FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Format: 11,111 U or 11,111 F

1. Sales price variance

2. Cost price variance

3. Quantity variance

4. Sales mix variance

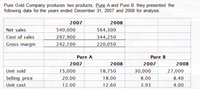

Transcribed Image Text:Pure Gold Company produces two products, Pure A and Pure B. they presented the

following data for the years ended December 31, 2007 and 2008 for analysis.

2007

2008

Net sales

540,000

564,300

Cost of sales

297,900

344,250

Gross margin

242,100

220,050

Pure A

Pure B

2007

2008

2007

2008

Unit sold

15,000

18,750

30,000

27,000

Selling price

20.00

18.00

8.00

8.40

Unit cost

12.00

12.60

3.93

4.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 8 part 3arrow_forward4arrow_forward1.What is the labor rate variance ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 2. What is the variable overhead efficiency variance ? ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 3. what is the variable overhead rate variance?arrow_forward

- Total variance in variance analysis compares ● Flexible budget and actual outcome Static budget and flexible budget Flexible budget and static outcome Static budget and actual outcomearrow_forwardWhich statement is true? A. Gross profit (GP) variance analysis, is an essential part of financial statements analysis that is used to evaluate the performance of a firm's departments responsible for the firm's line activities (functions). B. Increases and decreases in sales and cost of sales have direct relationship with increases and decreases in GP. C. If there is a negative sales price variance and there is no cost variance, the gross profit variance will be equal to the sales price variance. D. A zero cost variance indicates that there is no difference between the standard cost prices and actual cost prices. E. none of the abovearrow_forward8arrow_forward

- 1. Please, compute mean returns, variances and covariance among the two assets of the IBEX35 and present the vector of returns and the matrix.arrow_forwardHelp question 26arrow_forwardAt the beginning of the year, you estimated the following - Production - 75,000 units Raw Material - 270,000 pounds at a cost of $1,026,000 Direct Labor - 187,500 hours at a cost of $4,125,000 Variable Overhead - 135,000 machine hours at a cost of $567,000 Fixed Overhead - $900,000 At the end of year, the actual results were as follows - Production - 73,000 units Raw Material - 265,720 pounds purchased and used at a cost of $1,036,308 Direct Labor - 179,580 hours at a cost of $3,968,718 Variable Overhead - 133,590 machine hours at a cost of $558,406.20 Fixed Overhead - $891,000arrow_forward

- Gross profit volume variance is derived by A. combining sales and cost of sales variances. B. combining sales volume and cost volume variances. C. deducting cost price variance from gross profit variance. D. deducting sales price variance from gross profit variance.arrow_forwardLeast-squares regression is a statistical method for identifying cost behavior. True or False Truearrow_forwardS1: The percentage increase in selling price is found by dividing the favorable sales price variance by last year's sales at the current year's sales quantity. S2: The percentage decrease in units sold is found by dividing the favorable cost volume variance by the planned level of cost of sales. A. both are true C. S1 is true D. S2 is true B. both are falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education