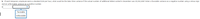

One of the operations in the Wonderland Post Office is a mechanical mail sorting operation. In this operation, letter mail is sorted at a rate of one letter per second. The letter is mechanically sorted from a three-digit code input by an operator sitting at a keyboard. The manager of the mechanical sorting operation wants to determine the number of temporary employees to hire for December. The manager estimates that there will be an additional 23,850,000 pieces of mail in December, due to the upcoming holiday season.

Assume that the sorting operators are temporary employees. The union contract requires that temporary employees be hired for one month at a time. Each temporary employee is hired to work 125 hours in the month.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- In a typical 5-day period, the operations team programs a machine to work for 94 hours. Changeovers and set-ups take 4 hours and breakdowns average 2.3 hours each week. Waiting for materials to be delivered constitutes three hours in which the machine is not working. The machine also has 2 hours a week without any work scheduled. When the machine is running, it averages 87% rated speed. After production, 1.8% of the parts processed are found to be defective. What is the OEE to 2d.p.arrow_forwardA. Compute the total targeted production of the finished product for the coming year. B. Compute the required amount of plastic to be purchased for the coming year.arrow_forwardThe administrator of Scotland Yard would like a cost formula linking the costs involved in processing law offenders to the number of offenders processed during a month. The processing costs and the number of offenders for the preceding twelve months are given in the following table: Month Number of Offenders Processing Costs August 200 182,700 September 440 410,600 October 420 391,000 November 450 437,100 December 510 434,000 January 380 395,950 February 610 801,800 March 330 367,150 April 260 220,500 May 370 404,250 June 320 362,400 July 380 323,950 The administrator has estimated that the institution's relevant range of monthly activity in the future will be 260 to 520 offenders. Required:1. Use the high-low method to express the cost function for processing costs. The cost function needs to be able to reasonably predict future monthly costs for Scotland Yard.2. Explain whether you will use this cost function to predict the processing costs for 600…arrow_forward

- Adams Air is a large airline company that pays a customer relations representative $16,425 per month. The representative, who processed 1,100 customer complaints in January and 1,360 complaints in February, is expected to process 21,900 customer complaints during the year. Required Determine the total cost of processing customer complaints in January and in February.arrow_forwardSanchez Trucking has been experiencing delays at its warehouse operations. Management hired a consultant to find out why service deliveries to local businesses have taken longer than they should. The consultant narrowed down the problem to the number of work crews loading and unloading trucks. Each crew consists of 7 employees who work as a team on a variety of tasks; each employee works a full 40 hours a week. However, costs are also a concern. The consultant advised management that they could supplement work crews with short-term employees, at a higher cost, to cover unexpected needs on a weekly basis. Each work crew permanently hired by Sanchez costs $3,500 per week in wages and benefits, while a crew of short-term employees costs $6,000 per week. Complicating the decision is the fact that the weekly hourly requirements for work crews is uncertain because of the volatility in the number of deliveries to be made. Deliberating with management, the consultant arrived at the following…arrow_forwardSifton Electronics Corporation manufactures and assembles electronic motor drives for video cameras. The company assemble. the motor drives for several accounts. The process consists of a lean cell for each customer. The following information relates t only one customer's lean cell for the coming year. For the year, projected labor and overhead was $3,120,000 and materials costs were $31 per unit. Planned production included 5,120 hours to produce 16,000 motor drives. Actual production for August was 1,870 units, and motor drives shipped amounted to 1,480 units. Conversion costs are applied based on units of production From the foregoing information, determine the cell conversion cost rate. a. $2,108.11 b. $195.00 c. $1,668.45 d. $609.38arrow_forward

- Gibson Corporation estimated its overhead costs would be $23,600 per month except for January when it pays the $135,240 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $158,840 ($135,240+ $23,600). The company expected to use 7,500 direct labor hours per month except during July, August, and September when the company expected 9,200 hours of direct labor each month to build inventories for high demand that normally occurs during the Christmas season. The company's actual direct labor hours were the same as the estimated hours. The company made 3,750 units of product in each month except July, August, and September, in which it produced 4,600 units each month. Direct labor costs were $23.40 per unit, and direct materials costs were $11.40 per unit. Required a. Calculate a predetermined overhead rate based on direct labor hours. b. Determine the total allocated overhead cost for January, March, and August c. Determine…arrow_forwardRooney Corporation estimated its overhead costs would be $23,200 per month except for January when it pays the $165,960 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $189,160 ($165,960 + $23,200). The company expected to use 7,600 direct labor hours per month except during July, August, and September when the company expected 9,400 hours of direct labor each month to build inventories for high demand that normally occurs during the Christmas season. The company’s actual direct labor hours were the same as the estimated hours. The company made 3,800 units of product in each month except July, August, and September, in which it produced 4,700 units each month. Direct labor costs were $23.10 per unit, and direct materials costs were $10.20 per unit. Required Calculate a predetermined overhead rate based on direct labor hours. Determine the total allocated overhead cost for January, March, and August. Determine the…arrow_forwardPeter Ltd makes 3 products that must be offered for sale each month to complete market service. The products are fragile and deteriorate quickly shortly after production. They are produced on two types of machines and worked on a single grade of direct labour. 50 direct employees are paid $8 per hour for a guaranteed minimum of 160 hrs per month. All the products are first pasteurised on a machine A and then finished and sealed on a Machine type B The machine hours required for each of the products are as follows: Soya (hrs per unit) Milco (hrs per unit) Yoghurt (hrs per unit) Machine Type A 1.5 4.5 3 Machine Type B 1.0 2.5 2 The capacity of the available machines type A and B are 6000 hours and 5000 hours per month respectively. The selling prices, unit costs and monthly demand for the 3 products are as follows: Soya ($per unit) Milco( $ per unit) Yogurt ($ per unit) Selling price 910 1740 1400 Concentrate cost 220 190 160 Other direct materials 230 110…arrow_forward

- The Kaumajet Factory produces two products-table lamps and desk lamps. It has two separate departments-Finishing and Production. The overhead budget for the Finishing Department is $550,000, using 500,000 direct labor hours. The overhead budget for the Production Department is $400,000 using 80,000 direct labor hours. If the budget estimates that a table lamp will require 2 hours of finishing and 1 hour of production, how much factory overhead will the Kaumajet Factory allocate to each table lamp using the multiple production department factory overhead rate method with an allocation base of direct labor hours? O $5.00 OS7.00 511.10 S7.20arrow_forwardTarnish Industries produces miniature models of farm equipment. These collectibles are in great demand. It takes two operations, molding and finishing, to complete the miniatures. Next year's expected activities are shown in the following table: Molding Finishing Direct labor hours 75,000 DLH 160,500 DLH Machine hours 98,000 MH 81,500 MH Tarnish Industries uses departmental overhead rates and is planning on a $1.80 per direct labor hour overhead rate for the Finishing department. Compute the budgeted manufacturing overhead cost for the Finishing department given the information shown in the table.arrow_forwardA telephone call center uses two customer service representatives (CSRs) during the 8:30 a.m. to 9:00 a.m. time period. The standard service rate is 3.0 minutes per telephone call per CSR. Assuming a target labor utilization rate of 70 percent, how many calls can these two CSRs handle during this half-hour period? Round your answer to the nearest whole number. callsarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education