FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

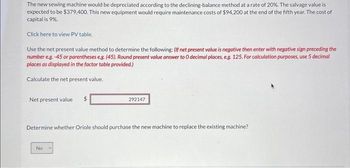

Transcribed Image Text:The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is

expected to be $379,400. This new equipment would require maintenance costs of $94,200 at the end of the fifth year. The cost of

capital is 9%.

Click here to view PV table.

Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the

number e.g. -45 or parentheses e.g. (45). Round present value answer to 0 decimal places, e.g. 125. For calculation purposes, use 5 decimal

places as displayed in the factor table provided.)

Calculate the net present value.

Net present value $

292147

Determine whether Oriole should purchase the new machine to replace the existing machine?

No

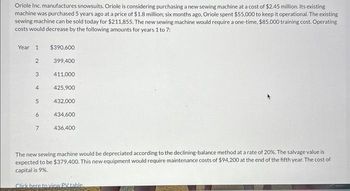

Transcribed Image Text:Oriole Inc. manufactures snowsuits. Oriole is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing

machine was purchased 5 years ago at a price of $1.8 million; six months ago, Oriole spent $55,000 to keep it operational. The existing

sewing machine can be sold today for $211,855. The new sewing machine would require a one-time, $85,000 training cost. Operating

costs would decrease by the following amounts for years 1 to 7:

Year 1

2

3

4

5

6

7

$390,600

399,400

411,000

425.900

432,000

434,600

436,400

The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is

expected to be $379,400. This new equipment would require maintenance costs of $94,200 at the end of the fifth year. The cost of

capital is 9%.

Click here to view PV table

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Fleming Company, a food distributor, is considering replacing a filling line at its Oklahoma City warehouse. The existing line was purchased several years ago for $3,600,000. The line’s book value is $445,000, and Fleming's management feels it could be sold at this time for $350,000. A new, increased capacity line can be purchased for $2,575,000 and will require and increase in NWC of $55,000. Delivery and installation of the new line are expected to cost $50,000 and 215,000 respectively. Assuming Fleming’s marginal tax rate is 35%, calculate the net investment for the new line.arrow_forwardThe Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,060,000, and it would cost another $20,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $488,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $18,000. The sprayer would not change revenues, but it is expected to save the firm $358,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is the additional…arrow_forwardOahu Inc. is considering an investment in new equipment that will be used to manufacture a smartphone. The phone is expected to generate additional annual sales of 5,100 units at $276 per unit. The equipment has a cost of $521,700, residual value of $39,300, and an 8-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Line Item Description Amount Cost per unit: Direct labor $47.00 Direct materials 182.00 Factory overhead (including depreciation) 31.60 Total cost per unit $260.60 Determine the average rate of return on the equipment. If required, round to the nearest whole percent.arrow_forward

- Neptune Company produces toys and other items for use in beach and resort areas. A small, inflatable toy has come onto the market that the company is anxious to produce and sell. The new toy will sell for $2.70 per unit. Enough capacity exists in the company's plant to produce 30,400 units of the toy each month. Variable expenses to manufacture and sell one unit would be $1.72, and fixed expenses associated with the toy would total $44,188 per month. The company's Marketing Department predicts that demand for the new toy will exceed the 30,400 units that the company is able to produce. Additional manufacturing space can be rented from another company at a fixed expense of $2,209 per month. Variable expenses in the rented facility would total $1.89 per unit, due to somewhat less efficient operations than in the main plant. Required: 1. What is the monthly break-even point for the new toy in unit sales and dollar sales. 2. How many units must be sold each month to attain a target profit…arrow_forwardThe answers are provided, but need help discovering how to get them.arrow_forwardGold Star Industries is contemplating a purchase of computers. The firm has narrowed its choices to the SAL 5000 and the HAL 1000. The company would need nine SALs, and each SAL costs $3,250 and requires $300 of maintenance each year. At the end of the computer’s eight-year life, each one could be sold for $195. Alternatively, the company could buy seven HALs. Each HAL costs $3,600 and requires $355 of maintenance every year. Each HAL lasts for six years and has a resale value of $140 at the end of its economic life. The company will continue to purchase the model that it chooses today into perpetuity, and the tax rate is 25 percent. Assume that the maintenance costs occur at year-end. Depreciation is straight-line to zero. What is the EAC of each model if the appropriate discount rate is 12 percent? (Your answers should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would be needed to increase plant capacity. The machine would cost $18,000 with a useful life of six years and no salvage value. The company uses straight-line depreciation on all plant assets. (Ignore income taxes.) Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would…arrow_forwardThe Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,130,000, and it would cost another $21,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $591,000. The MACRS rates for the first three years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $13,500. The sprayer would not change revenues, but it is expected to save the firm $316,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 25%. (Ignore the half-year convention for the straight-line method.) Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What are the net operating cash flows in Years 1, 2, and 3? Year 1: $ Year 2: $ Year 3: $ What is the additional Year-3 cash flow (i.e, the after-tax…arrow_forwardHillsong Inc. manufactures snowsuits. Hillsong is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Hillsong spent $55,000 to keep it operational. The existing sewing machine can be sold today for $240,352. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $390,600 2 400,200 3 410,000 4 425,200 5 432,400 6 435,500 7 436,300 The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $380,500. This new equipment would require maintenance costs of $94,900 at the end of the fifth year. The cost of capital is 9%. Use the net present value method to determine the following: (If net present value is negative then enter with negative sign…arrow_forward

- Waterway Inc. manufactures snowsuits. Waterway is considering purchasing a new sewing machine at a cost of $2.45 million. Its existing machine was purchased five years ago at a price of $1.8 million; six months ago, Waterway spent $55,000 to keep it operational. The existing sewing machine can be sold today for $243,257. The new sewing machine would require a one-time, $85,000 training cost. Operating costs would decrease by the following amounts for years 1 to 7: Year 1 $390,900 2 399,900 3 410,400 4 425,200 5 432,600 435,300 7 437,700 The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $379,700. This new equipment would require maintenance costs of $98,400 at the end of the fifth year. The cost of capital is 9%. Click here to view PV table. Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the number e.g. -45 or…arrow_forward2arrow_forwardGonzalez Corporation manufactures a children's bicycle, model CT8. Gonzalez currently manufactures the bicycle frame. During 2023, Gonzalez made 30,000 frames at a total cost of $750,000. Ryan Corporation has offered to supply as many frames as Gonzalez wants at a cost of $23.50 per frame. Gonzalez anticipates needing 33,000 frames each year for the next few years. Required Requirement 1. (a) What is the average cost of manufacturing a bicycle frame in 2023? How does it compare to Ryan's offer? The average cost of $ per frame is than Ryan's offer. (b) Can Gonzalez use the answer in requirement 1a to determine the cost of manufacturing 33,000 bicycle frames? Explain. Gonzalez take the average manufacturing cost in 2023 to determine the total cost of manufacturing 33,000 bicycle frames. The reason is that Requirement 2. Gonzalez's cost analyst uses annual data from past years to estimate the following regression equation with total manufacturing costs of the bicycle frame as the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education