Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

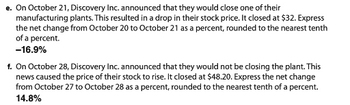

Transcribed Image Text:e. On October 21, Discovery Inc. announced that they would close one of their

manufacturing plants. This resulted in a drop in their stock price. It closed at $32. Express

the net change from October 20 to October 21 as a percent, rounded to the nearest tenth

of a percent.

-16.9%

f. On October 28, Discovery Inc. announced that they would not be closing the plant. This

news caused the price of their stock to rise. It closed at $48.20. Express the net change

from October 27 to October 28 as a percent, rounded to the nearest tenth of a percent.

14.8%

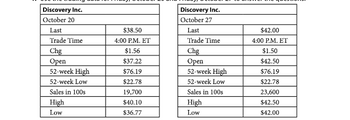

Transcribed Image Text:Discovery Inc.

October 20

Last

Trade Time

Chg

Open

52-week High

52-week Low

Sales in 100s

High

Low

$38.50

4:00 P.M. ET

$1.56

$37.22

$76.19

$22.78

19,700

$40.10

$36.77

Discovery Inc.

October 27

Last

Trade Time

Chg

Open

52-week High

52-week Low

Sales in 100s.

High

Low

$42.00

4:00 P.M. ET

$1.50

$42.50

$76.19

$22.78

23,600

$42.50

$42.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- This is not a writing assignment. I was asked by the last person answering my questions to break down the question in multiple questions, so I did. For each of the following scenarios, discuss whether profit opportunities exist from trading in the stock of the firm under the conditions that (2) the market is weak form but not semi-strong form efficient. The stock price has risen steadily each day for the past 30 days.b. The financial statements for a company were released three days ago, and you believe you’ve uncovered some anomalies in the company’s inventory and cost control reporting techniques that are causing the firm’s true liquidity strength to be understated.c. You observe that the senior management of a company has been buying a lot of the company’s stock on the open market over the past week. Use the following information for the next two questions: Technical analysis is a controversial investment practice. Technical analysis covers a wide array of techniques, which are…arrow_forwardOn Friday, August 28, 2020, the stock of Tesla Inc. closed at $2,217.99 per share. On the following Monday, the company split its stock 3-for-1, and the stock price traded for $741.42 per share. Were Tesla shareholders better off, worse off, or in the same position after the split compared with before? What return did they earn from Friday to Monday? The price of Tesla immediately after the split is predicted to be $(enter your response here) per share. What calculation should I use to figure out the answer?arrow_forwardComparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 600,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company’s common stock at the end of this year was $22. All of the company’s sales are on account. Weller CorporationComparative Balance Sheet(dollars in thousands) This Year Last Year Assets Current assets: Cash $ 1,230 $ 1,310 Accounts receivable, net 10,500 7,900 Inventory 12,500 12,200 Prepaid expenses 770 550 Total current assets 25,000 21,960 Property and equipment: Land 9,100 9,100 Buildings and equipment, net 49,348 37,336 Total property and equipment 58,448 46,436 Total assets $ 83,448 $ 68,396…arrow_forward

- Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 600,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company’s common stock at the end of this year was $20. All of the company’s sales are on account. Weller CorporationComparative Balance Sheet(dollars in thousands) This Year Last Year Assets Current assets: Cash $ 1,230 $ 1,350 Accounts receivable, net 10,900 6,900 Inventory 13,600 10,800 Prepaid expenses 670 620 Total current assets 26,400 19,670 Property and equipment: Land 9,200 9,200 Buildings and equipment, net 48,992 41,286 Total property and equipment 58,192 50,486 Total assets $ 84,592 $ 70,156…arrow_forwardAngela invested his savings in shares of a new company. The company's share price dropped by $3.25 at the end of the first year, and by a further $0.75 at the end of the second year. The share price was $28.44 at the end of the second year. a. Calculate the original share price (at the beginning of the first year). Round to the nearest cent. b. Calculate the percent change in the share price over the two-year period. % Round to two decimal places.arrow_forwardComparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 940,000 shares of common stock were outstanding. The interest rate on the bond payable was 12%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company’s common stock at the end of this year was $25. All of the company’s sales are on account. Weller CorporationComparative Balance Sheet(dollars in thousands) This Year Last Year Assets Current assets: Cash $ 5,304 $ 5,350 Accounts receivable, net 15,800 10,450 Inventory 10,400 8,760 Prepaid expenses 1,940 2,380 Total current assets 33,444 26,940 Property and equipment: Land 7,400 7,400 Buildings and equipment, net 20,600 20,400 Total property and equipment 28,000 27,800 Total assets $ 61,444 $ 54,740…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education