FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

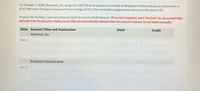

Transcribed Image Text:On October 1, 2020, Shamrock, Inc. assigns $1,160,700 of its accounts receivable to Bridgeport National Bank as collateral for a

$747,900 note. The bank assesses a finance charge of 3% of the receivables assigned and interest on the note of 9%.

Prepare the October 1 journal entries for both Shamrock and Bridgeport. (If no entry is required, select "No Entry" for the account titles

and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Shamrock, Inc.

Oct. 1

Bridgeport National Bank

Oct. 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Western Flyers received its bank statement for the month of July 2019 with an ending balance of $11,065.00 whereas the cash book balance for Western Flyers is $12875. Western Flyers determined that check #598 for $125.00 and check #601 for $375.00 were both outstanding. Also, a $7,500.00 deposit for July 30th was in transit as of the end of the month. Big Bucks Bank also collected an amount of $5,300 from a client of Western Flyer as payment of a note ($5,000) and interest ($300) earned on a note. Big Bucks Bank charged Flyers a $15.00 fee for the collection service and $20 for issuance of 10 check books. 5. A check for $75.00 from Colin Abraham, a client, was returned with the bank statement marked “NSF”.arrow_forwardOn December 1, 2020, RB Company assigned on a non-notification basis accounts receivable of Php6,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 31, 2020, the entity collected assigned accounts of Php2,000,000 less discount of Php200,000. The entity remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance. The entity accepted sales returns of Php100,000 on the assigned accounts and wrote off assigned accounts totaling Php300,000. What is the equity of the assignor in assigned accounts on December 31, 2020?arrow_forwardPlease show work. On July 1 of the current year, Rio Bravo factored receivables with a carrying value of $250,000 to a local bank. The transfer was made with a recourse of $3000. The bank assesses a finance charge of 3% of the amount of accounts receivable and retains an amount equal to 5% of the accounts receivable (for probable adjustments). The journal entry for this transaction will include which of the following? A. Debit to Recourse Liability of $3,000 B. Debit to Cash of $233,000. C. Debit to Due from Bank of $15,500. D. Debit to Loss on Sale of Receivables of $10,500. E. Mor than one of these.arrow_forward

- On May 10, 20X1, Washington Company received a 90-day, 8 percent, $8,400 interest-bearing note from Whitehead Company in settlement of Whitehead's past-due account. On June 30, Washington discounted this note at City Bank and Trust. The bank charged a discount rate of 13 percent. On August 8, Washington received a notice that Whitehead had paid the note and the interest on the due date. Required: Prepare the entries in general journal form to record these transactions. Analyze: If the company prepared a balance sheet on July 31, 20X1, how should Notes Receivable-Discounted be presented on the statement?arrow_forwardAt December 31 2019, according to the records of Graser Company, the balance of Cash account was $21,783. The October 31 bank statement showed a balance of $26,394. You are to prepare the bank reconciliation of Graser Company at December 31, using the following supplementary information: (iii) Service charge of $150 was charged wrongly to Graser's account by the bank. (iv) A note receivable for $15,000 left by Graser Company with bank for collection that had been collected and credited to company's account. Along with the note collection, interest of $150 was also collected. Interest was accrued and recorded in the month-end adjusting entries by Graser Company previously. (v) A check for $420 drawn by a customer, Stuart Sands, but deducted from Graser's account (i) The December 31 bank statement showed the following checks and deposits. Bank Statement by the bank and returned with the notation "NSF." (vi) Graser's account had a check issued in payment of Building, correctly written in…arrow_forwardMax Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forward

- Max Corp. sold goods for $36,000 on July 17, 2020, and accepted a 12%, 90-day note. On August 1, the note was sold to a bank at a 15% discount rate. Required: a. Compute the proceeds. Assume a 360-day year. $ b. If the maker dishonored the note at maturity, prepare the entry for Max Corp. assuming $75 of bank protest fees. If an amount box does not require an entry, leave it blank.arrow_forwardThe bookkeeper for Blossom Manufacturing Ltd. was trying to determine what items would be used in preparing the company's bank reconciliation that she is completing at May 31, 2021, the end of the company's first month of operations. The company's bank statement showed the following: Date May 1 3 5 15 19 21 25 25 27 28 31 BLOSSOM MANUFACTURING LTD. Bank Statement May 31 NSF fee Description Deposit Cheque, No. 001 Cheque, No. 002 Deposit Cheque, No. 004 Cheque, No. 006 Returned cheque-NSF, S. Gillis Cheque, No. 009 Cheque, No. 010 Bank service charges Amounts Deducted from Account (Debits) 1.648 7,277 8,457 1,016 1,377 31 2,173 2,005 43 Amounts Added to Account (Credits) 25,500 4,743 Balance 25,500 23,852 16,575 21,318 12,861 11,845 10,468 10,437 8,264 6,259 6,216 Blossom's summary of cash receipts (which were all deposited) and summary of cheques (which were all mailed out to suppliers) for the month of May showed the following:arrow_forwardOn October 1, 2017, Chung, Inc. assigns $1,000,000 of its accounts receivable to Seneca National Bank as collateral for a $750,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 9%. Prepare the October 1 journal entries for both Chung and Seneca.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education