FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

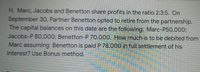

Transcribed Image Text:H. Marc, Jacobs and Benetton share profits in the ratio 2:3:5. On

September 30O, Partner Benetton opted to retire from the partnership.

The capital balances on this date are the following: Marc-P50,000;

Jacobs-P 80,000; Benetton-P 70,000. How much

Marc assuming Benetton is paid P 78,000 in full settlement of his

interest? Use Bonus method.

to be debited from

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Memanarrow_forwardOn December 31, 2015, partners Barry, Manny and Lou shares profits and losses by 30:50:20.Before the retirement of partner Barry, the partners have interest amounting to: Barry- 35,100,Manny- 56,500 and Lou- 21,400.Final settlement to Barry is amounted to 30,900. How much is the capital balance of Lou afterretirement?arrow_forwardThe E.N.D. partnership has the following capital balances as of the end of the current year: Pineda $ 270,000 Adams 240,000 Fergie 230,000 Gomez 220,000 Total capital $ 960,000 Answer each of the following independent questions: Assume that the partners share profits and losses 3:3:2:2, respectively. Fergie retires and is paid $269,000 based on the terms of the original partnership agreement. If the goodwill method is used, what is the capital balance of the remaining three partners? Assume that the partners share profits and losses 4:3:2:1, respectively. Pineda retires and is paid $355,000 based on the terms of the original partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round your intermediate calculations. Round your final answers to the nearest dollar amounts.)arrow_forward

- The E.N.D. partnership has the following capital balances as of the end of the current year: Pineda 160,000 Adams 140,000 Fergie 130,000 Gomez 120,000 Answer each A. Assume that the partners and losses 3:3:2:2,respectively. Fergie retires and is paid 151,000 based on the terms of the orginal partnership agreement. If the Goodwill method is used;what is the capital of the remaining three partners? B. Assume that the partners share profit and losses 4:3:2:1, respectively. Peneda retires and is paid 305,000 based on the terms of the orginal partnership agreement. If the bonus method is used, what is the capital balance of the remaining three partners? (Do not round intermediate calculations. Round to the nearest amounts. A. Pineda capital Balance__________ Adams capital Balance__________ Gomez capital Balance__________ B. Pineda capital Balance__________ Adams capital Balance__________ Gomez capital Balance__________arrow_forwardMyles Etter and Crystal Santori are partners who share in the income equally and have capital balances of $199,800 and $62,680, respectively. Etter, with the consent of Santori, sells one-third of his interest to Lonnie Davis. Assume the sale occurs on December 31. What entry is required by the partnership if the sales price is (a) $66,600? (b) $87,700?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education