FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

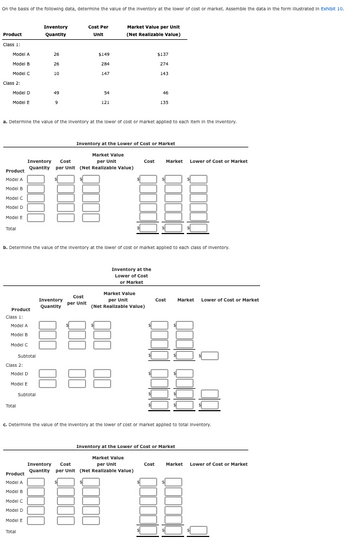

Transcribed Image Text:On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10.

Product

Class 1:

Model A

Model B

Model C

Class 2:

Model D

Model E

Product

Model A

Model B

Model C

Model D

Model E

Total

Product

Class 1:

Model A

Model B

Model C

Class 2:

Total

Subtotal

Model D

Model E

Inventory

Quantity

Total

26

a. Determine the value of the inventory at the lower of cost or market applied to each item in the Inventory.

Subtotal

Product

Model A

Model B

Model C

Model D

Model E

26

10

49

9

b. Determine the value of the inventory at the lower of cost or market applied to each class of inventory.

Cost Per

Unit

Inventory

Quantity

Inventory at the Lower of Cost or Market

Market Value

per Unit

Inventory Cost

Quantity per Unit (Net Realizable Value)

Cost

per Unit

$149

284

147

54

121

00000

Market Value per Unit

(Net Realizable Value)

88

38

00000

$137

274

143

46

Inventory at the

Lower of Cost

or Market

Market Value

per Unit

(Net Realizable Value)

135

Cost Market Lower of Cost or Market

c. Determine the value of the inventory at the lower of cost or market applied to total inventory.

Cost Market Lower of Cost or Market

Inventory at the Lower of Cost or Market

Market Value

Inventory Cost

per Unit

Quantity per Unit (Net Realizable Value)

Cost Market Lower of Cost or Market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 10. Product InventoryQuantity Cost PerUnit Market Value per Unit(Net Realizable Value) Class 1: Model A 16 $162 $169 Model B 32 190 198 Model C 34 152 148 Class 2: Model D 31 298 309 Model E 42 72 78 Question Content Area a. Determine the value of the inventory at the lower of cost or market applied to each item in the inventory. Inventory at the Lower of Cost or Market Product InventoryQuantity Costper Unit Market Valueper Unit(Net Realizable Value) Cost Market Lower of Cost or Market Model A fill in the blank 1b67cb01c017023_1 $fill in the blank 1b67cb01c017023_2 $fill in the blank 1b67cb01c017023_3 $fill in the blank 1b67cb01c017023_4 $fill in the blank 1b67cb01c017023_5 $fill in…arrow_forwardJames's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Cost per Unit $100 Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 During 2025, the company had the following purchases and sales. 10,000 5,000 250 22,500 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600arrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exh Inventory Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) Birch 28 $82 $68 Cypress 8 137 128 Mountain Ash 48 106 102 Spruce 10 135 155 Willow 18 80 93 Inventory at the Lower of Cost or Market Inventory Item Total Cost Total Market Total Lower of C or M Birch Cypress Mountain Ash Spruce Willow Totalarrow_forward

- On the basis of the data shown below: Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) МX62 80 $42 $40 05T4 155 20 23 Determine the value of the inventory at the lower of cost or market by applying lower of cost or market to each inventory item, as shown in Exhibit 9. $ 6,925 xarrow_forwardThe following information is taken from a company’s records. Costper Unit Market valueper Unit Inventory Item 1 (10 units) $39 $38 Inventory Item 2 (22 units) 19 19 Inventory Item 3 (12 units) 9 11 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory? $fill in the blank 1arrow_forwardGlasgow Corporation has the following inventory transactions during the year. Unit Number of Units 53 133 Cost $ 45 47 Total Cost $ 2,385 6,251 10,150 5,763 Date Transaction Jan. 1 Beginning inventory Purchase Purchase Purchase Apr. 7 Jul.16 203 50 Oct. 6 113 51 502 $24,549 For the entire year, the company sells 433 units of inventory for $63 each.arrow_forward

- Lower-of-cost-or-market method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Commodity InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) JFW1 53 $39 $34 SAW9 108 19 23 fill in the blank 1 of 1$arrow_forwardWildhorse Co. is a retailer operating in Calgary, Alberta. Wildhorse uses the perpetual inventory method. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Wildhorse for the month of January 2022. Date Description Quantity Unit Cost or Selling Price Dec. 31 Ending inventory 150 $ 20 Jan. 2 Purchase 100 21 Jan. 6 Sale 180 42 Jan. 9 Purchase 70 25 Jan. 10 Sale 60 42 Jan. 23 Purchase 112 26 Jan. 30 Sale 128 49arrow_forwardLower-of-cost-or-market method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Commodity InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) JFW1 78 $58 $55 SAW9 148 28 33arrow_forward

- Lower-of-Cost-or-Market Method On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Market Value per Unit Item Inventory Quantity Cost per Unit (Net Realizable Value) JFW1 150 $27 $31 SAW9 314 14 10 Feedbackarrow_forwardDetermine the ending inventory amount by applying the lower of cost or market value to a. Each inventory item of inventoryb. Total inventory The following data refer to Froning Company’s ending inventoryItem Code, Quantity, Unit Cost, Unit MarketLXC 60 $45 $48KMT 210 $38 $34MOR 300 $22 $20NES 100 $27 $32arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education