Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

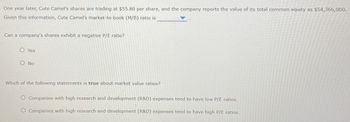

Transcribed Image Text:One year later, Cute Camel's shares are trading at $55.80 per share, and the company reports the value of its total common equity as $54,366,000.

Given this information, Cute Camel's market-to-book (M/B) ratio is

Can a company's shares exhibit a negative P/E ratio?

O Yes

O No

Which of the following statements is true about market value ratios?

O Companies with high research and development (R&D) expenses tend to have low P/E ratios.

O Companies with high research and development (R&D) expenses tend to have high P/E ratios.

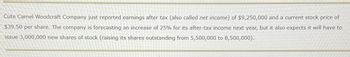

Transcribed Image Text:Cute Camel Woodcraft Company just reported earnings after tax (also called net income) of $9,250,000 and a current stock price of

$39.50 per share. The company is forecasting an increase of 25% for its after-tax income next year, but it also expects it will have to

issue 3,000,000 new shares of stock (raising its shares outstanding from 5,500,000 to 8,500,000).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company has revenues of 24 million and depreciation and amortization expenses of 9 million. Operating margin is 42%, net margin is 7%, and gross margin is 57%. It has 19 million of debt, 6 million in cash, and 11 million shares outstanding. Comparable companies are trading at An average EV/EBITDA multiple of 12. How much are this company's shares worth using relative valuation? Round to one decimal place.arrow_forwardSuppose Compco Systems pays no dividends but spent $5.15 billion on share repurchases last year. If Compco's equity cost of capital is 12.3%, and if the amount spent on repurchases is expected to grow by 8.9% per year, estimate Compco's market capitalization. If Compco has 5.9 billion shares outstanding, to what stock price does this correspond?arrow_forwardKalil, Inc. (a for-profit college), has the following data: average stock return (market rate of return) is 7%; market risk premium is 5%. and b = 0. What is the firm's cost of equity (k) from retained earnings based on the CAPM? 12arrow_forward

- S Suppose Wacken, Limited just issued a dividend of $2.61 per share on its common stock. The company paid dividends of $2.11, $2.18, $2.35, and $2.45 per share in the last four years. If the stock currently sells for $80, what is your best estimate of the company's cost of equity capital using arithmetic and geometric growth rates? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Cost of equity using arithmetic growth rate Cost of equity using geometric growth rate % %arrow_forward7. Determine the P/E ratio of the company ZYX if you know that the number of company's outstanding shares is 18,000,000. The current market price of the company corresponds to 588.5 per share. The company's intrinsic value is 654 per share. The expected return for investors is 8.7 %. The dividend amounts to 62.4. The EBIT in the given year corresponded to the amount of 481,530,000. a. 24.4 b. 26.6 c. 22 d. 19.7 e. 25 8. Consider the spot rate of 24.36 CZC/EUR. If we assume a payment for goods of 5.000 EUR in two months and the spot rate at that time will be 24.95 CZC/EUR. For hedging purposes, it is possible to arrange a forward on the exchange rate with a fixation of 24.7 CZC/EUR. If the company were to import goods. closing a forward would mean a profit/loss in the amount of: a. 1.250 EUR gain b. 1,700 CZC loss c. 2,950 EUR gain d. 1,250 CZC gain e. 1,250 CZC lossarrow_forwardViewPoints Security's financial statements, which were constructed a few days ago, report the companys has $1 million of common equity with 500,000 shares of common stock outstanding and its net income was $2.1 million. If ViewPoint's common stock currently sells for $33.60 per sahre, what are (a) P/E ratio and (b) M/B ratio?arrow_forward

- Hank Corp.'s common stock currently sells for $53 per share. The most recent dividend (Do) was $2.48, and the expected growth rate in dividends per year is 7%. The cost of common equity, Re, is ____%. Round your final answer to 2 decimal places (example: enter 12.34 for 12.34%), but do not round any intermediate work in the process.arrow_forwardNeed the answer of the following questionarrow_forwardOne year ago, Barkley's stock sold for $28 a share. During last year, Barkley's paid $1.23 per share in dividends and saw its stock price increase by 7 percent for the year. Today, the firm announced that it will pay $1.30 per share in dividends this year. What do you know with certainty about the performance of Barkley's stock for this year? Multiple Choice The capital gains yield will be positive. The dividend yield for this year will be lower than it was last year. The total rate of return will be lower this year than it was last year. The total rate of return will be higher this year than it was last year. The dividend yield for this year will be higher than it was last year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education