EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please solve and show work for general accounting question

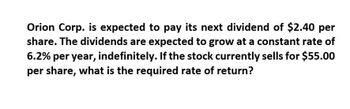

Transcribed Image Text:Orion Corp. is expected to pay its next dividend of $2.40 per

share. The dividends are expected to grow at a constant rate of

6.2% per year, indefinitely. If the stock currently sells for $55.00

per share, what is the required rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The next dividend payment by Savitz, Inc., will be $2.43 per share. The dividendsare anticipated to maintain an annual growth rate of 3.5% forever. If the stockcurrently sells for $70 per share, what is the required return?arrow_forwardFranklin Corporation is expected to pay a dividend of $1.40 per share at the end of the year. The stock sells for $33.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate?arrow_forwardThe next dividend payment by Circular Bubbles Inc., will be $12.34 per share. The dividends are anticipated to maintain a growth rate of 5 percent forever. If the stock currently sells for $60 per share, what is the required return?arrow_forward

- grey manufacturing is expected to pay a dividend of $1.25 per share at the end of the year (D1=$1.25). The stock sells fo $27.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate?arrow_forwardWhat is the required return on these financial accounting question?arrow_forwardA firm will pay a dividend of $1.05 next year. The dividend is expected to grow at a constant rate of 3.42% forever and the required rate of return is 13.83%. What is the value of the stock?arrow_forward

- CanPro Co. is expecting that its dividend for this coming year will be $1.2 a share and that all future dividends are expected to increase by 3 percent annually. What is the required return of this stock if the current market price of the stock is $17?arrow_forwardXYZ, Inc. is expected to pay a dividend of $5 which is expected to grow at a constant annual rate of 5%. What is the expected rate of return on this stock if it currently sells at $43 per share? Show your answer in percent to one decimal.arrow_forwardBugatti, Inc is expected to pay a dividend of $3.55 next year (i. e., D1 = 3.55) and its current stock price is $48. The discount rate for the company is 13%. If the market expects Bugatti's dividends to grow at a constant rate forever, then the growth rate must be %arrow_forward

- MMC expects to pay its first dividend at the end of the year. The first dividend is expected to be $0.75 and the second $1.25. Then, dividends are expected to grow at 3.5% thereafter. Given a required return of 8.5%, what should the value of the stock be today?arrow_forwardThe next dividend payment by Savitz, Incorporated, will be $2.05 per share. The dividends are anticipated to maintain a growth rate of 5 percent forever. If the stock currently sells for $47 per share, what is the required return?arrow_forwardABC, Inc.'s stock is currently selling for $66.17. The dividends are expected to grow at 1.16% each year forever. If the required rate of return on the stock is 13.98%, what is the current period's dividend? That is, solve for D0.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning