666 37.8568 47.4141 59.2697 73.9490 92.0918 114.4755

1.3082 1.7069 2.2213 2.8834 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 21.3249 27.1093 34.3899 43.5353 55.0004 69.3455 87.2598 109.5893 137.3706

28 1.3213 1.7410 2.2879 2.9987 3.9201 5.1117 6.6488

8.6271 11.1671 14.4210 18.5799 23.8839 30.6335 39.2045 50.0656 63.8004 81.1342 102.9666 130.4112 164.8447

29 1.3345 1.7758 2.3566 3.1187 4.1161 5.4184 7.1143 9.3173 12.1722 15.8631 20.6237 26.7499 34.6158 44.6931 57.5755 74.0085 94.9271 121.5005 155.1893 197.8136

30 1.3478 1.8114 2.4273 3.2434 4.3219 5.7435 7.6123 10.0627 13.2677 17.4494 22.8923 29.9599 39.1159 50.9502 66.2118 85.8499 111.0647 143.3706 184.6753 237.3763

40 1.4889 2.2080 3.2620 4.8010 7.0400 10.2857 14.9745 21.7245 31.4094 45.2593 65.0009 93.0510 132.7816 188.8835 267.8635 378.7212 533.8687 750.3783

1.6446 2.6916 4.3839 7.1067 11.4674 18.4202 29.4570 46.9016 74.3575

184.5648 289.0022 450.7359 700.2330 1083.657 1670.704 2566.215 3927.357

16

17

18

5.5599

6.1159

19

31.9480

6.7275

20

21

7.4002

38.3376

46.0051

55.2061

8.1403

9.9336

66.2474

26

27

1051.668 1469.772

50

117.3909

5988.914 9100.438

n

Future Value of a Single Amount ($1 at the End of n Periods) (Used to Compute the Compounded

Future Value of a Known Lump Sum)

1.1000

1.2100

1.3310

1.4641

1.6105

1.7716

1.9487

1.5181

1.6851

1.8704

2.0762

2.3045

2.5580

2.8394

3.1518

3.4985

3.8833

4.3104

4.7846

5.3109

5.8951

6.5436

7.2633

8.0623

8.9492

Expert Solution

arrow_forward

Step 1

Future value of a single present amount

With periodic interest rate (r), periods (n) and present value (PV), the future value (FV) is calculated as shown below.

Future value factor can be calculated using 'r' and 'n' as shown above or it can be found in the future value table provided with question.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- After one year of employment, Hasan has joined his company's pensionplan. He estimates he will retire in 35 years, and will be retired for a total of 25 years. During his retirement, he will need S50, 000 at the beginning of each year. At a discount rate of 4%, compounded quarterly, what should be his savings goal? a. S807, 655b. S963, 258c. S2, 184,431d . S3, 878, 614arrow_forwardFor the last 15 years Joseph has deposited $4500 at the end of every six months into an account paying 6.5% compounded semi-annually.He now converts the accumulated amount into a retirement income fund which will ear interest at 5.25% compounded monthly. Joseph plans to receive equal payments at the end of every six months from this fund for the next 10 year. Determine the size of each payment.arrow_forwardA woman, with her employer's matching program, contributes $300 at the end of each month to her retirement account, which earns 7% interest, compounded monthly. When she retires after 43 years, she plans to make monthly withdrawals for 25 years. If her account eams 6% interest, compounded monthly, then when she retires, what is her maximum possible monthly withdrawal (without running out of money)? The maximum possible monthly withdrawal is approximately $ (Simplify your answer. Round to the nearest cent as needed) CD-arrow_forward

- How do I solve the following: An employee that has 35 years until retirement has a current salary of $30,000 per year. The employee's wages are expected to increase by 5% annually over the next 35 years. The employer has a defined benefit pension plan in which a worker’s annual pension benefit is equal to 2% of the employee's final year’s wage for each year of employment, multiplied by the number of years of employment. The employee's expected annual pension benefit is calculated as $115,836.32. The cmpany contributes to the pension plan each year for the next 35 years. Assume 10% actuarial rate of return, and 30 years of retirement life. At the employee's time of retirement, what does the accumulated amount in the employee's pension plan have to be in order to meet the employee's annual pension benefit each year in 30 years?arrow_forwardLinda's salary is $49000 a year. As a part of it's incentive program the company decides to give her a raise of $1000 every year. What is the discounted value of her income for the next 11 years at j₁ = 6.2%? To keep things simple, assume Linda is paid her entire salary at the end of each year. Answer: $arrow_forwardYour company’s pension plan earns 4.3 % interest per year, compounded quarterly. a) You would like to receive payments of $40,000 quarterly while retired. If you would like these payments paid out over 25 years, what amount of money will you need in your pension fund at the beginning of your retirement years? Give the answer correctly to 2 decimal places, and do not use the $ sign in the answer box. The money you will need at the beginning of your retirement years is Blank 1. Calculate the answer by read surrounding text. dollars. b) Use your answer from part a to help you to determine how much you should put into your pension fund quarterly during your working years to reach your retirement goals. Assume you are planning to work for 30 years. Give the answer correctly to 2 decimal places, and do not use the $ sign in the answer box. The amount you should deposit quarterly during your working years is Blank 2. Calculate the answer by read surrounding text.…arrow_forward

- A couple is planning to finance its three-year-old son's university education. Money can be deposited at 10% compounded quarterly. What quarterly deposit must be made from the son's 3rd birthday to his 18th birthday to provide $8000 on each birthday from the 18th to the 21st? (Note that the first deposit is made three months after the 3rd birthday and the last deposit is made on the date of the first withdrawal.) Answer:arrow_forwardOHaganBooks.com has just introduced a retirement package for its employees. Under the annuity plan operated by Sleepy Hollow, the monthly contribution by the company on behalf of each employee is $700. Each employee can then supplement that amount through payroll deductions. The current rate of return of Sleepy Hollow's retirement fund is 7.1%. Jane Callahan, the website developer at OHaganBooks.com, plans to retire in 10 years. She contributes $1,000 per month to the plan (in addition to the company contribution of $700). Currently, there is $40,000 in her retirement annuity. How much (to the nearest dollar) will it be worth when she retires? (Assume interest is compounded monthly.) $arrow_forwardOne month from now, Kelly will make her first monthly contribution of $250250 to a Tax-Free Savings Account (TFSA). She expects to earn 88% compounded annually. How long will it take for the contributions and accrued earnings to reach $65 comma 00065,000?arrow_forward

- Paul intends to retire in 15 years and would like to receive $1,500 every month for 20 years, starting at the end of the first month in which he retires. How much must he have at the beginning of retirement if interest is 5% compounded annually? Select one: a. $191,834.03 b. $229,415.16 c. $228,235.00 d. $227,287.97 e. $230,349.83arrow_forwardYour employer contributes $500 per month, at the beginning of each month, to a retirement fund on your behalf. The contributions earn interest at a rate of 6% per year, compounded monthly. At the end of twenty years, what will be the balance of the fund? Group of answer choices $69,790 $232,175 $70,139 $220,713 $231,020arrow_forwardA couple is planning to finance its three-year-old son's university education. Money can be deposited at 9% compounded quarterly. What quarterly deposit must be made from the son's 3rd birthday to his 18th birthday to provide $10000 on each birthday from the 18th to the 21st? (Note that the first deposit is made three months after the 3rd birthday and the last deposit is made on the date of the first withdrawal.) (keep 2 decimal places) Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education