FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

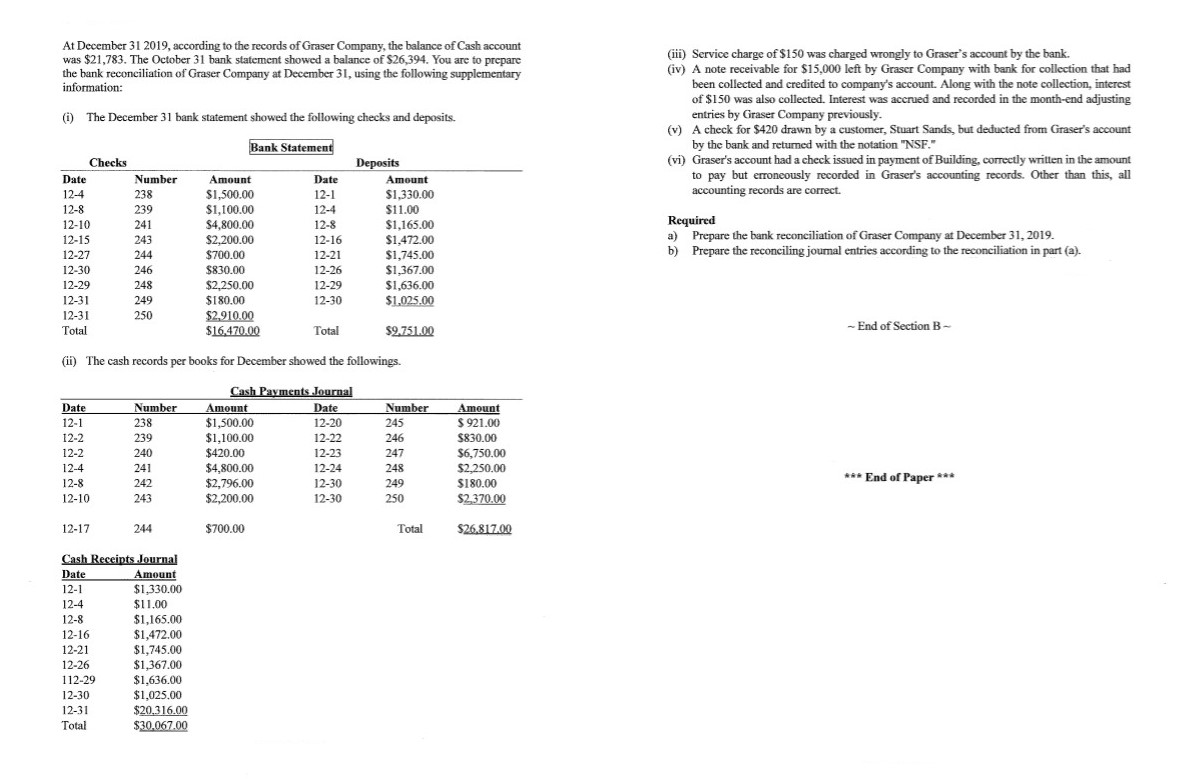

Transcribed Image Text:At December 31 2019, according to the records of Graser Company, the balance of Cash account

was $21,783. The October 31 bank statement showed a balance of $26,394. You are to prepare

the bank reconciliation of Graser Company at December 31, using the following supplementary

information:

(iii) Service charge of $150 was charged wrongly to Graser's account by the bank.

(iv) A note receivable for $15,000 left by Graser Company with bank for collection that had

been collected and credited to company's account. Along with the note collection, interest

of $150 was also collected. Interest was accrued and recorded in the month-end adjusting

entries by Graser Company previously.

(v) A check for $420 drawn by a customer, Stuart Sands, but deducted from Graser's account

(i) The December 31 bank statement showed the following checks and deposits.

Bank Statement

by the bank and returned with the notation "NSF."

(vi) Graser's account had a check issued in payment of Building, correctly written in the amount

to pay but erroncously recorded in Graser's accounting records. Other than this, all

accounting records are correct.

Checks

Deposits

Date

Number

Amount

Date

Amount

12-4

238

$1,500.00

$1,100.00

$4,800.00

$2,200.00

$700.00

$830.00

$2,250.00

$180.00

12-1

$1,330.00

12-8

239

12-4

$11.00

Required

a) Prepare the bank reconciliation of Graser Company at December 31, 2019.

b) Prepare the reconciling journal entries according to the reconciliation in part (a).

