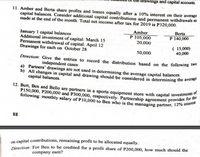

11. Amber and Berta share profits and losses equally after a 10% interest on their average capital balances. Consider additional capital contributions and permanent withdrawals as made at the end of the month. Total net income after tax for 2019 is P320,000.

(see attached image, kindly answer it based on your knowledge, thank you!)

Direction: Give the entries to record the distribution based on the following two independent cases:

a) Partner's drawings are not used in determining the average capital balances

b) All changes in capital and drawing should be considered in determining the average capital balances.

17. Beth, Luz and Ana divide

a) Net income earned was P480,000 and bonus is based on net income before salaries and bonus.

b) Net income earned was P480,000 and bonus is based on net income after salaries and bonus.

c) Net loss for the year was P480,000 and bonus based on net income before salaries and bonus.

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

- 1. Annual salary allowance to Gonzalez of $25,000. 2. Interest of 5% on each partner's capital balance on January 1. 3. Any remaining net income divided to Gonzalez and Van Home, 2:1. Gonzalez and Van Horne had $126,000 and $189,000, respectively, in their January 1 capital balances. Net income for the year was $115,000. Required: How much net income should be distributed to Gonzalez and Van Horne? Gonzalez: Van Horne: Sarrow_forwardExposing this to me step by step how I you got 5850arrow_forwardRequired information [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $80,000, $112,000, and $128,000, respectively, in a partnership. During its first calendar year, the firm earned $249,000. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $249,000 net income under each of the following separate assumptions. 2. The partners agreed to share income and loss in the ratio of their beginning capital investments. Complete this question by entering your answers in the tabs below. Appropriation of profits Allocate $249,000 net income in the ratio of their beginning capital investments. Note: Do not round intermediate calculations. Supporting Computations General Journal Ries Bax Thomas Percentage of Total Equity X Income Summary Allocated Income to Capitalarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education