FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

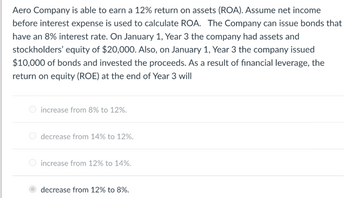

Transcribed Image Text:Aero Company is able to earn a 12% return on assets (ROA). Assume net income

before interest expense is used to calculate ROA. The Company can issue bonds that

have an 8% interest rate. On January 1, Year 3 the company had assets and

stockholders' equity of $20,000. Also, on January 1, Year 3 the company issued

$10,000 of bonds and invested the proceeds. As a result of financial leverage, the

return on equity (ROE) at the end of Year 3 will

increase from 8% to 12%.

decrease from 14% to 12%.

increase from 12% to 14%.

decrease from 12% to 8%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the first day of it's fiscal year, Ebert Co. issued $11,000,000 of 10-year, 7% bonds to finance it's operations. Interest is payable semiannually. The bonds were issued at a market interest rate of 9%, resulting in Ebert receiving cash of $9,569,097. The company uses the interest method. What is the first interest payment on June 30, and second interest payment on Dec. 31 including amortization of discount?arrow_forwardGodoarrow_forwardSelected debt investment transactions for Easy A Inc., a retail business, are listed below. Easy A Inc. has a fiscal year ending on December 31. Year 1: Feb. 1 May 1 Jun. 1 Sept. 1 Oct. 1 Dec. 1 Dec. 31 Year 2: Mar. 1 Jun. 1 Sept. 1 Bought $35,000 of 6%, XYZ Co. 12-year bonds at their face amount plus accrued interest of $700. The bonds pay interest semiannually on June 1 and December 1. Bought $200,000 of Simple Tree 5%, 20-year bonds at their face amount plus accrued interest of $2,500. The bonds pay interest semiannually on March 1 and September 1. Received semiannual interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Sold $15,000 of Simple Tree bonds at 102% plus accrued interest of $63. Received semiannual interest on the XYZ Co. bonds. Accrued $3,135 interest on the Simple Tree bonds. Accrued $175 interest on the XYZ Co. bonds. Received semiannual interest on the Simple Tree bonds. Received semiannual interest on the XYZ Co. bonds. Received…arrow_forward

- Luke Corp. issued $2,000,000 of 20-year, 9% callable bonds on July 1, Year 1, with interest payable on June 30 and December 31. The fiscal year of the company is the calendar year. What is the entry to record the payment of interest on December 31 in the year the bonds were issued? a. Interest Expense Cash Ob. Interest Payable Interest Expense Cash Oc. Interest Expense Cash d. Cash Interest Expense 90,000 90,000 90,000 180,000 90,000 90,000 180,000 180,000 90,000arrow_forwardO’Halloran Inc. produces and sells outdoor equipment. On July 1, Year 1, O’Halloran Inc. issued $32,000,000 of six-year, 8% bonds at a market (effective) interest rate of 7%, receiving cash of $33,546,022. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, Year 1.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. b. The interest payment on June 30, Year 2, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. 3. Determine the total interest expense for Year 1. 4. Will the bond proceeds always be greater than the face amount of the bonds when the contract rate is…arrow_forwardin ESPAÑOL INGLÉS FRANCÉS Under what conditions is the current portion of long-term debt reported as current debt? to. If it is to be paid with the issuance of a 36-month note payable. b. If it is going to be paid with working capital. С. If it is going to be paid with the issuance of Bonds Payable. d. If you are going to pay with common shares of the company. Enviar comentarios MacBook Air DII DDarrow_forward

- During two consecutive years, Antlers Company, Inc., completed the following transactions: Year 1 June 1 Issued $750,000 face value, 20-year, 12 percent bonds, dated June 1 of this year, at 103. Interest is payable semiannually on December 1 and June 1. Dec. 1 Paid semiannual interest on the bonds. 31 Recorded an adjusting entry for accrued interest payable. 31 Recorded an adjusting entry for amortization of premium on bonds. 31 Closed the Interest Expense account. Year 2 Jan. 1 Reversed the adjusting entry for accrued interest payable. June 1 Paid semiannual interest on the bonds. Dec. 1 Paid semiannual interest on the bonds. June 31 Recorded an adjusting entry for accrued interest payable. 31 Recorded an adjusting entry for amortization of premium on bonds. 31 Closed the Interest Expense account. Can I get some help for the second year?arrow_forwardPrepare journal entries to record the following transactions involving short-term debt investments.arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forward

- On the first day of the fiscal year, a company issues a $584,000, 11%, 10-year bond that pays semiannual interest of $32,120 ($584,000 x 11% x 1/2), receiving cash of $613,200. Journalize the entry to record the first interest payment and amortization of premium using the straight-line method. If an amount box does not require an entry, leave it blank. Interest Expense Premium on Bonds Payable Casharrow_forwardOn the first day of the fiscal year, a company issues a $621,000, 11%, 10-year bond that pays semiannual interest of $34,155 ($621,000 × 11% × 1/2), receiving cash of $652,050. Required: Journalize the entry to record the first interest payment and amortization of premium using the straight-line method. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Merchandise Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds…arrow_forwardOn the first day the fiscal year, a company issue a $437,000, 7%, 10years bond that pays semiannual interest of $15,295 ($437,000 x 7% x 1/2), receiving cash of $458,900. Journalize the entry for the first interest payment and amortization of premium using the straight-in line method. If an amount box does not require an entry, leave in blank. ____________ _____ _______ _____________ ______ ________arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education