FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

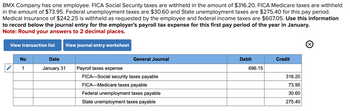

Transcribed Image Text:BMX Company has one employee. FICA Social Security taxes are withheld in the amount of $316.20. FICA Medicare taxes are withheld

in the amount of $73.95. Federal unemployment taxes are $30.60 and State unemployment taxes are $275.40 for this pay period.

Medical Insurance of $242.25 is withheld as requested by the employee and federal income taxes are $607.05. Use this information

to record below the journal entry for the employer's payroll tax expense for this first pay period of the year in January.

Note: Round your answers to 2 decimal places.

View transaction list View journal entry worksheet

No

1

Date

January 31

General Journal

Payroll taxes expense

FICA-Social security taxes payable

FICA-Medicare taxes payable

Federal unemployment taxes payable

State unemployment taxes payable

Debit

696.15

Credit

316.20

73.95

30.60

275.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The employees of Lillian's Interiors are paid on a semimonthly basis. All employees are single. Required: Compute the FICA taxes for the employees for December 31, 2021, pay period. All employees have been employed for the entire calendar year. (Round "Social Security Tax" and "Medicare Tax" to 2 decimal places.) Employee W. Babish G. Hanoush R. Fezzeti T. Gomez N. Bertraud R. LaPonte Semimonthly Pay $ $ $ $ 69 69 $ X Answer is complete but not entirely correct. Social Security Tax $ YTD Pay for 12-15- 2021 8,345 $191,935 $ 6,295 $ 144,785 $ 9,270 $ 213,210✔✔ $ $ 105,110 $ 4,570 5,725 $ 131,675$ 4,970 $ 114,310 $ Medicare Tax for 12- 31-2021 Pay for 12-31- 2021 Pay 0.00 $ 0.00 $ 0.00 $ 283.34 354.95 $ $ 308.14 $ 121.00 x 91.28 217.85✔ 66.27✔ 83.01✔ 72.07✔arrow_forwardRequired Information [The following Information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 pald to its employee. a. b. C. Gross Pay through August 31 $ 6,400 2,000 131,400 Gross Pay for September $ 800 2,100 8,000 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answers in the tabs below. Payroll Taxes Expense General Journal Assuming situation (a), compute the payroll taxes expense. Note: Round your answers to 2 decimal places. Employer Payroll taxes September earnings subject to tax Tax Rate Tax Amountarrow_forwardAZT Company has one employee who has worked January - March 15 of the current year. The employee is single, paid semi-monthly, and claims two allowances on his W-2. The federal withholding is $143. The company is in a state that has no state income taxes. The FICA Social Security tax rate is 6.2% on the first $118,500 of wages and the FICA Medicare tax rate is 1.45% on all wages. AZT Company's FUTA tax rate is 0.6% on the first $7,000 of wages and their SUTA tax rate is 1.95% on the first $8,000 of wages. The employee's earnings thus far are as follows: Gross pay Jan - Mar 15th Gross pay for March 31st $6,200 $1,280 Use the information above to calculate the employer's payroll taxes and prepare the journal entry AZT Company will use to record the employer's portion of the payroll taxes for the pay period ended March 31st. Date 03/31 Description Debit Credit to record employer's portion of payroll taxes for the pay period ending March 31starrow_forward

- The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. (Round your intermediate calculations and final answers to 2 decimal places.) Employee S. Bergstrom C. Pare L Van der Hooven S Lightfoot Filing Status. Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 $ $ $ $ Pay Union Dues per Periodi 1,730 3,560 $ 3,285 $ 2,910 120 240 Garnishment per Period $ $ S 50 75 100 Net Payarrow_forwardThe required deduction for Social Security is 6.2% OASDI (Old Age Survivors and Disability Insurance) of wages earned, to a maximum of $97,500 and 1.45% HI (Hospital Insurance, commonly known as "Medicare") for all earnings. Refer to the Social Security and Medicare information. Employers are required to match the employee's deductions and send the total to the IRS. Compute the maximum percent that can be sent to the IRS for any one employee during the period of a year. 13.3% 13.5% 15.3% 15.5%arrow_forwardThe following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix Cito determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. (Round your intermediate calculations and final answers to 2 decimal places.) Employee S. Bergstrom C. Pare L. Van der Hooven S. Lightfoot Filing Status, Dependents MJ-0 MJ-2 (<17) S-1 (Other) MJ-0 Pay $ $ 1,715 3,880 $ 3,605 $ 3,230 Union Dues per Period $ $ GA Garnishment per Period $ 120 240 $ $ 50 75 100 $ $ $ $ Net Pay 1,398.35 3,117.86 2,541.37 2,760.04arrow_forward

- > The payroll register of Seaside Architecture Company indicates $830 of social security taxes and $225 of Medicare taxes withheld on total salaries of $15,500 for the period. Assume earnings subject to state and federal unemployment compensation taxes are $5,200 at the federal rate of 0.8% and state rate of 5.4%. Journalize the entry for the employer's payroll taxes. If an amount box does not require an entry, leave it blank. If required, round your answers to two decimal places. 00000 ?arrow_forwardN2. Accountarrow_forwardKenneth Noll’s gross earnings for the week were $2,600, his federal income tax withholding was $468, and his FICA total was $199. There were no state income taxes. What was Noll’s net pay for the week? Net pay $enter Net pay in dollars eTextbook and Media List of Accounts Journalize the entry for the recording of his pay in the general journal. (Note: Use Salaries and Wages Payable, not Cash.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount eTextbook and Media List of Accounts…arrow_forward

- Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0,6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee Gross Pay through August 31 $ 5,700 3,200 132,600 Gross Pay for September $1,800 3,300 9,200 Exercise 9-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Complete this question by entering your answers in the tabs below. Payroll Taxes General Expense Journal Assuming situation (a), compute the payroll taxes expense. Note: Round your answers to 2 decimal places.arrow_forwardThe following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay Required: Calculate their net pay using the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine federal income tax. Assume box 2 is not checked for any employee. Include Colorado income tax of 4.55 percent of taxable pay. No employee has exceeded the maximum FICA limit. (Round your intermediate calculations and final answers to 2 decimal places.) Employee Filing Status, Dependents S. Bergstrom MJ-0 Pay $ Union Dues per Period Garnishment per Period Net Pay 1,730 $ 50 C. Pare MJ-2 (<17) $ 3,560 $ 120 L Van der Hooven S-1 (Other) S 3,285 $ 240 $ 75 S Lightfoot MJ-0 S 2.910 S 100arrow_forwardSolvearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education