FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

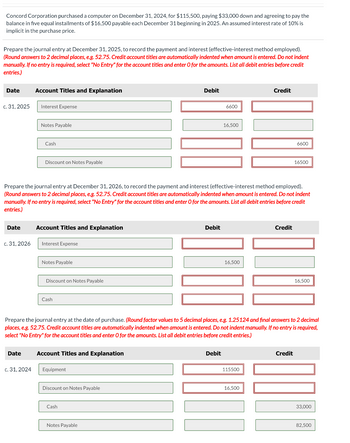

Transcribed Image Text:Concord Corporation purchased a computer on December 31, 2024, for $115,500, paying $33,000 down and agreeing to pay the

balance in five equal installments of $16,500 payable each December 31 beginning in 2025. An assumed interest rate of 10% is

implicit in the purchase price.

Prepare the journal entry at December 31, 2025, to record the payment and interest (effective-interest method employed).

(Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit

entries.)

Date

Account Titles and Explanation

c. 31, 2025

Interest Expense

Notes Payable

Cash

Discount on Notes Payable

Debit

6600

16,500

Credit

6600

16500

Prepare the journal entry at December 31, 2026, to record the payment and interest (effective-interest method employed).

(Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit

entries.)

Date

Account Titles and Explanation

c. 31, 2026

Interest Expense

Notes Payable

Discount on Notes Payable

Cash

Debit

16,500

Credit

16,500

Prepare the journal entry at the date of purchase. (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal

places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required,

select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Date

Account Titles and Explanation

c. 31, 2024

Equipment

Discount on Notes Payable

Cash

Notes Payable

Debit

115500

16,500

Credit

33,000

82,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Straight Industries purchased a large piece of equipment from Curvy Company on January 1, 2019. Straight Industries signed a note, agreeing to pay Curvy Company $370,000 for the equipment on December 31, 2019. The market rate of interest for similar notes was 10%. The present value of $370.000 discounted at 10% for four years was $252,715. On January 1, 2019, Straight Industries recorded the purchase with a debit to equipment for $252,715 and a credit to notes payable for $252,715. On Straight Industries' balance sheet for the year ended December 31, 2019, the book value of the liability for notes payable, including accrued interest would be closest to: Multiple Cholce $277,987. $289.715. $285,208. $287.408.arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.7 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 24%. Required: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?arrow_forwardMurphy Company purchased a new machine for $120,000 on December 31, 2020. They obtained a loan at the bank to finance the purchase. The terms of the loan were: 5 years, 5% interest, annual payments of principal and interest on December 31 of each year. a. Using the table provided, calculate the annual payment on the loan. b. Record the purchase of the new machine on December 31, 2020. c. Record the loan payment on December 31, 2021. d. Record the loan payment on December 31, 2022. d. Calculate the loan balance for December 31, 2022 after the payment. a. Using the table below, calculate the annual payment on the loan. Loan Amount…arrow_forward

- 2.) Anxious Company acquired two items of machinery as follows: On December 31, 2019, Anxious company purchased a machine in exchange for a noninterest bearing note requiring 10 payments of P500,000. The first payment was made on December 31, 2020, and the others are due annually on December 31. The prevailing rate of interest for this type of note at date of issuance was 12%. The present value of ordinary annuity of I at 12% is 5.33 for the nine periods and 5.65 for ten periods. • On December 31, 2020, Anxious Company acquired use of machinery by issuing the seller a two year noninterest bearing note for P3,000,000. In recent borrowing, Anxious Company has paid a 12% interest for this type of note. The present value of 1 at 12% for two years is .80 and the present value of an ordinary annuity of 1 at 12% for two years is 1.69. Required: Prepare all journal entries for 2019, 2020, and 2021.arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $24.8 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%. Required: 1. & 2. Prepare the journal entries for LCD's purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024?arrow_forwardVaughn Cosmetics Co. purchased machinery on December 31, 2024, paying $54,400.00 down and agreeing to pay the balance in four equal installments of $53,600.00 payable each December 31. An assumed interest of 10% is implicit in the purchase price. Click here to view factor tables. Prepare the journal entries that would be recorded for the purchase and for (1) the payments and (2) interest on the following dates. (Round present value factor to 5 decimal places, e.g. 1.23465 and final answers to 2 decimal places, e.g. 38,548.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) (a) (b) (c) (d) (e) December 31, 2024. December 31, 2025. December 31, 2026. December 31, 2027. December 31, 2028.arrow_forward

- Crane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $47,300. Click here to view the factor table What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should receive $arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2021. In payment for the $24 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%.Required:1. Prepare the journal entry for LCD’s purchase of the components on November 1, 2021.2. Prepare the journal entry for the first installment payment on November 30, 2021.3. What is the amount of interest expense that LCD will report in its income statement for the year endedDecember 31, 2021?arrow_forwardSabonis Cosmetics Co. purchased machinery on December 31, 2018, paying $50,000 down and agreeing to pay the balance in four equal installments of $40,000 payable each December 31. An assumed interest of 8% is implicit in the purchase price. Instructions Prepare the journal entries that would be recorded for the purchase and for the payments and interest on the following dates. a. December 31, 2018. b. December 31, 2019. c. December 31, 2020. d. December 31, 2021. e. December 31, 2022.arrow_forward

- American Food Services, Inc., acquired a packaging machine from Barton and Barton Corporation. Barton and Barton completed construction of the machine on January 1, 2021. In payment for the $4 million machine, American Food Services issued a four-year installment note to be paid in four equal payments at the end of each year. The payments include interest at the rate of 10%.Required:1. Prepare the journal entry for American Food Services’ purchase of the machine on January 1, 2021.2. Prepare an amortization schedule for the four-year term of the installment note.3. Prepare the journal entry for the first installment payment on December 31, 2021.4. Prepare the journal entry for the third installment payment on December 31, 2023.arrow_forwardTamarisk Corporation purchased a computer on December 31, 2024, for $138,600, paying $39,600 down and agreeing to pay the balance in five equal installments of $19,800 payable each December 31 beginning in 2025. An assumed interest rate of 9% is implicit in the purchase price. (a) Your answer is partially correct. Prepare the journal entry at the date of purchase. (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date :. 31, 2024 Account Titles and Explanation Equipment Discount on Notes Payable Notes Payable Cash Debit 116615.00 21985.00 Credit 0 99000 39600arrow_forward(Purchase of Computer with Zero-Interest-Bearing Debt) Cardinals Corporation purchased a computer on December 31, 2016, for $105,000, paying $30,000 down and agreeing to pay the balance in five equal installments of $15,000 payable each December 31 beginning in 2017. An assumed interest rate of 10% is implicit in the purchase price.Instructions(Round to two decimal places.)(a) Prepare the journal entry(ies) at the date of purchase.(b) Prepare the journal entry(ies) at December 31, 2017, to record the payment and interest (effective-interest method employed).(c) Prepare the journal entry(ies) at December 31, 2018, to record the payment and interest (effective-interest method employed).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education