ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

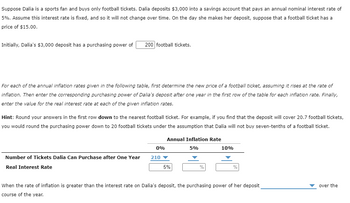

Transcribed Image Text:Suppose Dalia is a sports fan and buys only football tickets. Dalia deposits $3,000 into a savings account that pays an annual nominal interest rate of

5%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a football ticket has a

price of $15.00.

Initially, Dalia's $3,000 deposit has a purchasing power of

200 football tickets.

For each of the annual inflation rates given in the following table, first determine the new price of a football ticket, assuming it rises at the rate of

inflation. Then enter the corresponding purchasing power of Dalia's deposit after one year in the first row of the table for each inflation rate. Finally,

enter the value for the real interest rate at each of the given inflation rates.

Hint: Round your answers in the first row down to the nearest football ticket. For example, if you find that the deposit will cover 20.7 football tickets,

you would round the purchasing power down to 20 football tickets under the assumption that Dalia will not buy seven-tenths of a football ticket.

Annual Inflation Rate

0%

5%

10%

Number of Tickets Dalia Can Purchase after One Year

Real Interest Rate

210

5%

%

%

When the rate of inflation is greater than the interest rate on Dalia's deposit, the purchasing power of her deposit

course of the year.

over the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In 2019 and in 2020, consumers in Dexter purchased only books and pens. The prices and quantities for 2019 and 2020 are listed in the table. The reference base period for Dexter's CPI is 2019, and 2019 is also the year of the Consumer Expenditure Survey. What is the inflation rate in 2020? The inflation rate in 2020 is OA. 148.1 B. 2.1 C. 80.0 D. 48.1 percent. C Item Books Pens 2019 2020 Price Quantity Price Quantity $6 4 $5 8 $5 6 $10 5arrow_forwardSuppose you'll have an annual nominal income of $20,000 for each of the next three years, and the inflation rate is 5 percent per year. Hint: Present value = Future value = (1 + Growth in prices)* = Real value of next year's income = Next year's income ÷ (1+ Growth in prices) Instructions: Round your responses to the nearest whole dollar. a. Find the real value of your $20,000 salary for each of the next three years. Year 1: $ Year 2: $ Year 3: $ b. If you have a COLA in your contract, what is the real value of your salary for each year? Year 1: $ 19047 Year 2: $ 18144 Year 3: $ 17276arrow_forwardA price index for a basket of goods over four years was calculated to be: 2014 = 92, • 2015 =97, • 2016=100, • 2017=107. Calculate the inflation rate for each year so that you will enter: Blank #1 = Inflation Rate for 2015 Blank #2 = Inflation Rate for 2016 • Blank #3 = Inflation Rate for 2017 What is the base year in this scenario? • Blank #4 = Base year for this basket %3D Round to two decimal places Blank # 1 Blank # 2 Blank # 3 Blank # 4arrow_forward

- QUESTION 20 Table: The table below is for an imaginary economy of Orangeland where a typical consumer basket consists of 2 blankets and 10 coffees. Price of a Price of a Year Blanket Coffee 2017 $40 $3 2018 $45 $4 2019 $50 $5 Refer to Table. If the base year is 2018, then the economy's inflation rate in 2019 was O a. 15.38 percent. O b. 13.98 percent. Oc. 25.00 percent. O d. 20.00 percent.arrow_forward3. Consider the relative PPP. If Foreign country's inflation rate is 5% and E changes by 2%, how much in % is Home's inflation rate?arrow_forwardA generalization of the fisher effect that can be applied to other variables is the relationship between real price growth and nominal price growth if we know the inflation rate. We can express this relationship T, where g is the growth rate (real or nominal) and t is inflation rate. Use this as greal information for problems 10-12. gnomial - 10. Assume that data shows the nominal price of a new Nissan Maxima was $12,000 in 1992 and $15,000 in 2002, but you also found a reliable source that claimed real price growth for Maximas this claim about real price growth A) 16.5% B) 5% C) 10% D) 8.5% E) Not enough information to determine was closer to 8.5%. For experienced from 1992 to 2002? to be true, how much inflation was 11. Assume that the inflation rate is the level you found in 10. If the real price growth for a Mercedes- AMG was 10%, and the nominal price in 1992 was 2002? $42,000; what is the nominal price of the Mercedes in A) $50,000 B) $53,130 C) $56,750 D) $60,070 E) $77,000 12.…arrow_forward

- The reference base period is a period for which the is defined to equal Currently, the reference base period is 1982-1984. O A. inflation rate; 1 percent O B. PPI; 110 O C. interest rate; 1 percent O D. CPI; 100 Click to select your answer. DIarrow_forwardIn 2020 and in 2021, consumers in Dexter consumed only books and pens. The prices and quantities for 2020 and 2021 are listed in the table. The reference base period for Dexter's CPI is 2020, and 2020 is also the year of the Consumer Expenditure Survey. Calculate the inflation rate in 2021. The inflation rate in 2021 is A. 121.7 B. 73.0 C. 21.7 D. 4.6 percent. ID Item Books Pens 2020 2021 Price Quantity Price Quantity 10 $5 7 $4 $5 5 8 $9arrow_forwardIn detail, explain what is happening in this graph for Inflation rate based on CPIarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education