FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

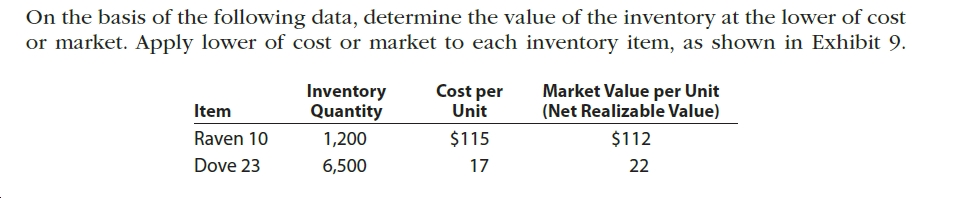

Transcribed Image Text:On the basis of the following data, determine the value of the inventory at the lower of cost

or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.

Cost per

Unit

Market Value per Unit

(Net Realizable Value)

Inventory

Quantity

Item

Raven 10

$115

$112

1,200

Dove 23

6,500

17

22

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Determine the unit value that should be used for inventory costing following "lower-of-cost-or-market value". (Round answers to 2 decimal places, e.g. 52.75.) A B C D E F Cost $2.80 $2.44 $2.80 $2.62 $2.44 $2.44 Replacement cost 2.25 3.00 2.25 2.60 2.37 2.46 Net realizable value 2.95 2.95 2.95 2.41 2.50 2.50 Net realizable value less normal profit 2.70 2.75 2.85 2.25 2.30 2.30 Case A $ Case B $ Case C $ Case D Case E $ Case F $arrow_forwardLower-of-Cost-or-Market Inventory On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. InventoryItem InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) Birch 24 $156 $151 Cypress 13 156 165 Mountain Ash 17 266 284 Spruce 25 115 139 Willow 9 193 169 Inventory at the Lower of Cost or Market Inventory Item Total Cost Total Market Total LCM Birch $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Cypress fill in the blank 4 fill in the blank 5 fill in the blank 6 Mountain Ash fill in the blank 7 fill in the blank 8 fill in the blank 9 Spruce fill in the blank 10 fill in the blank 11 fill in the blank 12 Willow fill in the blank 13 fill in the blank 14 fill in the blank 15 Total $fill in the blank 16 $fill in the blank 17 $fill in the blank 18arrow_forwardApplying the lower-of-cost-or-market method to each item of inventory, what should the total inventory value be for the following items? Total Cost Total Market Inventory Item Quantity Cost per Unit Market Value Total per Unit Price Price LCM A 181 $12 $17 $2,172 $3,077 $ B 91 18 16 1,638 1,456 C 70 10 22 25 1,540 1,750 Previous Nextarrow_forward

- James's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Cost per Unit $100 Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 During 2025, the company had the following purchases and sales. 10,000 5,000 250 22,500 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exh Inventory Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) Birch 28 $82 $68 Cypress 8 137 128 Mountain Ash 48 106 102 Spruce 10 135 155 Willow 18 80 93 Inventory at the Lower of Cost or Market Inventory Item Total Cost Total Market Total Lower of C or M Birch Cypress Mountain Ash Spruce Willow Totalarrow_forwardOn the basis of the data shown below: Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) МX62 80 $42 $40 05T4 155 20 23 Determine the value of the inventory at the lower of cost or market by applying lower of cost or market to each inventory item, as shown in Exhibit 9. $ 6,925 xarrow_forward

- The following information is taken from a company’s records. Costper Unit Market valueper Unit Inventory Item 1 (10 units) $39 $38 Inventory Item 2 (22 units) 19 19 Inventory Item 3 (12 units) 9 11 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory? $fill in the blank 1arrow_forwardGlasgow Corporation has the following inventory transactions during the year. Unit Number of Units 53 133 Cost $ 45 47 Total Cost $ 2,385 6,251 10,150 5,763 Date Transaction Jan. 1 Beginning inventory Purchase Purchase Purchase Apr. 7 Jul.16 203 50 Oct. 6 113 51 502 $24,549 For the entire year, the company sells 433 units of inventory for $63 each.arrow_forwardLower-of-cost-or-market method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Commodity InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) JFW1 53 $39 $34 SAW9 108 19 23 fill in the blank 1 of 1$arrow_forward

- Wildhorse Co. is a retailer operating in Calgary, Alberta. Wildhorse uses the perpetual inventory method. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Wildhorse for the month of January 2022. Date Description Quantity Unit Cost or Selling Price Dec. 31 Ending inventory 150 $ 20 Jan. 2 Purchase 100 21 Jan. 6 Sale 180 42 Jan. 9 Purchase 70 25 Jan. 10 Sale 60 42 Jan. 23 Purchase 112 26 Jan. 30 Sale 128 49arrow_forwardA v2.cengagenow.com Lower-of-Cost-or-Market Method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Market Value per Unit Item Inventory Quantity Cost per Unit (Net Realizable Value) JFW1 58 $29 $24 SAW9 119 15 20 Check My Work Previous Next All work saved. Save and Exit Submit Assignment for Grac %24arrow_forwardLower-of-cost-or-market method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Commodity InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) JFW1 78 $58 $55 SAW9 148 28 33arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education