Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

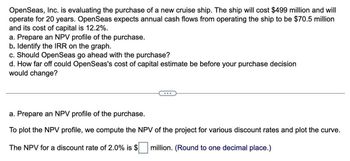

Transcribed Image Text:OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship will cost $499 million and will

operate for 20 years. Open Seas expects annual cash flows from operating the ship to be $70.5 million

and its cost of capital is 12.2%.

a. Prepare an NPV profile of the purchase.

b. Identify the IRR on the graph.

c. Should OpenSeas go ahead with the purchase?

d. How far off could OpenSeas's cost of capital estimate be before your purchase decision

would change?

a. Prepare an NPV profile of the purchase.

To plot the NPV profile, we compute the NPV of the project for various discount rates and plot the curve.

The NPV for a discount rate of 2.0% is $

million. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Strange Manufacturing Company is purchasing a production facility at a cost of $12 million. The company expects the project to generate annual cash flows of $6.4 million over the next 5 years. Its cost of capital is 6.7 per cent. What is the net present value of this project? Round your answer to 2 decimal places. E.g. if the final value is $12345.8342, please type 12345.83 in the answer box (do not type the dollar sign).arrow_forwardLakeCraft is considering investing in a transport ship with an expected life of 10 years that costs $60 million and will produce net cash flows of $7 million per year, LakeCraft's cost of capital is 5%. Enter your answers rounded to 2 DECIMAL PLACES. What is the payback period? Number What is the net present value (NPV) of the project? Number million (Enter your answer in millions of dollars)arrow_forwardCompute the net present value of this investment.arrow_forward

- Suppose Francine Dunkleberg's Sweets is considering investing in warehouse management software that costs $450,000, has $35,000 residual value, and should lead to cost savings of $130,000 per year for its five-year life. In calculating the ROR, which of the following figures should be used as the equation's denominator (average amount invested in the asset)? a) $485,000 b) $242,500 c) $207500 d)$225000arrow_forwardCaspian Sea Drinks is considering buying the J - Mix 2000. It will allow them to make and sell more product. The machine cost $1.92 million and create incremental cash flows of $582, 193.00 each year for the next five years. The cost of capital is 9.20 %. What is the profitability index for the J - Mix 2000?arrow_forwardOpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship will cost $501 million and will operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $70.7 million and its cost of capital is 12.1%. a. Prepare an NPV profile of the purchase. b. Identify the IRR on the graph. c. Should OpenSeas go ahead with the purchase? d. How far off could OpenSeas's cost of capital estimate be before your purchase decision would change?arrow_forward

- aaarrow_forwardVijayarrow_forwardOpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship will cost $499 million and will operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $69.6 million and its cost of capital is 12.0%. a. Prepare an NPV profile of the purchase. b. Identify the IRR on the graph. c. Should OpenSeas go ahead with the purchase? d. How far off could OpenSeas's cost of capital estimate be before your purchase decision would change? ...arrow_forward

- Halloween, Incorporated, is considering a new product launch. The firm expects to have an annual operating cash flow of $9.2 million for the next 8 years. The discount rate for this project is 13 percent for new product launches. The initial investment is $39.2 million. Assume that the project has no salvage value at the end of its economic life. a. What is the NPV of the new product? (Do not round intermediate calculations and After the first year, the project can be dismantled and sold for $26.2 million. If the estimates of remaining cash flows are revised based on the first year’s experience, at what level of expected cash flows does it make sense to abandon the project?arrow_forwardA company is developing a special vehicle for Arctic exploration. The development requires an initial investment of $80,000 and investments of $50,000 and $40,000 for the next two years, respectively. Net returns beginning in Year 4 are expected to be $41,000 per year for 10 years. If the company requires a rate of return of 13%, compute the net present value of the project and determine whether the company should undertake the project. The net present value of the project is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardOpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship will cost $501 million and will operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $70.7 million and its cost of capital is 12.0%. a. Prepare an NPV profile of the purchase. b. Identify the IRR on the graph. c. Should OpenSeas go ahead with the purchase? d. How far off could OpenSeas's cost of capital estimate be before your purchase decision would change? SITTE a. Prepare an NPV profile of the purchase. To plot the NPV profile, we compute the NPV of the project for various discount rates and plot the curve. The NPV for a discount rate of 2.0% is $ million. (Round to one decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education