$1,165.00

$1,472.00

$1,745.00

12-10

241

12-8

12-16

12-21

12-26

12-29

12-30

12-15

243

12-27

12-30

244

$1,367.00

246

$1,636.00

$1,025.00

12-29

248

12-31

249

12-31

250

$2,910.00

$16470.00

- End of Section B-

Total

Total

$9,751.00

The cash records per books for December showed the followings.

(ii)

Cash Payments Journal

Date

Number

238

Date

12-20

Number

Amount

Amount

$1,500.00

$1,100.00

$420.00

$4,800.00

$2,796.00

$2,200.00

$ 921.00

12-1

245

12-22

12-23

12-24

12-2

239

246

$830.00

$6,750.00

$2,250.00

S180.00

$2,370.00

12-2

240

247

12-4

241

248

*** End of Paper ***

12-8

242

12-30

249

12-10

243

12-30

250

12-17

244

$700.00

Total

$26,817.00

Cash Receints Jlournal

Amount

$1.330.00

$11.00

$1,165.00

$1,472.00

$1,745.00

$1,367.00

$1,636.00

$1,025.00

$20.316.00

$30.067.00

Date

12-1

12-4

12-8

12-16

12-21

12-26

112-29

12-30

12-31

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- I need help with questionarrow_forwardYour firm’s cash book shows a credit bank balance of $1,240 at 30 April 2021. On comparison with the bank statement, you determine that there are unpresented cheques totalling $450, and a receipt of $140 which has not yet been passed through the bank account. The bank statement shows bank charges of $75 which have not been entered in the cash book.Please provide solution. The balance on the bank statement is: ______ Dr./Cr.arrow_forwardThe accountant of Sophia Manufacturing Company was tasked to perform monthly bank reconciliation. She downloaded the company’s April 30, 2019 bank statement that showed a balance of P32,400. She also printed the cash ledger from the company’s computerized accounting system. It contains the ending balance of P8,350. She also found the following reconciling items:a. The bank statement showed bank service fee of P800.b. The bank collected P1,500 from a note receivable for Sophia Manufacturing. Also, a collection fee of P250.00 was charged.c. Deposit in transit, P51,000.d. Checks outstanding on April 30, P79,100.e. The accountant found a check issued to Rhys Corp. for P4,500 that cleared the bank but was not in the cash ledger. Requirement:a. Prepare the bank reconciliation statement.b. Journalize the adjusting entries.arrow_forward

- The cash account for Santiago Co. on May 31, 2021 indicated a balance of $15,515.00. The March bank statement indicated an ending balance of $20,245.00. Comparing the bank statement, the canceled checks, and the accompanying memos with the records revealed the following reconciling items: a. Checks outstanding totaled $4,820.00 b. A deposit of $3,796.00 had been made too late to appear on the bank statement. c. A check for $1,233.00 returned with the statement had been incorrectly recorded as $233.00. The check was originally for a vendor payment on account. d. The bank collected $5,541.00 on a note left for collection. e. Bank service charges for May amounted to $45.00. f. A check for $790.00 was returned by the bank because of insufficient funds. Prepare a bank reconciliation as of May 31, 2021. Journalize the necessary entries.arrow_forward1) Prepare a bank reconciliation dated December 31, 2020, for Welcome Inc. based on the following information. Balance per bank statement is $21,200.68. Balance per books is $20,559.40. The December bank statement indicated a service charge of $35. Cheque #1169 for $410.50 and cheque #1183 for $2,150.00 were not returned with the bank statement. The bank had not received a deposit in transit of $3,443.22 when the bank statement was generated. A bank debit memo indicated an NSF cheque written by Bill Broke to Welcome Inc. on December 11, 2020, for $169. A bank credit memo indicated a bank collection of $1,700 and interest revenue of $28 on December 15, 2020.arrow_forwardFrom the following particulars of Mark & Co. prepare a bank reconciliation statement as on August 31, 2017. 1. Balance as per the cash book $ 54,000. 2. $ 100 bank incidental charges debited to Anil & Co. account, which is not recorded in cash book. 3. Cheques for $ 5,400 is deposited in the bank but not yet collected by the bank. 4. A cheque for $ 20,000 is issued by Anil & Co. not presented for payment.arrow_forward

- Serato Company keeps all its cash in a checking account. An examination of the entity’s accounting records and bank statement for the month ended December 31, 2020 revealed a bank statement balance of P8,469,000 and a book balance of P8,524,000. A deposit of P950,000 placed in the bank’s night depository on December 29 does not appear on the bank statement. Checks outstanding on December 31 amount to P270, 000. The bank statement shows that on December 25, the bank collected a note for Serato Company and credited the proceeds of P935,000 to the entity’s account. The proceeds included P35,000 interest, all of which Serato Company earned during the current period. Serato Company has not yet recorded the said collection. Serato Company discovered that check number 1000759 written in December for P183,000 in payment of an account had been recorded in the…arrow_forwardBeckett Co. received its bank statement for the month ending June 30, 2019, and reconciled the statement balance to the June 30, 2019, balance in the Cash account. The reconciled balance was determined to be $6,428. The reconciliation recognized the following items: 1. Deposits in transit were $3,335. 2. Outstanding checks totaled $2,612. 3. Bank service charges shown as a deduction on the bank statement were $80. 4. An NSF check from a customer for $671 was included with the bank statement. Beckett Co. had not been previously notified that the check had been returned NSF. 5. Included in the canceled checks was a check written for $770. However, it had been recorded as a disbursement of $940. Required: Prepare the Bank reconciliation statement for the month ending June 30, 2019. BECKETT COMPANY Bank Reconciliation June 30, 2019 Balance per bank Balance per books Add: Add: Deduct: Deduct: Reconciled balance $ O Reconciled balancearrow_forwardMiller Corporation’s December 31, 2019, bank statement showed a $2,041.25 balance. On this date, Miller’s Cash account reflected a $150.90 overdraft. In reconciling these amounts, the following information is discovered: 1. Cash on hand for undeposited sales receipts, December 31, $131.25. 2. Customer NSF check returned with bank statement, $426.20. 3. Cash sales of $625.25 for the week ended December 18 were recorded on the books. The cashier reports this amount missing, and it was not deposited in the bank. 4. Note receivable of $2,400.00 and interest of $24 collected by the bank and not recorded on the books. 5. Deposit in transit December 31, $330.00. 6. A customer check for $195.40 in payment of its account was recorded on the books at $945.10. 7. Outstanding checks, $2,030.55. Includes a duplicate check of $63.85 to C. Brown, who notified Miller that the original was lost. Miller stopped payment on the original check and has already adjusted the cash account…arrow_forward

- On October 31, 2021, the bank statement for the checking account of Blockwood Video shows a balance of $12,742, while the company’s records show a balance of $12,336. Information that might be useful in preparing a bank reconciliation is as follows: Outstanding checks are $1,235. The October 31 cash receipts of $790 are not deposited in the bank until November 2. One check written in payment of utilities for $138 is correctly recorded by the bank but is recorded by Blockwood as a disbursement of $183. In accordance with prior authorization, the bank withdraws $551 directly from the checking account as payment on a note payable. The interest portion of that payment is $51 and the principal portion is $500. Blockwood has not recorded the direct withdrawal. Bank service fees of $25 are listed on the bank statement. A deposit of $568 is recorded by the bank on October 13, but it did not belong to Blockwood. The deposit should have been made to the checking account of Hollybuster Video, a…arrow_forwardGiven the following information to reconcile GCompany’s cash book balance with its bank statement balance as of July 31, 2021: a. Cheques #296 for $1,334 and #307 for $12,754 were outstanding on the September 30 bank reconciliation. Cheque #307 was returned with the October cancelled cheques, but cheque #296 was not. It was also found that cheque #315 for $893 and cheque #321 for $2,000, both written in July, were not among the cancelled cheques returned with the statement. b. In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320 for the July rent was correctly written for $4,090 but was erroneously entered in the accounting records as $4,900. c. Also enclosed with the statement was a $74 debit memo for bank services. It had not been recorded because no previous notification had been received. d. A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a…arrow_forwardCoasters Co. issued a note receivable to a customer. The customer made payment directly to the Coaster’s bank. The payment appeared on the month-end bank statement. How would this payment be adjusted in the bank reconciliation? Add to company records (book side) Subtract from company records (book side) Subtract from bank statement (bank side) Add to bank statement (bank side)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education